The Bitcoin price action has been on a rollercoaster ride. Bulls are in the back seat while bears rejoice in the downtrodden market. The Bitcoin futures market presented an interesting twist for market participants.

The last couple of weeks has been quite action-packed for the crypto space, especially Bitcoin. Even though the market showed slight signs of recovery from the FTX crash, the chaos has still not fully subsided.

In effect, most of the top cryptocurrencies were trading in the green on the short-term charts but were in a long-term bearish downtrend. With the spot market looking more or less similar, the futures market presented an interesting phenomenon that could aid momentum for BTC prices.

Backwardation in Bitcoin futures

Even though bearish signals were looming over the crypto market, some analysts saw signs of a recovery. Recent data highlighted that a major change might be afoot, one that might kick-start a different trend for BTC. Whether that’s bullish or bearish remains to be seen.

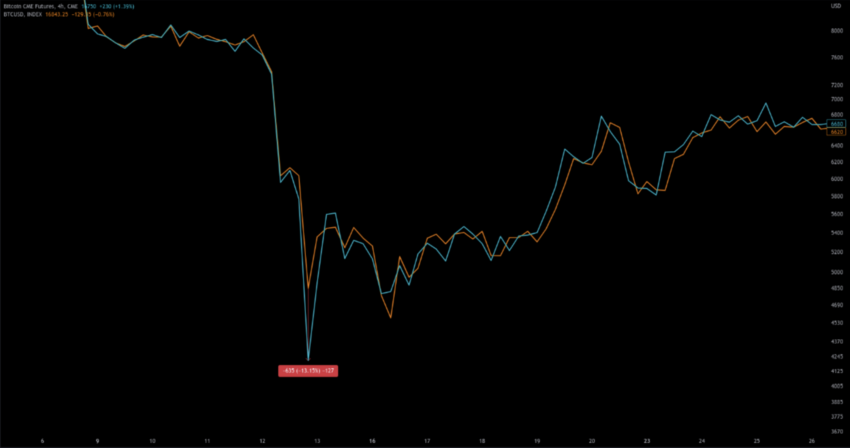

A look at BTC’s futures market showed that Bitcoin futures dropped into ‘backwardation.’ This occurs when contracts for maturity are trading at lower prices than the front-month contracts. Simply put, backwardation is a state where the future price is expected to be lower than the current trading price.

Recent data from CryptoQuant shows that there has been consistent backwardation in futures on CME, and the discount is roughly consistent with three previous significant bottoms.

Notably, previous BTC price bottoms since 2017 have followed a similar pattern. The chart below shows similar bearish deviations in December 2018.

Analyst Tomáš Hančar highlighted in a post that in March 2020, a massive discount on the September futures on BitMEX allowed him to catch the bottom of that dip. As seen below, March 2020 saw a similar backwardation phenomenon.

One reason behind the recent backwardation could be speculative shorts, most likely by institutional players that tend to be bigger players in futures trading.

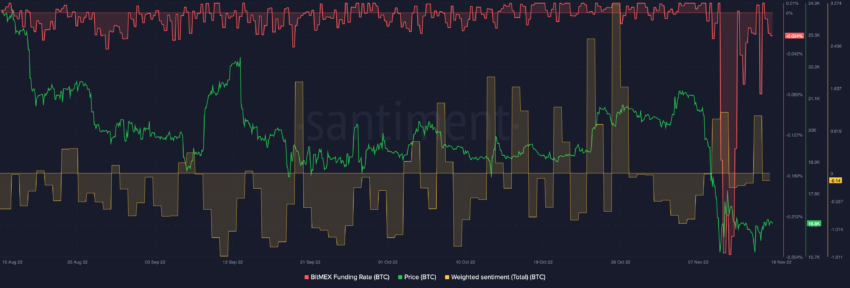

Notably, the BitMEX funding rate was in negative territory while the weighted sentiment was also negative.

So, with price action in deep trouble, can this backwardation act as a sign of reversal? Well, according to Hančar, the ‘first prerequisite for a bull market is futures in backwardation.’

Bitcoin bulls preparing to take off?

Hančar continued, saying that it was a good time to start accumulating with price action ‘deep enough’ below the realized price and futures in backwardation.

Bitcoin is trading at $16,950 at the time of press. This is a heavily discounted price, according to the analyst.

However, with the current macro conditions still shaky, the BTC price could explore another lower level of support in the near term.

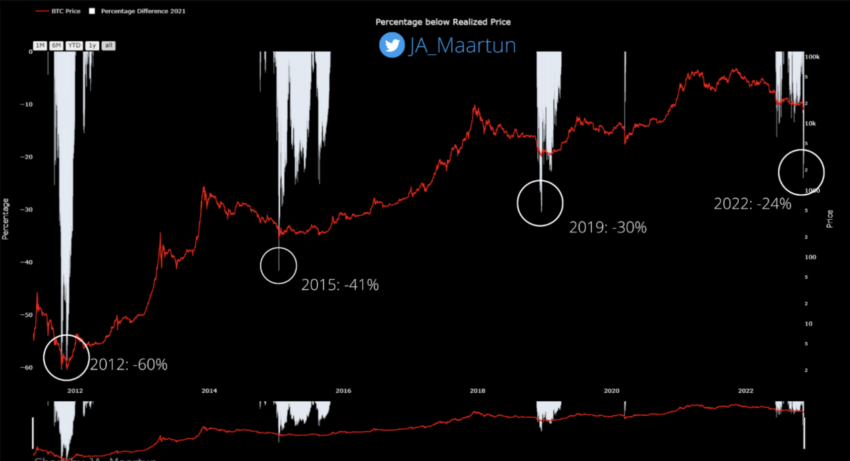

Notably, BTC’s percentage below realized price indicator shows that dips below the average price are decreasing. The same could be a positive sign suggesting broader market maturation.

Looking at the percentage difference between the Bitcoin price and its realized price, it is evident that the difference is reduced with each cycle.

In 2012, the difference was 60%, while in 2015, it was 41%. In 2019 the difference stood at 30%, while in 2022, the Bitcoin price is trading at 24% below its realized price.

Nonetheless, in the short term, another pullback wouldn’t be surprising. If the BTC price falls below $15,900, more pain could follow. However, if the $17,250 barrier gets cleared, the same could aid a short-term relief rally for BTC bulls.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.