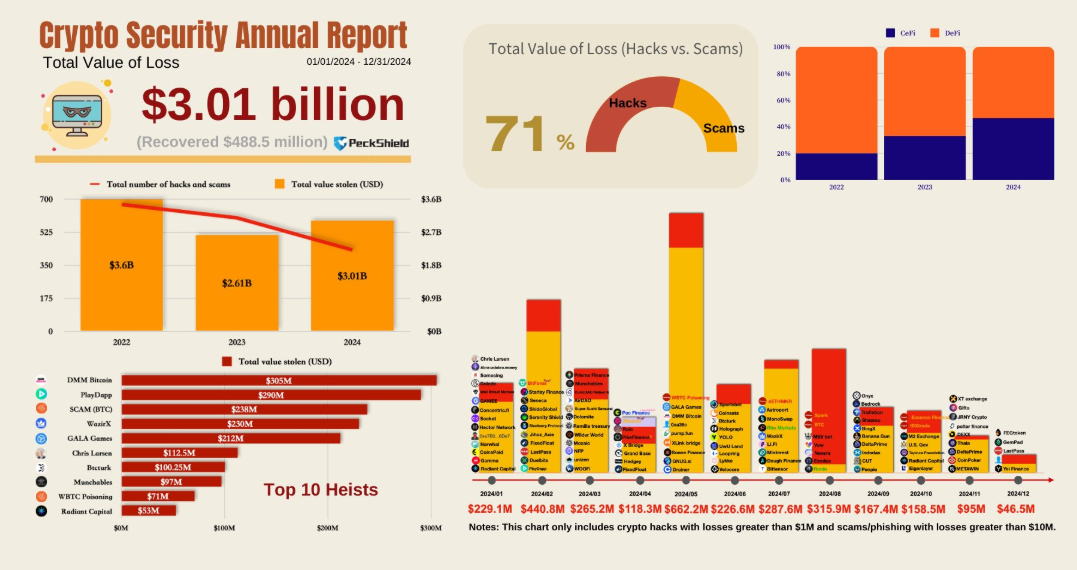

According to a report by blockchain security firm PeckShield, the cryptocurrency sector experienced a sharp rise in security breaches in 2024, with losses totaling $3.01 billion.

This marked a 15% increase from 2023’s $2.61 billion, reflecting growing vulnerabilities in the fast-paced digital asset market.

PeckShield‘s Breakdown of 2024 Crypto Losses

PeckShield’s analysis shows that the bulk of 2024’s losses came from crypto hacks, which accounted for $2.15 billion, or 71% of the total. The remaining $834.5 million stemmed from various scams, such as phishing attacks, Ponzi schemes, and fraudulent investment platforms.

Despite these massive losses, efforts to recover stolen funds have shown some success. According to PeckShield, approximately $488.5 million worth of cryptocurrencies were reclaimed through blockchain tracing and enforcement actions.

The report also highlights the top 10 heists of the year, highlighting the significant scale of individual incidents. These ranged from breaches of decentralized finance (DeFi) platforms to targeted attacks on major exchanges. Notable incidents include:

- AlphaX DeFi Hack — $320 million stolen in February.

- Lumos Bridge Exploit — $250 million drained in July.

- DeltaTrade Exchange Breach — $180 million stolen in October.

These high-profile cases indicate the ongoing security challenges within the DeFi ecosystem. It suggests that the sector remains a prime target for hackers due to its open-source nature and large pools of digital assets.

Monthly Trends in Hacking Activity

A bar graph accompanying the report illustrates the distribution of losses throughout the year. As indicated in the chart below, peaks were observed in March and September, coinciding with major protocol vulnerabilities and periods of heightened market activity.

The rise in attacks during these months indicates the need for continuous security audits and real-time monitoring of smart contracts. While hacks dominated the losses, scams also played a significant role. Scammers capitalized on the growing adoption of cryptocurrency, targeting inexperienced users with promises of high returns.

One of the largest scams of the year involved a fake investment platform that siphoned $140 million from unsuspecting investors before disappearing. This incident mirrors the importance of public education and thorough due diligence in mitigating risks.

The surge in crypto-related crimes has caught the attention of regulators and law enforcement agencies worldwide. In November, France’s Autorité nationale des jeux (ANJ) launched an investigation into fraudulent crypto operations. Elsewhere, the FBI worked closely with blockchain analytics firms to recover stolen funds and prosecute offenders.

PeckShield’s report stresses the importance of caution for crypto market participants as the industry continues to grow.

“The crypto wild west is alive and kicking. $3B lost in 2024 shows the stakes are higher than ever. Time to sharpen those digital defenses or risk being a sitting duck,” one user on X commented.