The Binance Coin (BNB) price is trading inside a short-term bullish pattern. While a breakout from it seems likely, the long-term trend indicates another nosedive will eventually occur.

BNB is the native token of the cryptocurrency exchange Binance, led by Changpeng Zhao. BNB decreased since reaching an all-time high price of $691.80 in May 2021. The downward movement led to a low of $183.40 in June 2022.

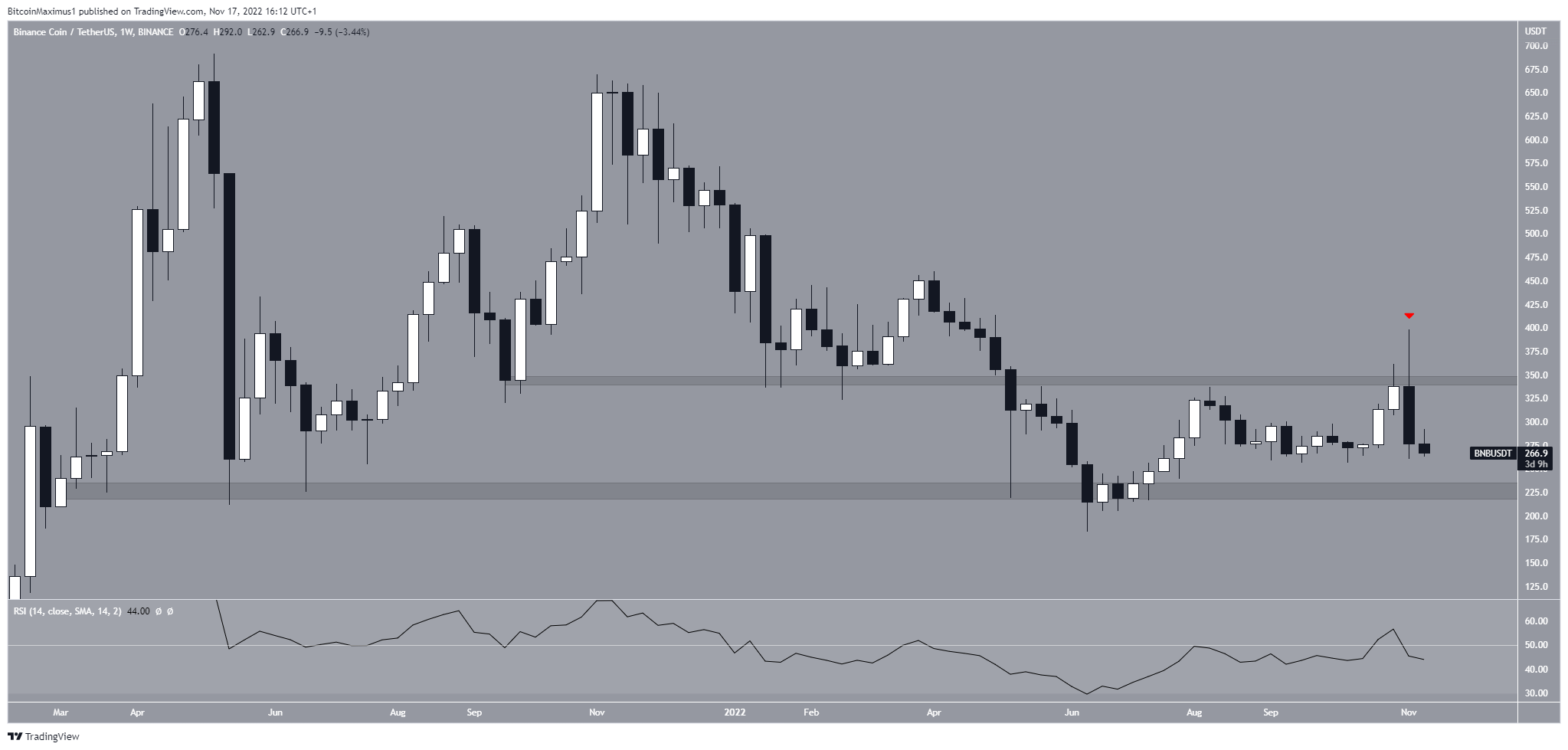

SponsoredThe BNB price has been increasing since. On Nov. 8, it seemed to break out from the long-term $345 horizontal resistance area. However, it failed to sustain its upward movement and closed below the area.

Additionally, the weekly RSI decreased below 50.

If the downward movement continues, the closest support would be at $225.

Will BNB Price Sustain Bounce?

