Decentralized on-chain liquidity protocol Bancor has proposed an upgrade that will introduce a number of improvements to the platform in addition to protection against impermanent loss.

Bancor launched its long-awaited version 2 protocol upgrade in late July, and it is now proposing v2.1 to bring in a raft of improvements and protection measures.

The protocol works in a similar fashion to Uniswap and relies on liquidity to perform its function. It uses an algorithmic automated market-making mechanism (AMM) through the use of ‘smart tokens,’ which ensures liquidity and accurate prices by maintaining a fixed ratio to connected tokens.

Providing liquidity requires token holders to forfeit their long positions in order to take on exposure to other assets in the pool. This can expose them to impermanent loss which occurs when staked tokens lose value compared to simply holding them. It is called ‘impermanent’ because the token prices may return to the levels they were at when the user entered the liquidity pool, as Bancor explains in a previous article.

Impermanent Loss Protection

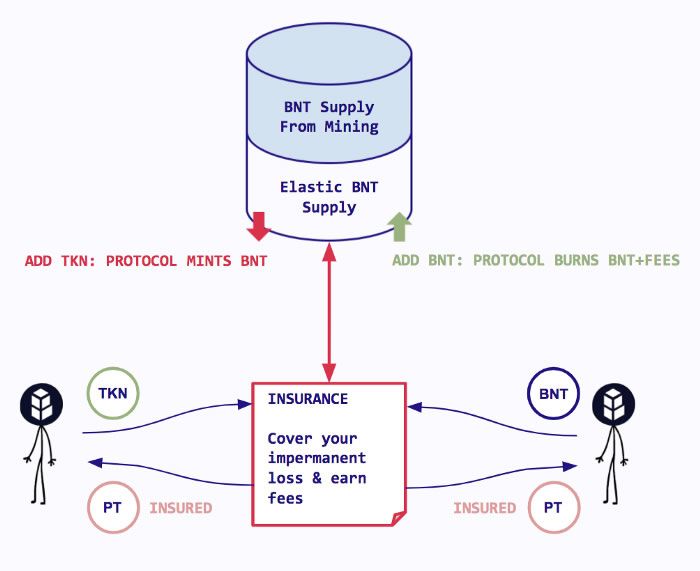

According to the most recent announcement, Bancor v2.1 offers two key features to AMMs; liquidity protection, or Impermanent Loss Insurance, and single-sided exposure.

It added that the protocol will protect the value of the tokens deposited, regardless of their price. Liquidity providers accrue this protection over time while earning from swap fees. This is achievable because Bancor uses its native BNT token as the counterpart asset in every pool;

“Using an elastic BNT supply, the protocol co-invests in pools alongside LPs and covers the cost of impermanent loss with swap fees earned from its co-investments.”

It added that DeFi farmers who provide liquidity to protected ‘whitelisted’ pools also receive vBNT tokens which represent their stake and can be used for governance and voting. Stakers will be able to stake with single-sided protection, which means only supplying one token instead of in pairs as is the case with Uniswap.

The upgrade is currently just a proposal and will go to a governance vote between Oct 14 and 17.

BNT Price Reaction

Bancor’s native token, BNT, reacted strongly to the proposal surging over 20% in the past 24 hours. BNT reached a peak of $1.40 before pulling back slightly to $1.34.

The DeFi token has recovered almost 100% of its late-September losses when DeFi tokens across the board took a dive. However, it’s still down more than 60% from its 2020 high of over $2.80 in early August following the v2 protocol upgrade.