Avalanche (AVAX) price is showing signs of a potential breakout as long-term holders surge and short-term traders decrease. With the price currently hovering around $29.26, AVAX is approaching two key resistance zones that could determine its next move.

A successful break above the $34.12 level could trigger a massive 79% rally. However, failure to break these resistances could result in significant downside risk, with potential drops ahead.

AVAX Long-Term Holders Surge: A Bullish Signal?

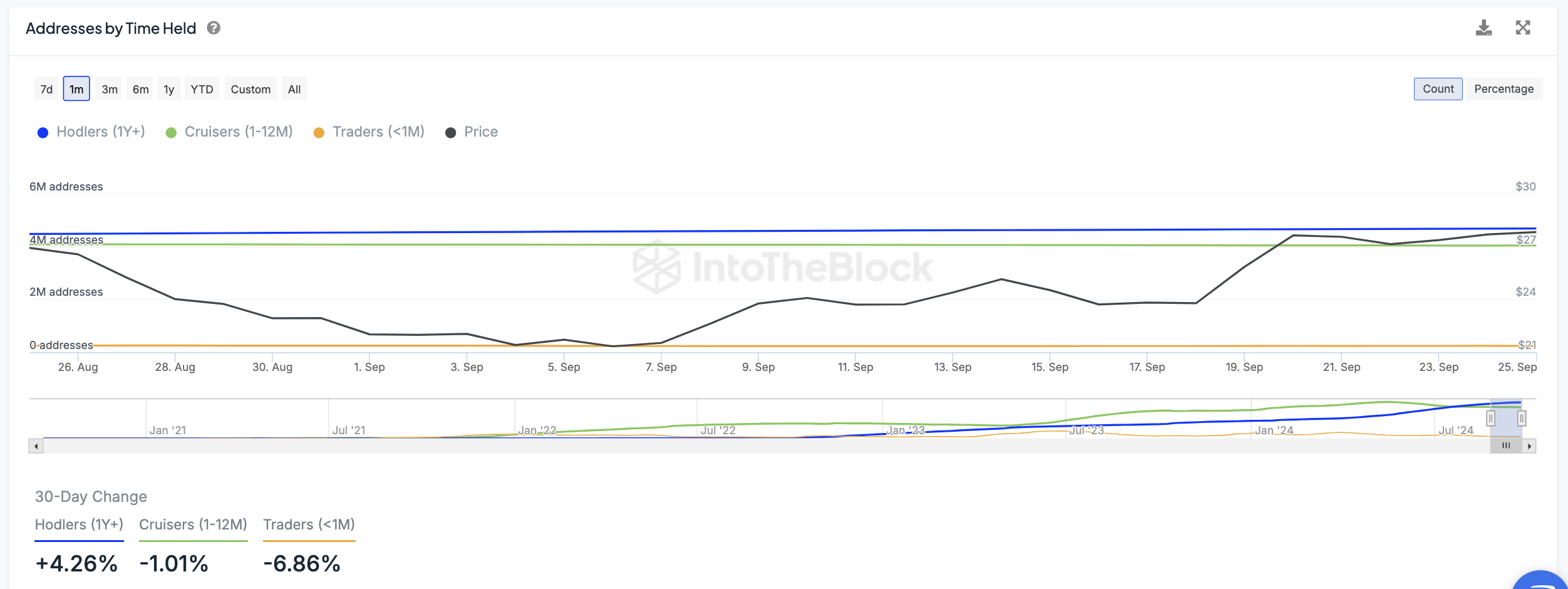

In the past month, the number of long-term holders of Avalanche (AVAX) has grown by 4.26%, which might not seem like much at first glance, but that translates to about 200,000 additional addresses.

These long-term holders, defined as those owning AVAX for more than a year, indicate a growing commitment to the asset, which can have a significant impact on its price stability and potential future growth.

Read more: How To Buy Avalanche (AVAX) and Everything You Need To Know

At the same time, the number of traders — those who hold AVAX for less than a month — has dropped by 6.86%, or around 13,000 addresses. This shift suggests a strengthening belief in coin’s value and long-term potential. As more people hold onto their AVAX for extended periods, selling pressure decreases, which could create a more favorable environment for price appreciation.

Fewer traders mean less volatility, and with more long-term holders showing confidence in the project, this could be a strong bullish signal for AVAX in the coming months.

Ichimoku Cloud Looks Bullish for AVAX

The Ichimoku Cloud chart for AVAX/USD shows several indications that point toward a bullish outlook for Avalanche. One of the key bullish signals in Ichimoku analysis is when the price is trading above the cloud, and this clearly happens in the chart.

