This week, Axie Infinity (AXS) price dipped below the critical $7 support level. While current demand is weak, on-chain data shows multiple green signals suggesting an imminent rebound. Can AXS reclaim the $7 milestone in the coming days?

After a price pump triggered by its Apple AppStore listing on May 17, Axie Infinity (AXS) bears now appear to have seized market control. AXS price is down 18% from the recent high of $7.7 recorded on May 17.

Despite the price drop, new users have continued to troop into the Axie Infinity GameFi ecosystem. With losses now approaching alarming levels, will AXS holders trigger a price rebound if they stop selling?

Axie Infinity is Still Attracting New Users

According to the underlying on-chain data, the recent price decline has not caused a major deterioration in Axie Infinity network activity.

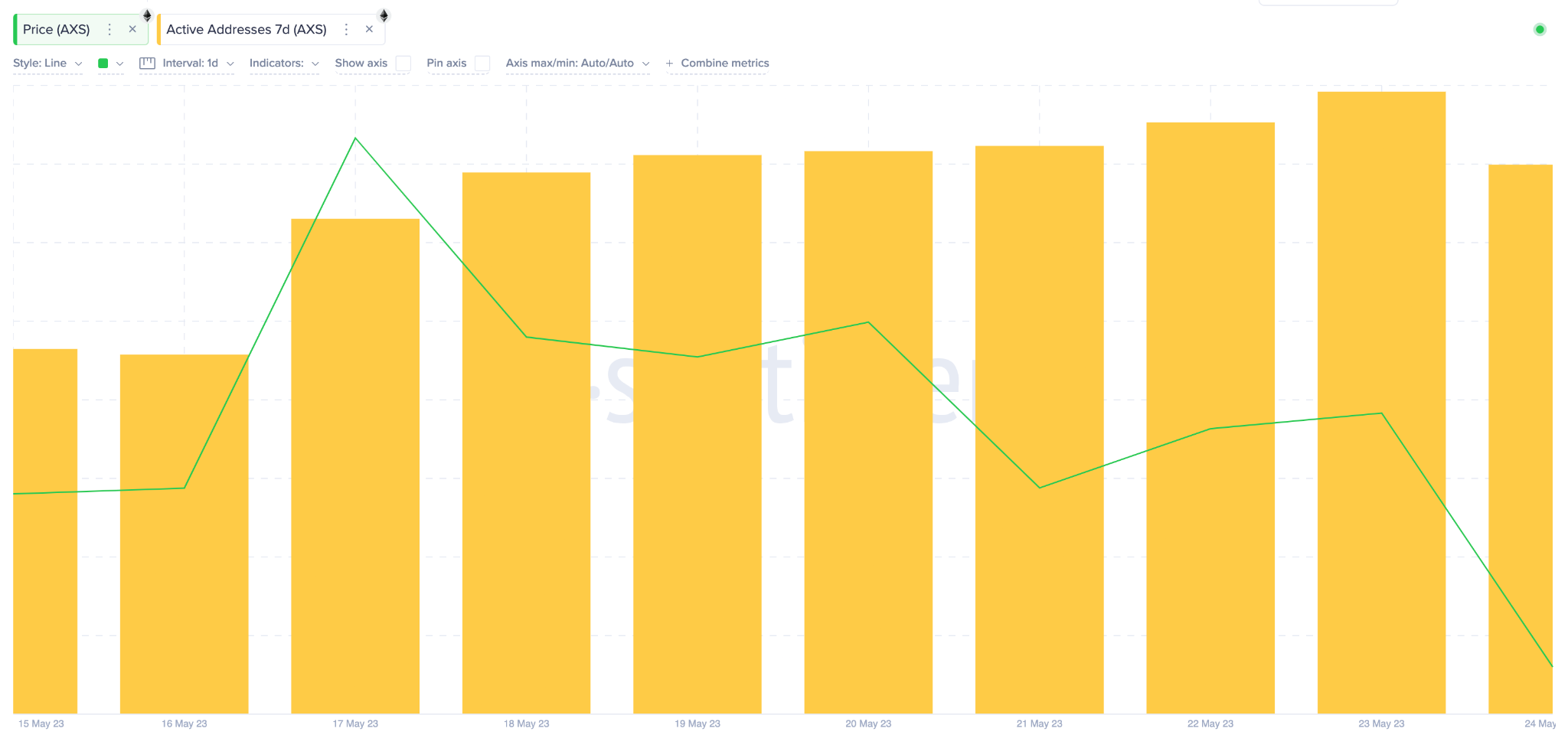

The Active Addresses (7d) chart below shows that AXS has continued to attract new users this week. Between May 16 and May 23, it soared 73% from 823 to 1425 active addresses.

As seen above, the number of AXS active users has been on the rise since May 17, when Apple announced the listing of the “Axie Infinity: Origins” strategy game on its native Appstore.

Evidently, new users have continued to troop into the Axie Infinity metaverse as they can now download the AXS game on their iPhones and other 1.5 billion active Apple devices worldwide.

If this trend continues, it’s only a matter of time before AXS makes a bullish price rebound.

