JPMorgan’s Chase UK bank will prohibit crypto payments from Oct. 16 amid a growing wave of scams targeting UK consumers. The company will prevent British customers from transferring money from Chase accounts to crypto firms and block attempts to trade crypto with Chase debit cards.

According to an email it sent to customers, the bank, which launched in the UK in September 2021, will decline any transaction in which they think customers are trying to purchase crypto assets. It said its clients can use a different bank or provider to buy crypto.

UK Banks Distance Themselves Despite Crypto’s Legal Status

The move by the JPMorgan-owned neobank seems oddly timed, given that crypto trading is a regulated financial activity under the UK’s new Financial Services and Markets Bill. The Financial Conduct Authority and other regulators have drafted specifics that Economic Secretary Andrew Griffith said should soon be finalized.

But it is hardly surprising, given the glut of UK banks that limit or ban crypto transactions after the failures of several crypto-friendly US banks, including Silicon Valley Bank, Silvergate, and Signature. The banks failed in March after experiencing mass withdrawals that exposed the illiquidity of their assets.

Learn more about the US banking crisis here.

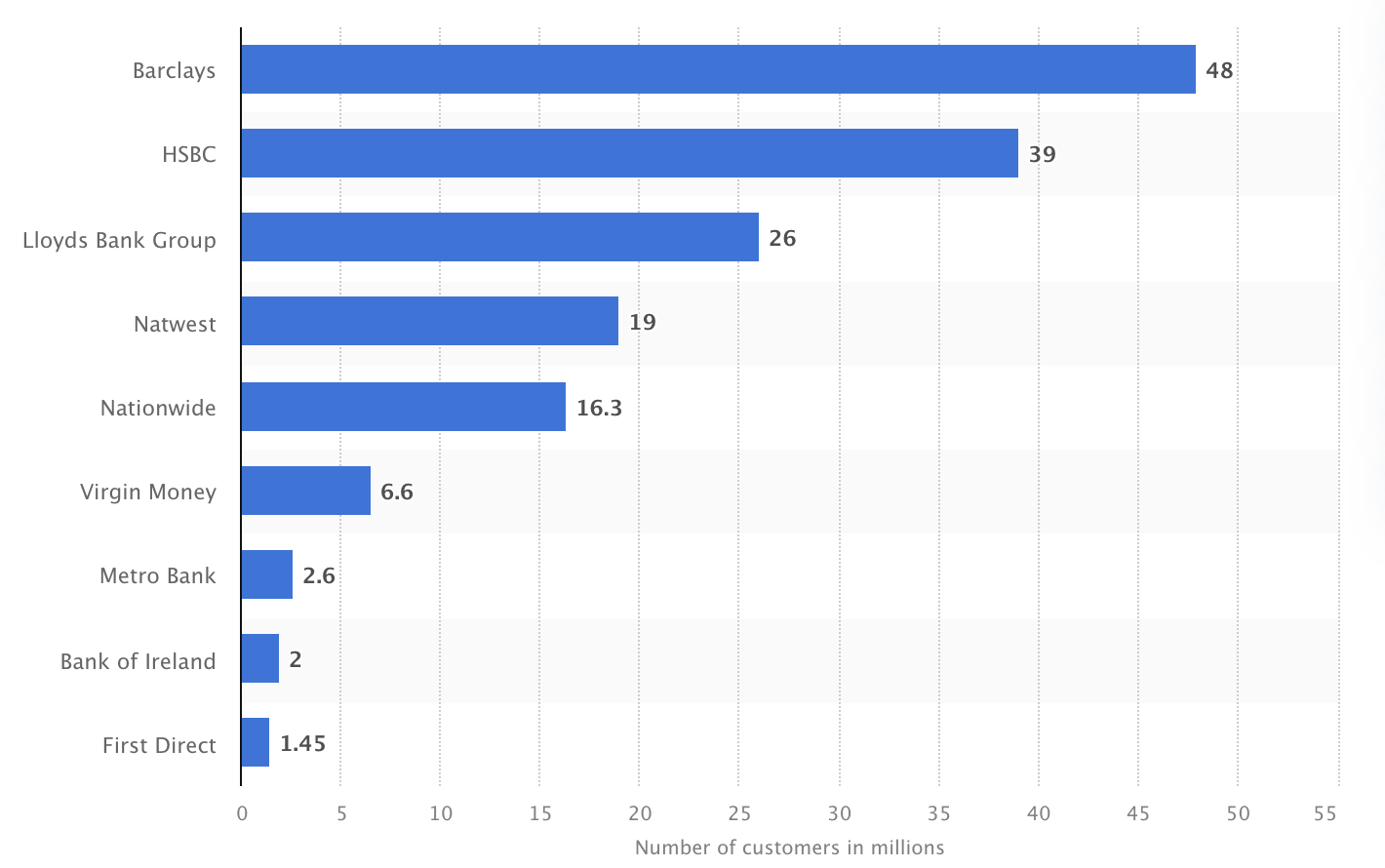

In May this year, NatWest, a large UK consumer bank, restricted how much customers could transfer to crypto exchanges. Customers could only transfer about $1,200 daily and about $6,000 monthly.

More recently, the Hong Kong Monetary Authority called HSBC and Standard Chartered on the carpet for avoiding crypto exchanges. The banks appeared reluctant to serve crypto companies after US allegations of money laundering at Binance.

Read our Binance review here.

UK Bull Market Millionaires Will Experience Déjà Vu

Chase’s move may result in similar frustrations experienced by UK crypto traders after the 2021 bull market. One French investor, who later moved to London, earned about $4 million from crypto investing but could not convert his crypto profits to sterling due to banks’ avoidance of crypto.

A crypto entrepreneur who quit his job after earning over $200,000 through crypto was denied banking access for his business. The Leicester resident said at the time:

“They have basically put a pseudo ban people using business accounts as a repository for crypto profits.”

In June 2021, Bank TSB, another bank in the UK, banned five million customers from buying cryptocurrencies over fears of excessive fraud levels on crypto platforms. The move was preceded by Barclays, Monzo, and Starling, all moving to block wire transfers to crypto exchanges temporarily.

Do you have something to say about why Chase bank bans crypto transactions for UK traders or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).