Ethereum (ETH) price has been following the broader market cues, declining on the chart after hitting a multi-month high last week.

The bigger question now is if ETH holders will be able to hold on to their assets or if they will succumb to the bearish woes.

Ethereum Price to See a Further Decline?

Ethereum price trading at $3,357 has failed in flipping the two-year-old resistance block into a support block. Even though the altcoin was successful in breaching the $3,582 to $3,829 range, it could not sustain above it for too long as ETH had already marked the market top.

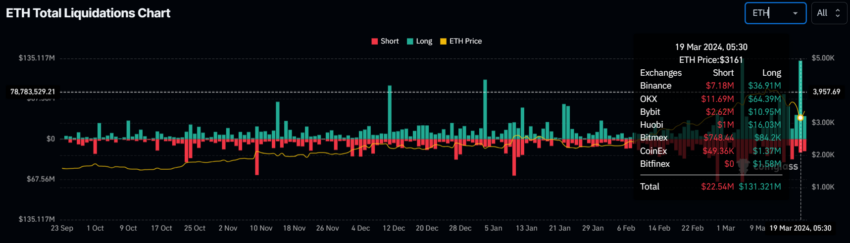

Thus, the overall decline wiped out a chunk of the recent profits, with most of the drawdown noted in the last 24 hours when the Ethereum price fell by more than 10%. This resulted in the second-generation cryptocurrency noting $170 million worth of long liquidations.

This means that over the coming few trading sessions, investors pining for a price rise will likely refrain from making a bullish bet. Consequently, there would be additional room for further bearishness.

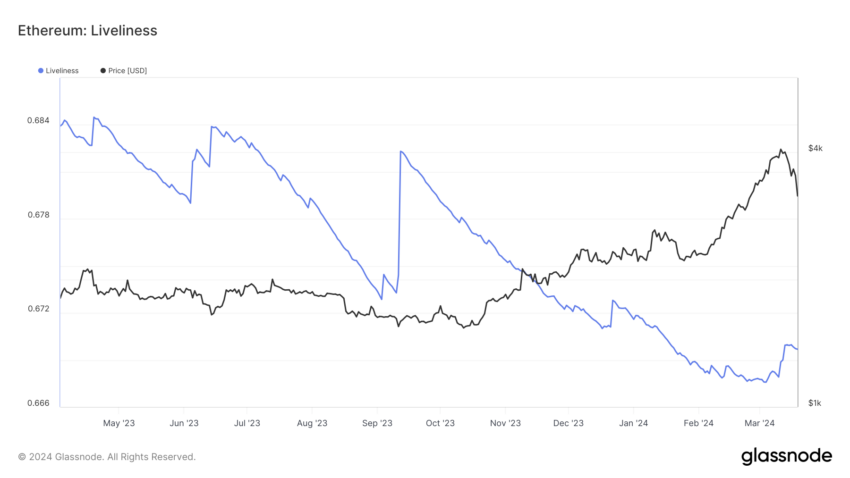

However, it is not just the derivatives market that is forced to act bearish at the moment. The same condition is that of another crucial cohort of investors – the long-term holders. These investors define the conviction of the market as when they hold ETH, they tend to do better, whereas, during excessively bearish periods, they move to sell.

This can be observed with the help of the Liveliness metric. This hints at conviction when the indicator is on an incline and liquidation when the metric notes a downtick.

At the time of writing, Liveline is observing an uptick, which means that long-term holders are moving to liquidate their positions and are losing confidence.

ETH Price Prediction: A Fallback to $3,000 Could Happen

Ethereum price is trading right above the $3,336 support level after falling through the resistance block. Considering the aforementioned developments, the bearishness might push ETH through the $3,336 support and test the $3,031 support line.

However, this support line also marks the confluence of the 38.2% Fibonacci Retracement of $4,626 to $2,539. This crucial support line could provide Ethereum with the necessary boost to bounce back and prevent excessive drawdown. Thus, the bearish thesis would be invalidated.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.