Investors Could Soon Stop Selling

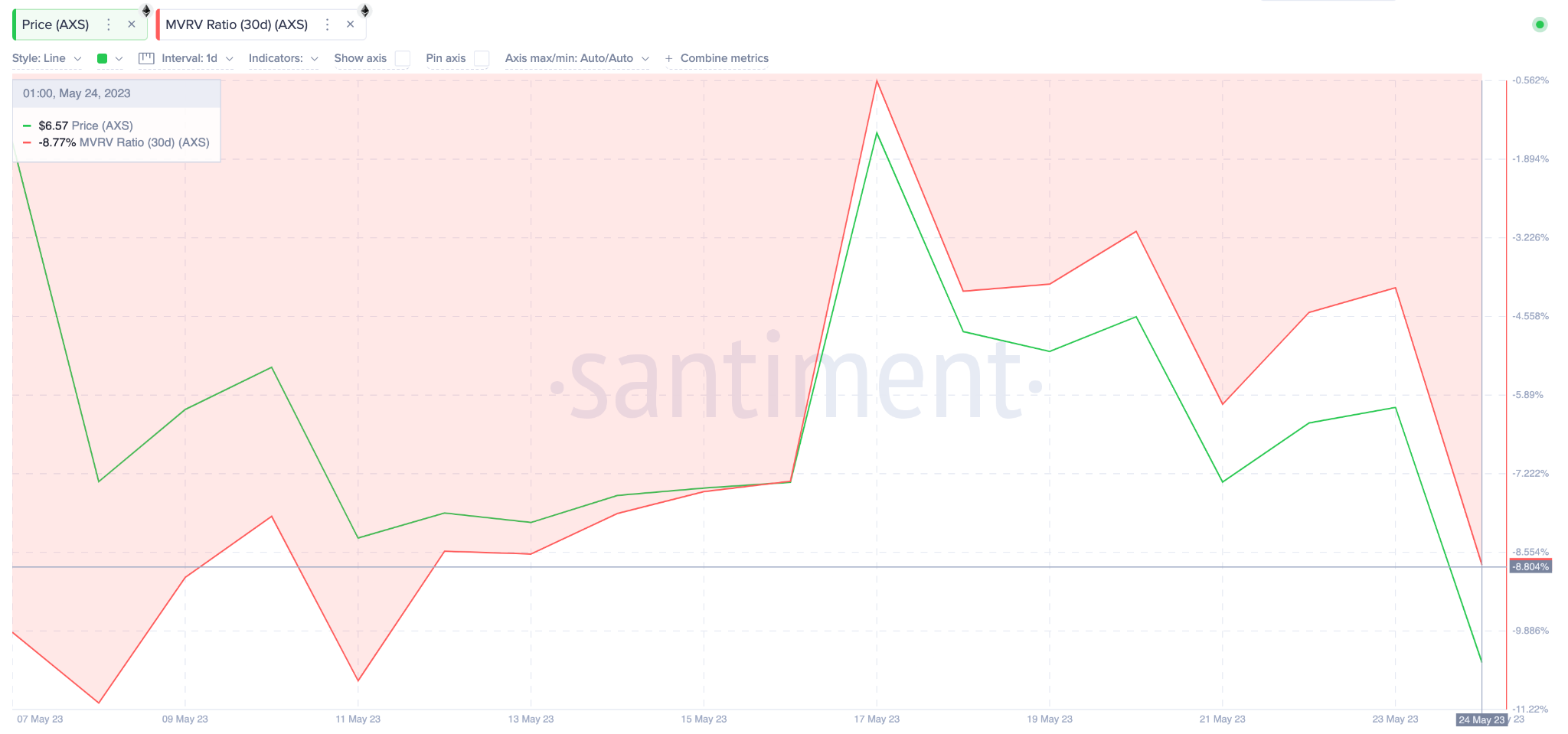

The Market Value to Realized Value (MVRV) data shows that most Cardano investors are now holding sizeable unrealized losses. The MVRV ratio evaluates the net financial position of investors by comparing their purchase prices to the asset’s current market value.

The Santiment chart below shows that, with prices at $6.53, investors that bought AXS in the last 30 days are holding nearly 9% unrealized losses.

With a net-loss position of 9%, most of the current Axie Infinity investors could become unwilling to sell at the current prices.

If they indeed stop selling as they desperately seek to keep their losses below 10%, they could inadvertently trigger another AXS price rally.

AXS Price Prediction: $7 is Still Within Reach

If Axie Infinity builds up enough bullish momentum as expected, it will face minimal resistance until it reaches $7.10.

However, to be confident of the bullish Axie Infinity price prediction, it has to first break above the $6.90 zone. At that zone, sell pressure from 2,130 investors that bought 1.77 million AXS at the average price of $6.91 could trigger a pullback.

If AXS can manage to breach that resistance, it could rally as high as $7.31.

Conversely, the bears could invalidate the bullish AXS price prediction if its current downtrend reaches $6. But the potential buy-wall mounted by 347 investors that 19,700 AXS at an average price of $6.07 could prevent the drop.

Axie Infinity could slide toward $5.51 if that support level does not hold as these areas feature smaller pockets of buyers left.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.