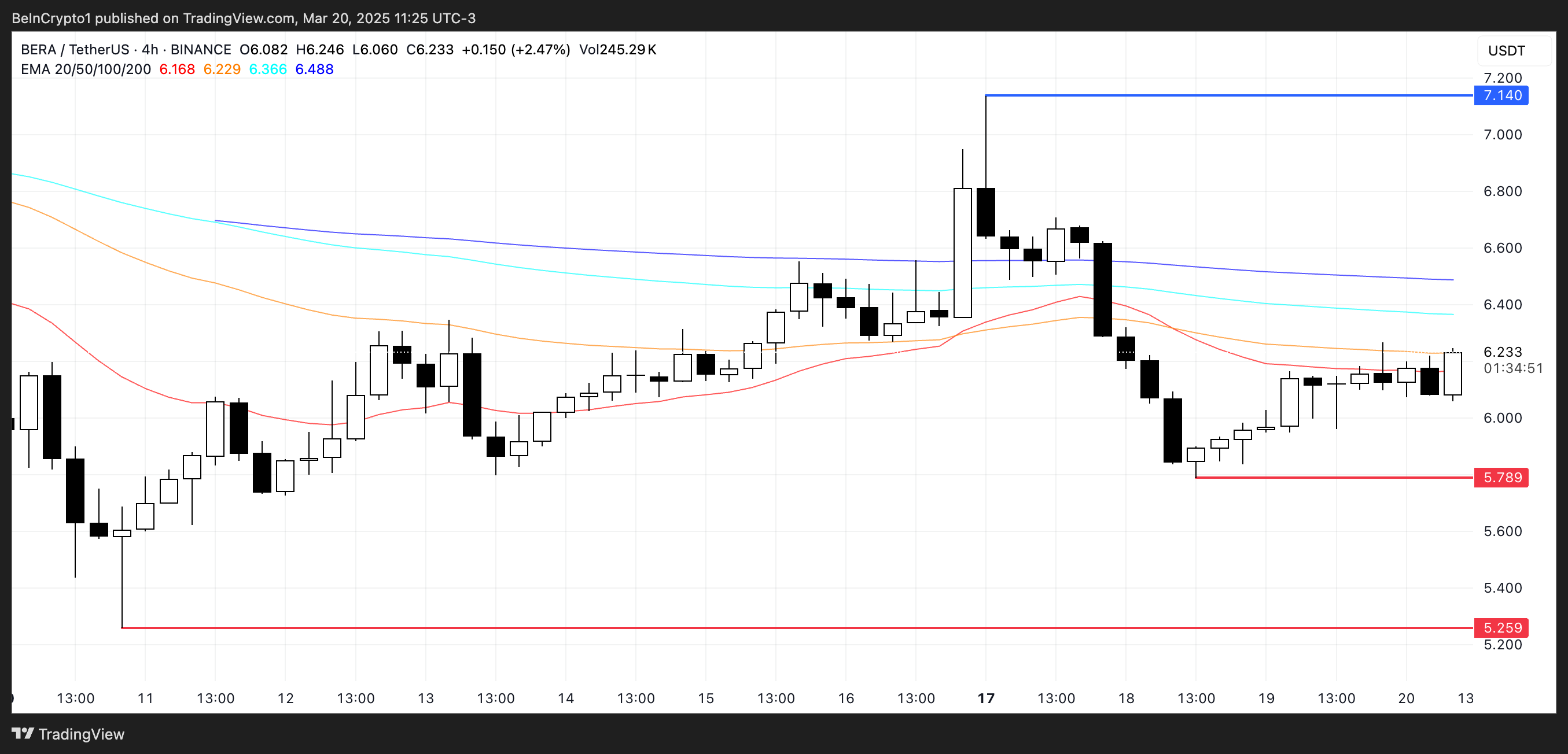

Berachain (BERA) is currently trading around $6.05, with a market cap sitting near $653 million, after pulling back from a recent high of $7.08 reached on March 17.

The asset has been consolidating after the recent price drop, as technical indicators suggest mixed signals. While bearish trends are still present, some early signs of bullish momentum are starting to emerge.

