Avalanche (AVAX) price is among the few altcoins showing signs of further drawdown over recovery.

To make it even more difficult for the altcoin is that even the AVAX investors are not expecting a rally.

Is Avalanche Doomed to Correct?

At the time of writing, Avalanche’s price is trading under $40, following corrections and a minor recovery in the last couple of days. While hopes of a further price increase arise in the market, such is not the case with AVAX.

This is because the altcoin is witnessing the first Death Cross in nearly a year. A Death Cross occurs when a short-term 50-day Exponential Moving Average (EMA) crosses below a long-term 200-day EMA, signaling a potential downward trend.

It suggests a bearish sentiment and is often considered a significant sell signal by traders. This is further substantiated by the investors’ sentiment, which is not optimistic at the moment.

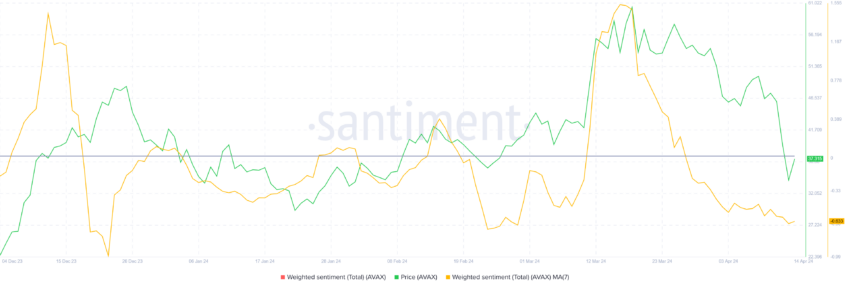

The weighted sentiment that has been treading downwards for the past month hit a two-month low owing to the sudden price drop. A lack of bullishness among AVAX holders also tends to hurt the price.

This could be the case with Avalanche price as the altcoin sets eyes at $27

AVAX Price Prediction: More Downtrend to Come

Avalanche’s price trading at $37 is set to fall back to test the support of $33, which did not fall through during the recent correction. Losing this support, combined with the bearish market cues, will result in a decline to $29.

The Average Directional Index (ADX) also exhibits a bearish outcome for the altcoin. The indicator above the 25.0 threshold is usually a sign of the active trend gaining strength, which is a downtrend in the case of AVAX.

Thus, further decline would see Avalanche’s price touching the low of $27.

However, if broader market cues turn bullish and, instead of the downtrend, the uptrend gains strength, AVAX could recover. Breaching the $44 resistance would invalidate the bearish thesis, which could send the altcoin further upwards.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.