It is raining lawsuits for Binance as the cryptocurrency exchange has been dragged into a new class action lawsuit seeking $1 billion in damages.

According to a Fortune report, Moscowitz Law Firm and Boies Schiller Flexner filed a class action lawsuit against Binance, its CEO Changpeng ‘CZ’ Zhao, and three crypto influencers — basketball star Jimmy Butler, Graham Stephan, and Ben Armstrong’ Bitboy.’

Binance Accused of Listing Unregistered Securities

According to the report, Binance listed unregistered securities as cryptocurrencies and paid social media influencers to promote these assets. The law firms claim they investigated the crypto exchange for over a year before filing the lawsuit.

One of the cryptocurrencies considered unregistered security in the case is the Binance token BNB. The filing argued that the BNB burn program makes the asset an unregistered security because it reduces the coin’s supply to boost its value.

The lawsuit is filed on behalf of three plaintiffs — two Florida residents and a person from California — who said they lost money while trading digital assets promoted by Binance and the influencers. The complaints suggested the case could have millions of people eligible for damages.

Speaking about the case, Adam Moskowitz of Moskowitz Law Firm reportedly said:

“The statute clearly states that if an influencer is promoting an unregistered security, and has a financial interest in doing so, the influencer may be liable to everyone who bought the assets. The exchange that facilitates the trades would be liable as well.”

Binance was yet to respond to BeInCrypto’s request for comment at the time of writing.

Meanwhile, this is not the first time the law firm has filed a class action lawsuit against a crypto firm. Moskowitz filed a similar lawsuit against bankrupt crypto exchange FTX and its promoters like Thomas Brady, Kevin O’Leary, and others. The firm also filed another case against bankrupt crypto lender Voyager, alleging that its Earn Program account constituted the sale of unregistered securities.

Binance Rising Legal Troubles

The timing of this lawsuit further puts more legal pressure on Binance. The Commodities Futures Trading Commission (CFTC) recently sued the exchange and CZ for violating derivative trading laws.

Besides that, there are reports that the US Department of Justice is investigating the exchange and its founder.

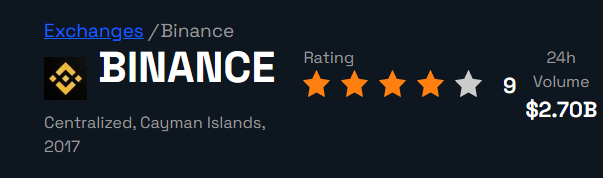

Meanwhile, Binance said it would cooperate with the regulators and has enjoyed the support of the broader crypto community. The exchange is the largest crypto exchange by trading volume and controls over 70% of the market, according to BeInCrypto data.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.