Binance has temporarily suspended token deposits to Multichain’s bridge token networks after five days of stuck transactions on several cross-chain pathways.

Affected swap pairs include POLS-BSC, ACH-BSC, BIFI-FTM, SUPER-BSC, AVA-ETH, SPELL-AVAXC, ALPACA-FTM, FTM-ETH, FARM-BSC, and DEXE-BSC.

No Word From Multichain on Releasing Funds and Clearing Pathways

The crypto exchange suspended deposits after the Multichain management team did not address the stuck transactions. Crypto Twitter speculated the project might be under force majeure after its management was allegedly arrested in China.

Multichain co-founder DJ Qian insisted that the team CEO was “not available yet” amid increasing frustration on the project’s Telegram group.

One user, Emeka Achodor, claimed their funds were stuck for five days on Thursday. Several other users complained of diminishing ETH liquidity across all Multichain’s pools.

Multichain allows crypto asset swaps over bridges through pegged tokens or liquidity pools. A router determines the best swap method.

Users can swap tokens across 70 chains, including Fantom, Kava, and Harmony, using cross-chain bridges or a network of liquidity pools. They can exchange multichain tokens like USDC only if sufficient liquidity exists on both chains.

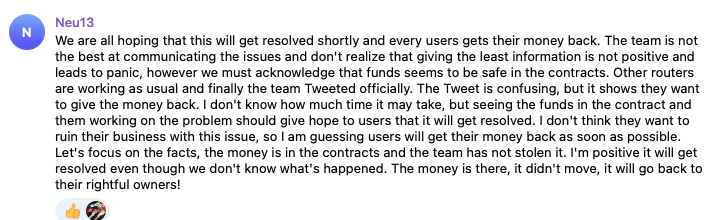

Neu13 pointed out that funds in smart contracts prove that the team didn’t execute a rug pull.

The Multichain team had yet to respond by press time.

Binance CEO Suggests TV Broadcast Could Start Bull Market

Last year, hackers exploited a Multichain deposit bug to steal $1.4 million. Cross-chain bridges, which lock tokens in a smart contract on a source chain for minting on a second network, have also resulted in hacks worth hundreds of millions of dollars.

Binance invested $350,000 in Multichain through its accelerator program in 2020.

Yesterday, the crypto exchange’s CEO, Changpeng Zhao, said China Central Television aired a broadcast, since taken down, mentioning crypto despite a nationwide mining and trading ban.

Zhao noted that previous coverage preceded bull markets. Gemini co-founder Cameron Winklevoss recently predicted that Asia would trigger the next bull market.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.