When the price breaks out above the cloud, it often suggests a shift towards upward momentum, which can indicate further price appreciation. Additionally, the cloud itself is currently green, reinforcing the positive trend. While the cloud is relatively thick, suggesting there may be some resistance ahead, the overall outlook remains favorable.

Another important aspect is the position of the lagging span (Chikou Span), which is currently above the price, confirming that current momentum is backing the upward trend. Furthermore, the conversion line (Tenkan-sen) is above the baseline (Kijun-sen), indicating stronger short-term momentum compared to longer-term trends, which adds to the bullish case.

Overall, the chart suggests that AVAX is likely to continue its positive movement.

AVAX Price Prediction: A 79% Pump?

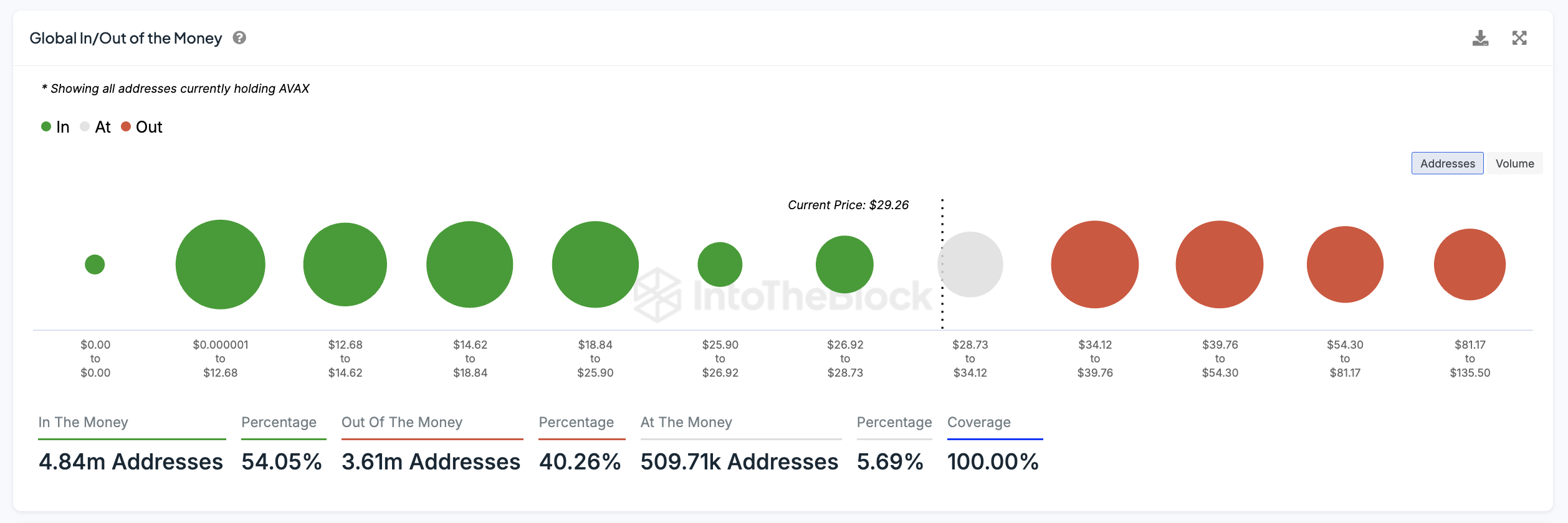

Looking at the Global In/Out of the Money chart for AVAX, we can observe two key resistance zones that lie ahead for its price.

The “Global In/Out of the Money” is a metric that measures the profitability of addresses holding AVAX. Essentially, it shows the percentage of addresses that are either “In the Money” (profit), “At the Money” (break-even), or “Out of the Money” (loss) based on the current AVAX price of $29.26.

The first significant resistance is around the $34.12 level, where a considerable number of addresses are holding AVAX, waiting to break even or sell at this price range.

Read more: How to Add Avalanche to MetaMask: A Step-by-Step Guide

If AVAX can successfully break through this resistance, the next zone to watch is between $39.76 and $54.30. This would represent a potential pump of up to 79%, signaling a major opportunity for upward price movement.

On the flip side, if the current trend fails to break through the resistances, AVAX could face significant downside risk. A price reversal could see it drop to the $25 range, where the next cluster of holders is concentrated.

In a more bearish scenario, the price could even fall as low as $18, leading to a potential 38% drop from current levels. This shows the importance of monitoring key levels closely, as breaking or failing to break them will determine AVAX’s short-term direction.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.