Berachain RSI Shows A Bullish Momentum Could Appear Soon

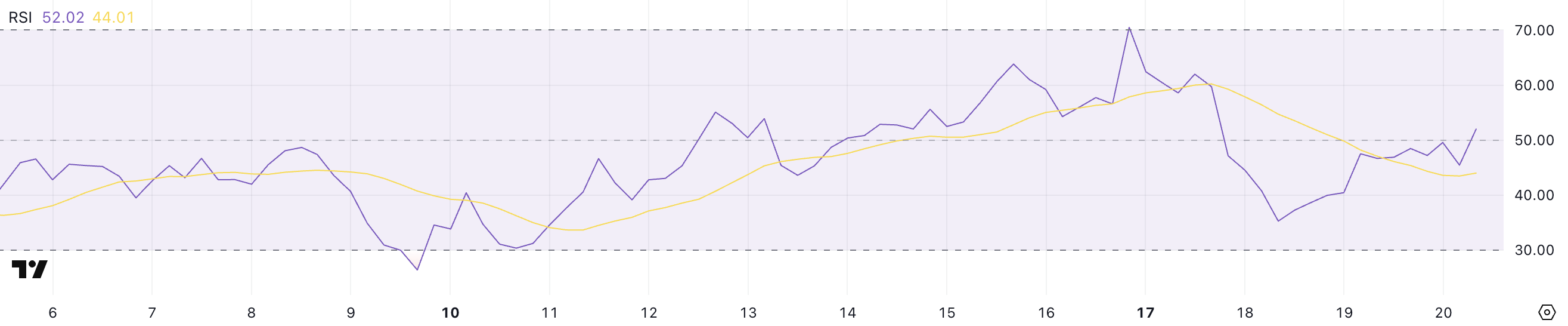

Berachain is showing signs of stabilizing after recent volatility, with its RSI currently sitting at 52, up from 35 just two days ago.

This rebound follows a sharp decline from an overbought level of 70.5, which was reached four days ago before the RSI cooled off.

The rise back above 50 suggests that bullish momentum is starting to regain some control after the recent correction, though the market remains relatively balanced between buyers and sellers for now.

The RSI (Relative Strength Index) is a momentum oscillator that measures the speed and magnitude of recent price changes, helping to identify potential overbought or oversold conditions.

Typically, an RSI above 70 signals that an asset might be overbought and due for a pullback, while an RSI below 30 points to oversold conditions, which could precede a price bounce.

With BERA’s RSI at 52, it is now in neutral territory, signaling neither an overbought nor an oversold condition. This suggests that while the selling pressure has eased, buyers still need to build more momentum to drive a sustained uptrend.

BERA CMF Is Rising, But Buying Pressure Is Still Building

Berachain CMF is currently at -0.01, an improvement from -0.23 yesterday, indicating that selling pressure has started to ease.

However, despite this slight recovery, the CMF is still hovering in negative territory, suggesting that the market is not yet seeing strong capital inflows.

What’s notable is that BERA’s CMF hasn’t climbed above 0.10 since March 14, signaling a prolonged period of weak buying volume and cautious investor sentiment.

The Chaikin Money Flow (CMF) is a volume-based indicator that measures the flow of money into and out of an asset over a given period.

Values above 0 indicate buying pressure or accumulation, while values below 0 signal selling pressure or distribution. With BERA’s CMF still near neutral but below zero, it shows that while sellers are losing momentum, buyers have yet to take control firmly.

Until the CMF pushes decisively into positive territory – particularly above 0.10 – any upward price movement may struggle to sustain itself without stronger capital inflows.

Can Berachain Surge To $7?

Berachain EMA lines continue to reflect a bearish setup, with short-term moving averages positioned below the long-term ones.

This indicates that downward momentum still dominates the market. However, if Berachain manages to reverse this trend and build bullish momentum, the price could first target the resistance around $7.14.

A breakout above this level could open the door for a move toward $7.50 or even $8, a price level not seen since March 3.

On the downside, if BERA fails to establish an uptrend and bearish momentum persists, the price could fall back to test the key support at $5.78.

Losing this level would likely deepen the bearish outlook, potentially driving Berachain price lower toward $5.25 in the near term.

For now, the EMA alignment suggests that sellers still have the upper hand, but a shift in momentum could quickly change the market structure and trigger a rally.