Over the past week, Avalanche (AVAX) price slumped 23%, disproportionately to the altcoin markets, which only shrunk 10%. The excess market supply suggests that the bearish momentum surrounding AVAX could linger.

Avalanche was one of the Layer-1 coins worst impacted by the recent contraction in the crypto markets. While the altcoin market has recovered in the two trading days, the bears still appear firmly in control of the AVAX price outlook.

Bearish Investors Are Still Looking to Sell AVAX

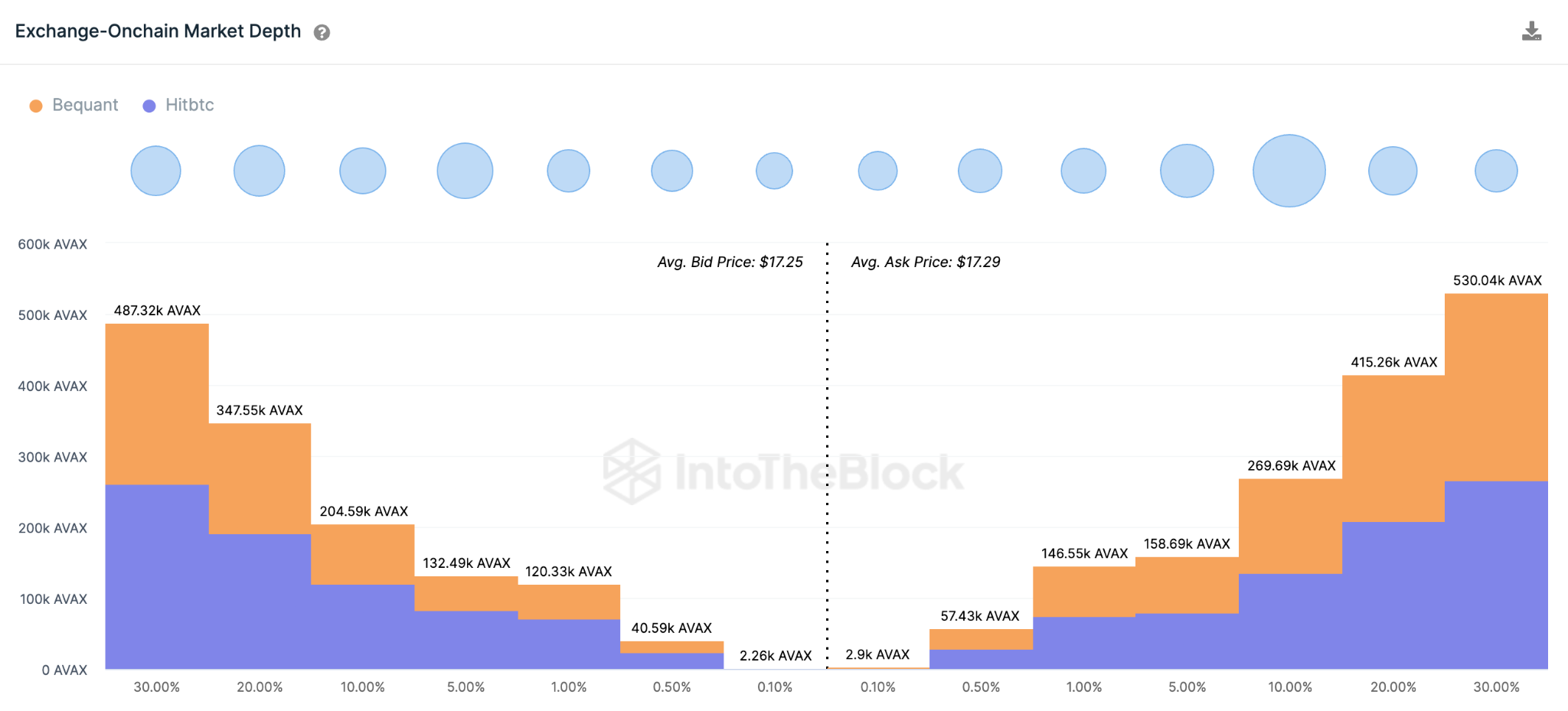

Despite the recent uptick in the global crypto market, AVAX holders are yet to close out their bearish positions. The exchange market depth chart, which presents the aggregate buy/sell orders from top exchanges, shows that active sell orders from AVAX currently outweigh demand.

More specifically, the chart below shows active sell orders for 1.6 million AVAX. Meanwhile, prospective buyers have only placed orders for 1.3 million coins.

It is a bearish signal when the market supply of an asset exceeds demand, as observed above. This excess supply of over 300,000 AVAX could trigger downward pressure, as sellers may look to lower their asking prices to get their orders filled.

