The Bank for International Settlements and the Bank of England recently concluded a central bank digital currency (CBDC) pilot that could refocus lawmakers on finalizing U.K. crypto regulation.

The pilot, Project Meridian, coordinated messages between the BoE’s Real-Time Gross Settlement System and the Land Registry to purchase a house using central bank money.

BoE Needs New Laws to Consider CBDC Stablecoin Settlements

The transfer only involved commercial banks and legal entities representing the buyer and seller.

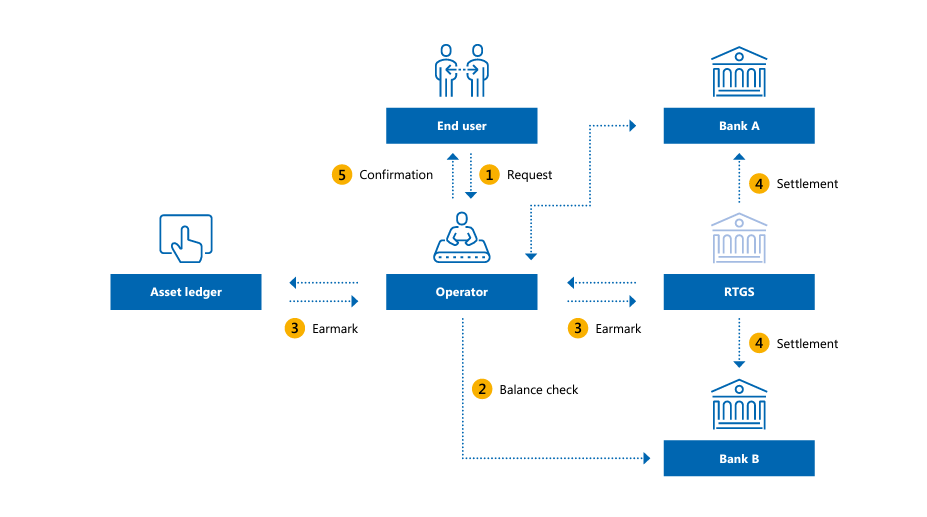

A synchronization operator linked the RTGS and the Land Registry, ensuring funds only changed hands only if the property did. The connection used application programming interfaces (APIs) conformant with global financial messaging standards. APIs define the interaction between two separate software systems.

The Bank of England could adapt APIs to transfer these messages to other asset classes before launching its RTGS system next year.

Earlier this month, U.K. Financial Stability Deputy Governor Sir John Cunliffe suggested a new interbank settlement system could pair RTGS with a distributed ledger.

Alternatively, the BoE could wait for the passage of the Financial Services Markets bill. The new laws define rules for stablecoin settlements.

Cunliffe argued that while stablecoins offer payment efficiency, they need rules before banks can use them to settle interbank transactions.

U.K. Lawmakers Could Finalize Bill in a Year, Says Treasury Official

While there is no fixed time frame for the bill’s passage, lawmakers can fast-track the process to respond quickly to unforeseen events. Financial Secretary Andrew Griffith recently told CNBC that the government plans to finalize crypto regulations within the next year.

The crypto-related FSM bill completed its committee stage in the House of Lords on March 23. The bill is currently in its report stage, where members can suggest further amendments not covered in the committee stage.

The bill is reprinted with all agreed changes before moving on to a third reading, which is the final opportunity for amendments.

The final stages of passage include considering amendments and the Royal Assent. If the both the House of Commons and House of Lords agree quickly on the final revisions, the king can turn the bill into law.

After that, crypto industry players will likely have a window to comply with the new law. Coinbase said U.S. crypto regulation might result in a shift in focus from the States to the U.K.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.