Bakkt Holdings Inc., the crypto trading and custody platform launched by the New York Stock Exchange (NYSE) parent, is reportedly exploring potential sale or breakup options.

This consideration emerges amid a spike in crypto-related takeover activity.

Evaluating Bakkt’s Financial Health and Future

The company has engaged a financial advisor to evaluate various strategic paths, including a potential breakup. However, a final decision has yet to be made, and Bakkt could remain independent. A representative for Bakkt declined to comment on the matter.

This development follows significant leadership changes at Bakkt. In March, Bakkt appointed a new CEO and president amid facing the risk of being delisted from the NYSE for failing to meet listing requirements.

Read more: The 7 Hottest Blockchain Stocks to Watch in 2024

Andy Main, a board member since Bakkt’s public listing in 2021, took over from Gavin Michael. Michael stepped down to pursue other opportunities but will serve as an advisor through March 2025.

“Andy has the expertise to lead the company forward from this inflection point, with a focus on broadening our institutional crypto capabilities, growing our client base, expanding internationally, and driving towards adjusted EBITDA breakeven,” Michael said.

In February, Bakkt faced liquidity difficulties and sought permission from the US Securities and Exchange Commission (SEC) to increase capital by up to $150 million over three years. The company also plans a reverse stock split to improve financial performance. Bakkt raised $40 million through a private placement to institutional investors and an additional $10 million to bolster its capital.

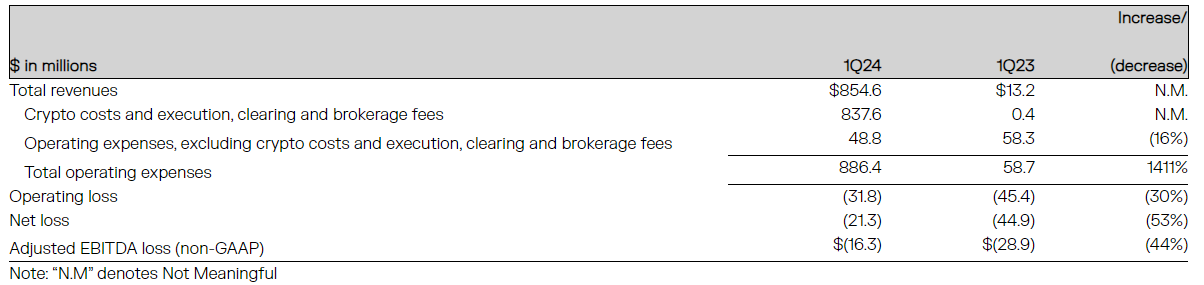

Despite these efforts, Bakkt reported a first-quarter loss of $1.86 per share, better than the expected loss of $2.08. The company posted a first-quarter loss of $21 million on $855 million in revenue. These financial challenges highlight the urgency for Bakkt to explore strategic alternatives.

Read more: Top 5 Crypto Companies That Might Go Public (IPO) in 2024

Bakkt’s decision to consider a sale or breakup comes as some companies expand after recovering from the crypto industry’s widespread downturn in 2022. The multi-asset trading platform Robinhood recently announced its acquisition of the European crypto exchange Bitstamp. Additionally, crypto miner Riot Platforms proposed taking over its rival Bitfarms.