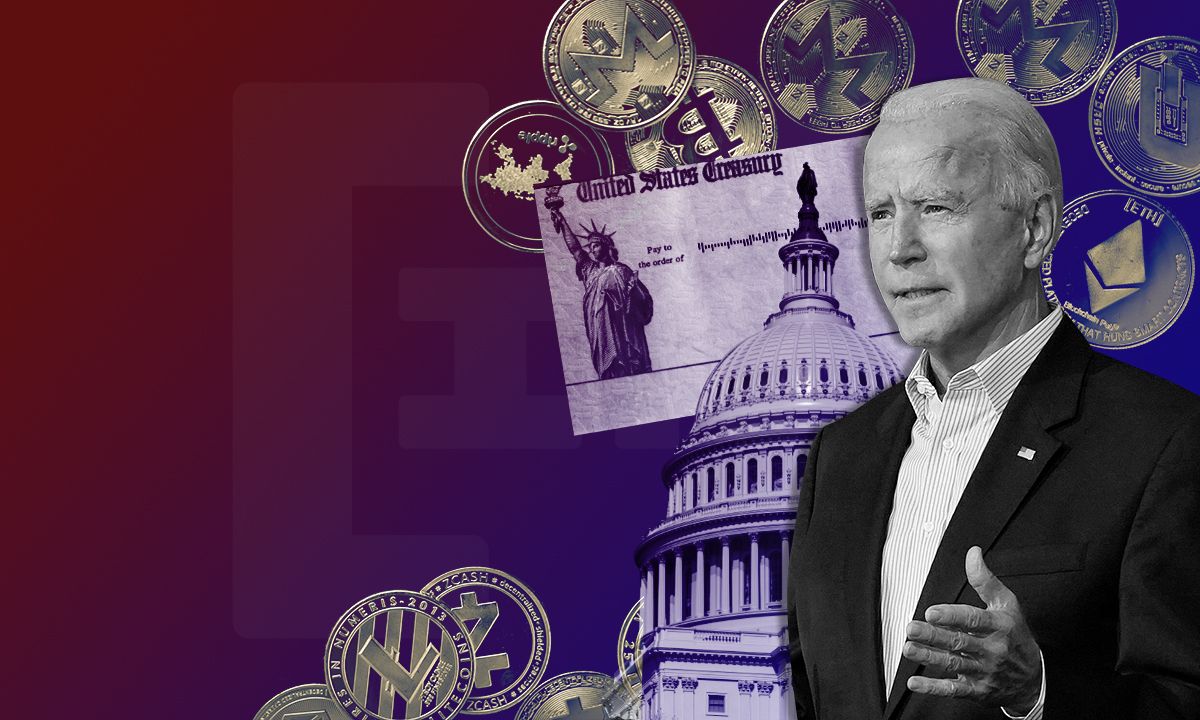

The Biden Administration’s executive order on digital assets has caused a stir in the crypto community and the majority of reactions have been positive.

The long-awaited executive order on cryptocurrencies was signed this week. It outlines the government’s view of crypto assets and commands further studies of a regulatory framework and central bank digital currency (CBDC) feasibility.

On March 9, Treasury secretary Janet Yellen commended the effort stating that it will work with other state departments to encourage innovation and mitigate risks. The order is not quite the crackdown everyone was expecting from an Administration that has become increasingly hostile towards the industry in recent months.

Pro-crypto Republican Senator Tom Emmer has also aired his thoughts on the order, stating that it is imperative that the U.S. as a nation develops a strategy to foster this innovation.

Uncle Sam finally moving forward

Emmer stated that the findings of the executive order were sound, and there is a national interest in fostering digital asset innovation. Much of the order focuses on “consumer protection, systemic risks, global competitiveness, international standards, and placing guardrails on code to make sure it is resilient,” he added.

The Minnesota representative continued to state that the order did not mention decentralization. The crypto industry and “disintermediation of the economy” will enable all Americans to decide their financial futures, not banks, big tech, or the government, he continued.

One key observation was that the order did not seek input from the Securities and Exchange Commission (SEC) which was seen as a good thing.

“SEC Chair Gensler has spent the past year intimidating crypto innovators and entrepreneurs with his unproductive regulation by public statement and enforcement action. His input is not critical.”

Emmer has previously warned against issuing a Fed-controlled CBDC as it could result in a system similar to China’s authoritarian control over financial flows.

Executive Director of the Washington-based crypto think tank Coin Center, Jerry Brito, also viewed the order as a positive development.

“The message I take from this EO is that the federal government sees cryptocurrency as a legitimate, serious, and important part of the economy and society, and I think it’s a good signal to serious people who’ve been holding back from getting involved.”

Crypto market reaction

Crypto markets initially reacted positively to the signing of the order, but have since resumed their downward trend.

Total market capitalization has fallen by 2.8% on the day to $1.83 trillion at the time of writing. The sell-off had started to accelerate during the morning of March 10, with BTC and ETH sliding 4.9% and 4.2% respectively.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.