Binance recently announced the completion of its fifth quarterly token burn, which saw an estimated $17 million worth of BNB burned and the total supply reduced by 1,643,986 BNB.

Following its fifth quarterly token burn, the circulating supply now stands at 117,443,301 BNB, with a market cap of $1.58 billion. The move is traceable on the Ethereum blockchain and functions to decrease the available supply of BNB.

The BNB token has a simple use case, acting to reduce the cost of exchange fees on the exchange. BNB holders can opt to use BNB to pay their exchange trading fees, currently providing them a 25 percent discount on all trades. This discount is reduced yearly, falling to 12.5 percent in July 2019, and just 6.25 percent a year later.

To date, Binance remains one of the most recognizable crypto success stories to date, raising around $15 million in its ICO last fall before going on to become the largest exchange by trade volume.

The simple-to-understand utility of the Binance token has helped the company attract more than 10 million users in just over a year, with 2018 profits expected to approach $1 billion.

Waning Interest

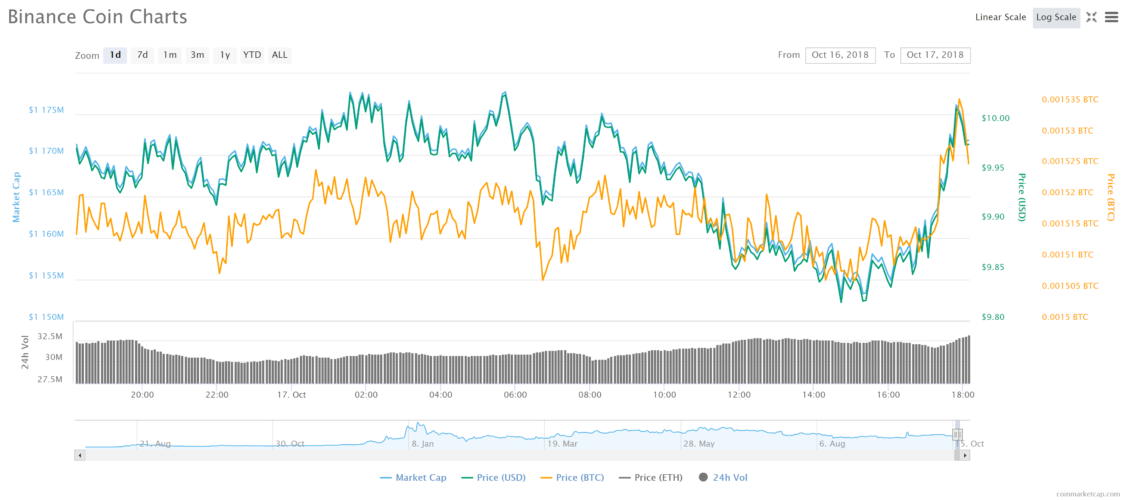

In terms of size, the most fifth token burn is one of the smaller burns in recent times, wiping out $17 million worth of BNB — compared to around $26 million for the third burn, and $30 million for the fourth. The third token burn saw the token value increase by more than 7.5 percent in 24 hours, whilst the fourth burn saw the value decrease by several percents over the next day. The market reaction to the most recent burn has been relatively muted compared to previous burns. It may be that, with the decreasing utility of the token and drastically reduced trading volume in the last 24 hours, interest is beginning to fade in the face of increased competition from other exchanges.

Why Burn Tokens?

A token burn is essentially the process of removing tokens from circulation by sending them to an invalid Ethereum address which lacks a private key. It is thought that burning tokens will increase the value of the remaining tokens by increasing scarcity. Binance uses 20 percent of its profits to buy back BNB tokens from the open market every quarter. These tokens are then sent to the invalid address, permanently destroying them. Binance will continue to repeat this process every quarter until a total of 100 million BNB have been burned, leaving 100 million BNB in the circulating supply. The next quarterly token burn is scheduled for January 2019, it remains to be seen how much of an effect this will have on market sentiment. What is your opinion on token burns? Do they genuinely increase the token value for the long term, or are they just a marketing gimmick? How do you think Binance Coin will perform leading up to the sixth token burn? Let us know your thoughts in the comments below!

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Daniel Phillips

After obtaining a Masters degree in Regenerative Medicine, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite any evidence to the contrary. Nowadays, Daniel works in the blockchain space full time, as both a copywriter and blockchain marketer.

After obtaining a Masters degree in Regenerative Medicine, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite any evidence to the contrary. Nowadays, Daniel works in the blockchain space full time, as both a copywriter and blockchain marketer.

READ FULL BIO

Sponsored

Sponsored