Social Media Buzz Could Deter New Investors

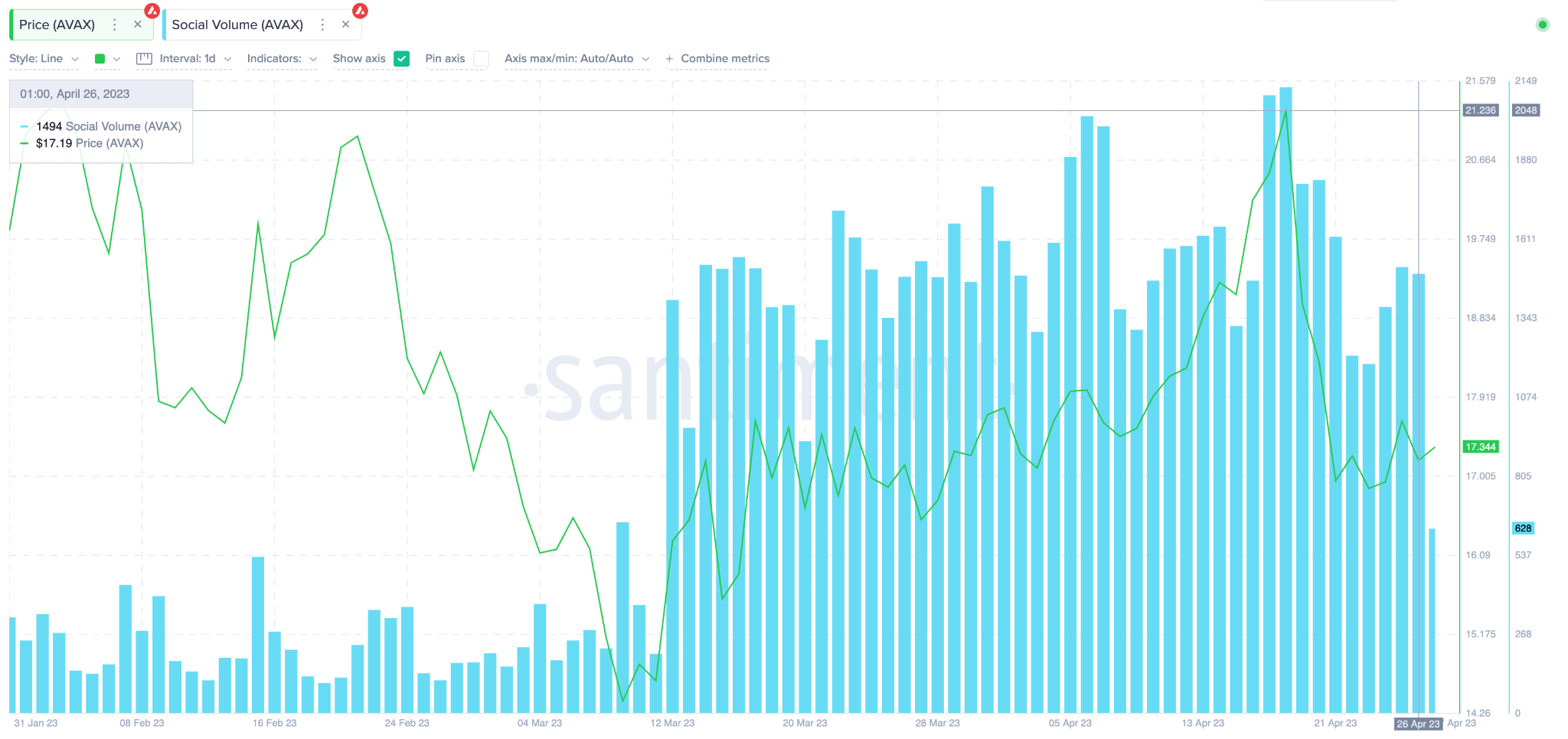

Furthermore, the heightened media buzz surrounding the Avalanche network is another critical bearish indicator. Santiment’s social volume metric tracks the number of times a project is mentioned across relevant crypto media channels.

Looking closely at the chart below, Avalanche social volume is currently heightened compared to the figures recorded in March.

Between the recent low on Mar. 11, Avalanche’s social volume has jumped 600% as of April 25.

Social volume is a contrarian metric in the sense that prices are likely to move in the opposite direction of the degree of media buzz. Essentially, avoid buying at the top, strategic investors look to enter the market when the social sentiment is gloomy and dysphoric.

Hence, given the high degree of media attention and excess sell orders, AVAX is likely to experience more price downswing in the coming weeks.

Avalanche Price Prediction: $20 Resistance Poses Major Roadblock

A critical analysis of the Global In/Out of The Money Around Price (GIOM) data shows that AVAX will likely drop to $16.5. However, the 456,000 addresses holding 11.8 million coins could attempt to prevent this and hold up the price.

But if the bearish outlook plays out, Avalanche could drop further to the next significant support level at $14, where roughly 566,000 addresses hold 8.7 million AVAX. This represents a strong support zone.

Conversely, the bulls can regain control if AVAX can surpass the massive sell wall at $19.80. At that zone, a cluster of 454,000 addresses holding 26 million coins will likely knock back the price rally.

But if Avalanche price manages to scale that sell-wall, holders can expect a prolonged bull rally toward $24.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.