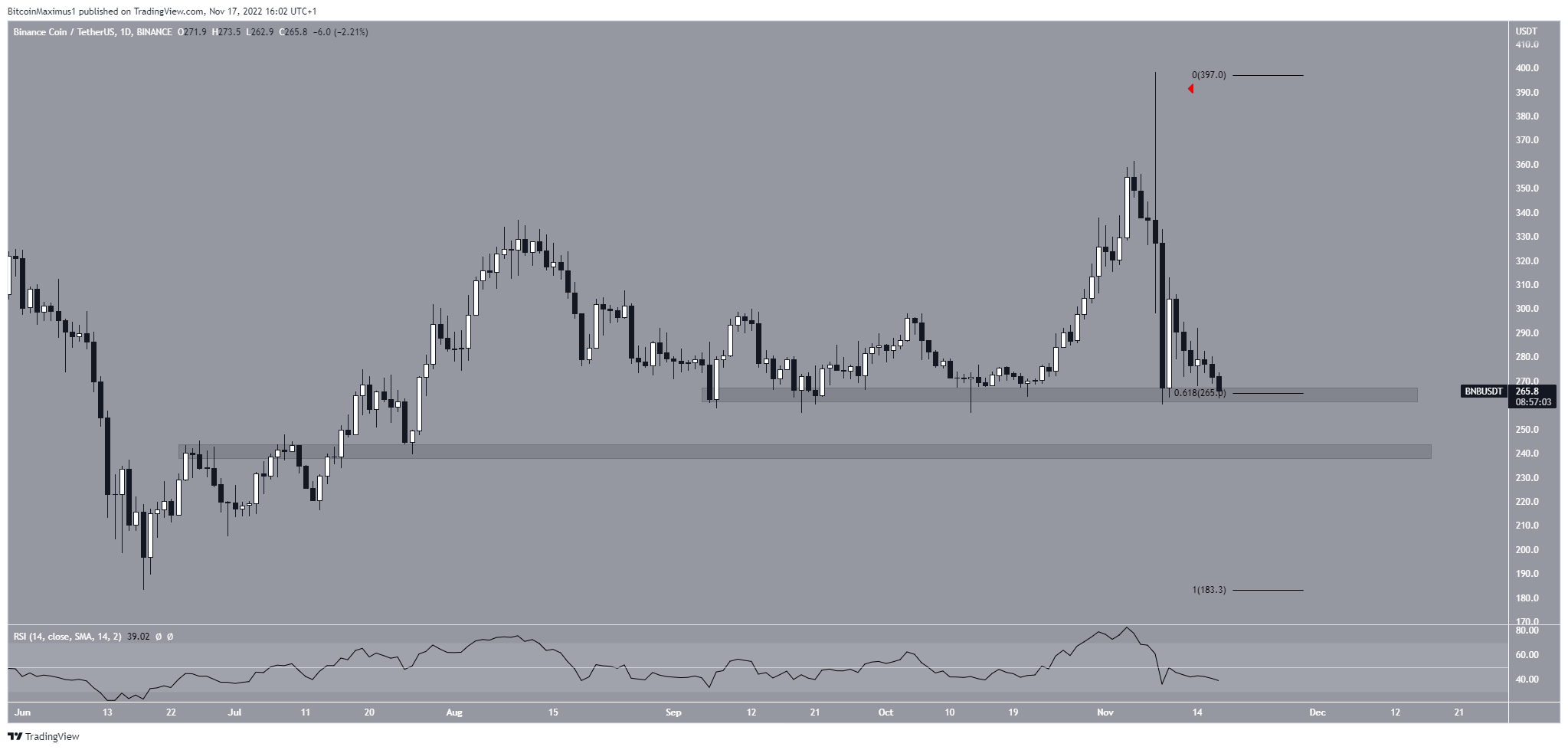

The technical analysis from the daily time frame shows that the BNB price has fallen since reaching a high of $398.30 on Nov. 8. The decrease was sharp, creating a very long upper wick (red icon), a sign of selling pressure.

The Binance Coin price currently trades inside the $265 horizontal support area. This is the 0.618 Fib retracement support level and a horizontal support area.

While the area did initiate a bounce (green icon), the increase has already been retraced. Moreover, the daily RSI is below 50, a bearish sign.

SponsoredIf a breakdown occurs, the next closest support would be at $240. However, due to the readings from the weekly time frame, the BNB price may fall to $225.

Relief Rally Prior to Breakdown?

The movement after the Nov. 9 bounce resembles a three-wave structure. The highest price reached after the bounce was $313. Afterward, the BNB price decreased inside a descending wedge, a bullish pattern. The decrease also looks like a three-wave structure.

As a result, a breakout from it is likely. If one occurs, the main target for the future price is at $316, giving both upward movements a 1:1 ratio (white). The BNB price has been relatively neutral over the past 24 hours, potentially consolidating for the upcoming breakout.

However, due to the bearish readings from the weekly time frame, the continuation of the downward movement is likely afterward.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.