Binance, the world’s largest crypto exchange by trading volume, announced that its security team has recovered or frozen over $73 million in user funds from external hacks as of July 31 this year.

This amount surpasses the $55 million secured during all of 2023.

$73M Stolen Funds Recovered by Binance

According to Binance’s press release, about 80% of these recoveries and freezes are related to hacks, exploits, and thefts happening externally, while the remaining 20% are linked to scams taking place outside the platform.

Although the exchange didn’t specify whether the increase in recovered funds was due to an actual rise in the amount of stolen crypto or a result of overall price gains in the crypto market, the announcement aligns with its recent efforts to present itself as a compliant financial institution, following its deal with the US Department of Justice in November.

“Market growth and volatility, as observed in recent months, often bring an influx of new investors who may be more susceptible to scams and hacks. Blockchain technology offers us a powerful tool in gathering essential evidence and taking action against scammers, paving the way for a more secure and safer investment environment,” Jimmy Su, Chief Security Officer at Binance, said in the statement.

Read more: Binance Review 2024: Is It the Right Crypto Exchange for You?

Binance agreed to pay a $4 billion penalty to resolve the DOJ’s investigation into alleged violations of US financial laws. Changpeng Zhao, co-founder and former CEO, pleaded guilty to failing to implement an effective money laundering program. In April, a federal judge sentenced Zhao to four months in prison. He began his sentence at the Federal Correctional Institution in Lompoc, California, in June.

In addition to the prison sentence, Changpeng Zhao agreed to pay a $50 million fine, a modest amount compared to his reported net worth of approximately $33 billion. He also resigned as Binance’s CEO but still holds a controlling stake.

Under new leadership, Binance has pledged to cooperate fully with regulatory bodies and ensure it meets all compliance requirements.

Crypto Losses Surpass $1.5B in H1 2024

Despite Binance’s efforts, the broader trend remains discouraging. The first half of 2024 has been turbulent for the crypto market, marked by a sharp increase in major hacks.

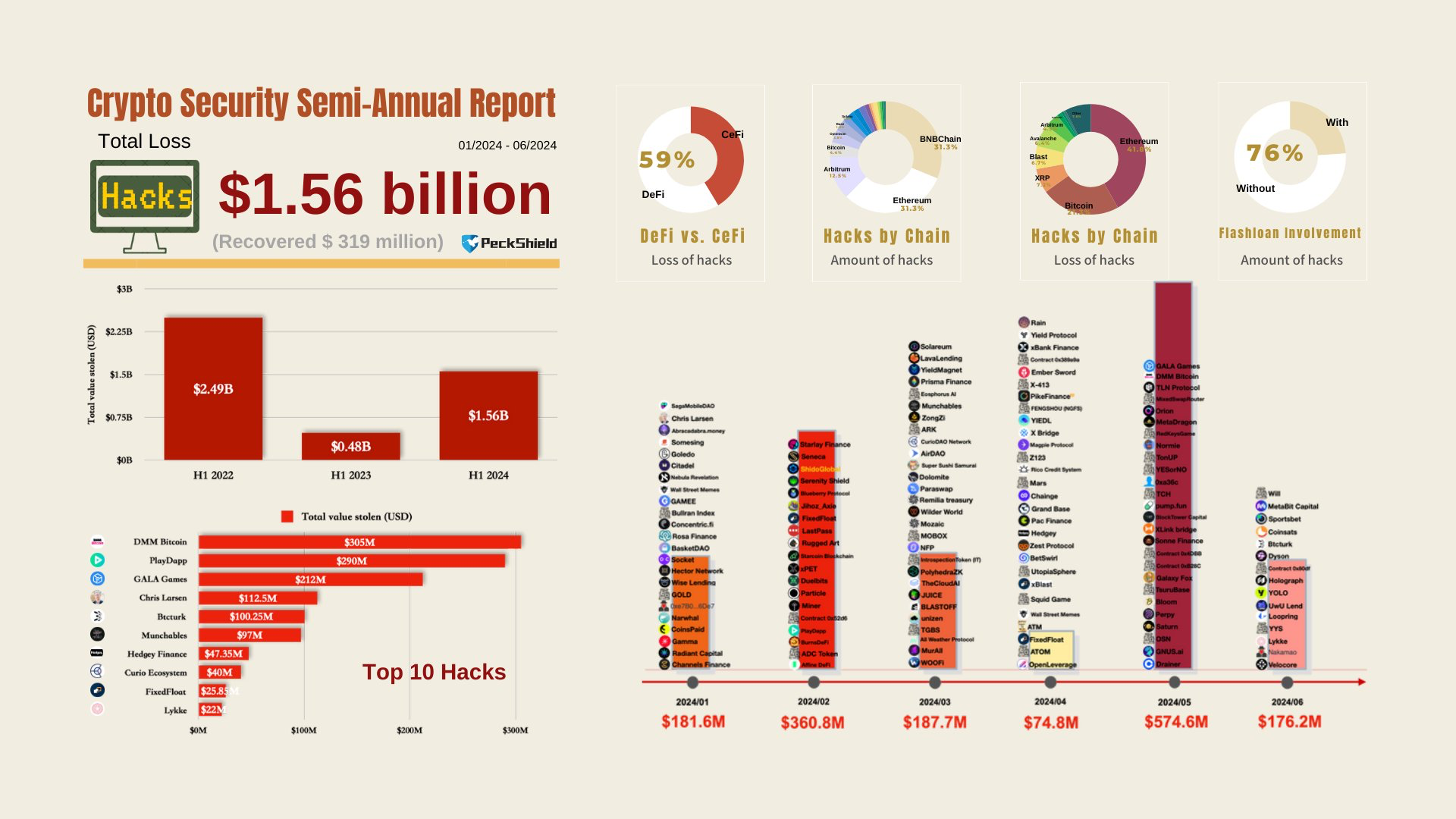

PeckShield’s H1 annual report highlighted over 200 significant incidents, resulting in $1.56 billion in losses — a 293% increase from the $480 million lost during the same period in 2023.

Read more: Top 9 Safest Crypto Exchanges in 2024

Decentralized finance (DeFi) protocols are the main targets for hackers, accounting for 59% ($81 million) of the total stolen crypto assets. The complexity and vulnerabilities in smart contract code make these decentralized applications (DApps) particularly enticing.

Flash loan attacks, exploiting unsecured borrowing, comprised 24% of the hacks, while the remaining 76% involved other sophisticated techniques.

More than 20 public blockchains were targeted, with Ethereum, Bitcoin, and XRP suffering the most. Ethereum and BNB Chain were the most popular among hackers, each accounting for 31.3% of the total hacks, followed by Arbitrum with 12.5% in losses.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.