Binance, the world’s leading cryptocurrency exchange, has unveiled its fourteenth Proof of Reserves (PoR).

The latest snapshot, dated January 1, reveals a robust growth in user assets, potentially bolstering confidence among investors and users alike.

Binance Proof of Reserves Update

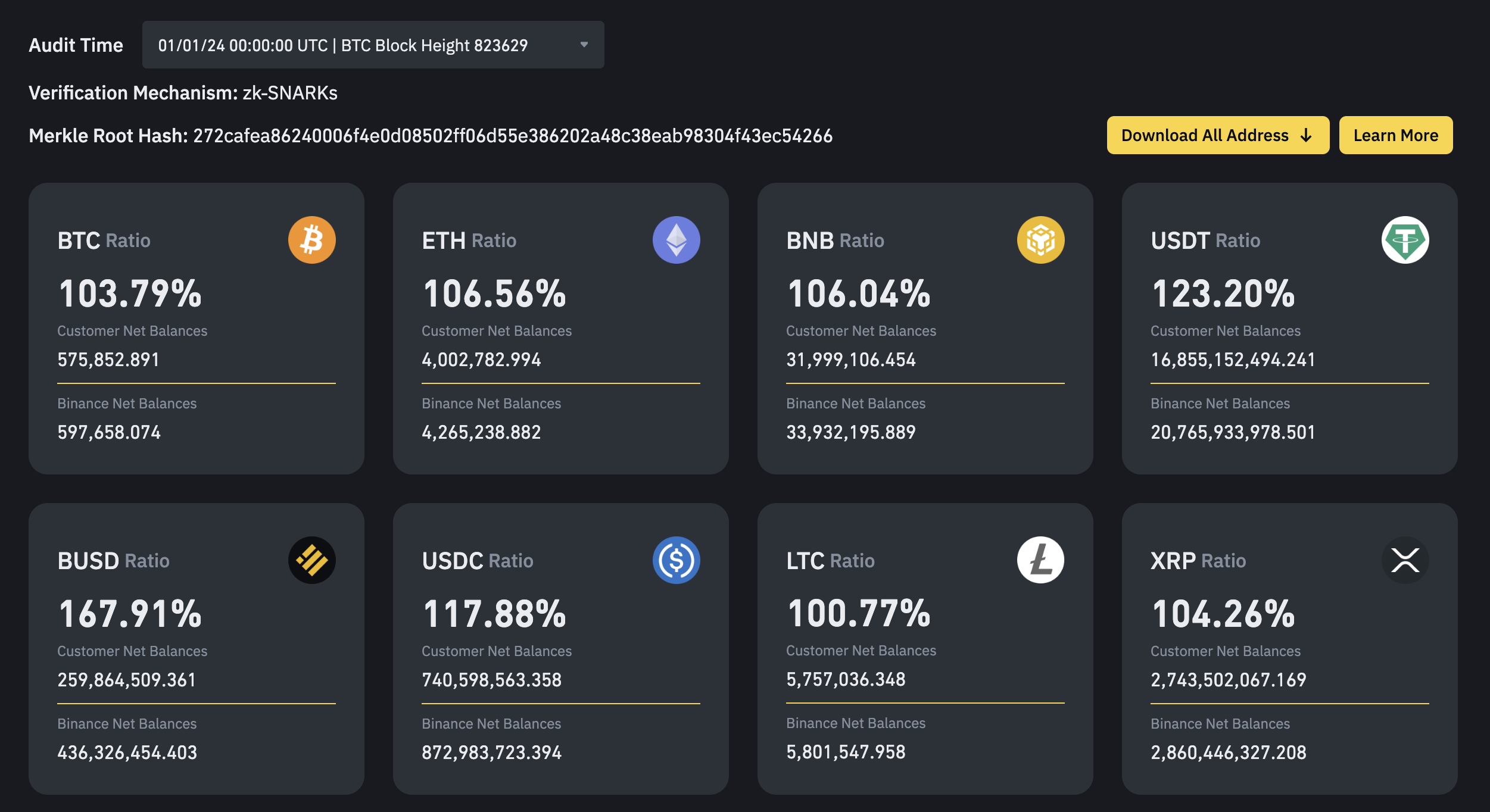

The data shows a notable increase in the holdings of major cryptocurrencies. Users’ Bitcoin (BTC) assets have risen to 575,000, marking a 2.65% jump, equivalent to an addition of 14,850 BTC. Similarly, Ethereum (ETH) holdings have climbed by 2.9%, reaching 4 million. Notably, the USDT (Tether) assets have surged by 4.45%, now standing at a substantial 16.8 billion.

Read more: Binance Review 2024: Is It the Right Crypto Exchange for You?

PoR is crucial in the crypto industry, serving as a verifiable assurance that any crypto exchange holds sufficient reserves to back its users’ assets on a 1:1 basis, along with additional reserves. This system is vital in ensuring that for every Bitcoin a user deposits, the crypto exchange’s reserves increase correspondingly, offering a safeguard against potential financial crises.

It’s important to note that these figures exclude Binance’s corporate holdings, which the firm manages separately. However, Binance has been accused of co-mingling users’ funds with its corporate holdings.

Read more: What Is Merkle Tree Proof of Reserves?

Due to various legal challenges, 2023 was a challenging year for Binance. In November 2023, it agreed to pay a fine of $4.3 billion to settle lawsuits with US regulators. Also, co-founder and CEO Changpeng Zhao, had to step down after pleading guilty to money laundering charges.

The company is still trying to dismiss the lawsuit from the US Securities and Exchange Commission (SEC). Nonetheless, Binance claims that it invested $213 million in the compliance program last year.

“We put compliance first. In 2023, we invested $213 million in our compliance program, an increase of 35% from last year ($158 million). We also continued investing in leading KYC vendors and product solutions,” Binance CEO Richard Teng said.