Australia is gearing up for a significant development in the crypto market. The VanEck Bitcoin ETF will start trading on the Australian Securities Exchange (ASX) on June 20.

Australia’s primary stock market has listed an exchange-traded fund (ETF) that invests directly in Bitcoin for the first time.

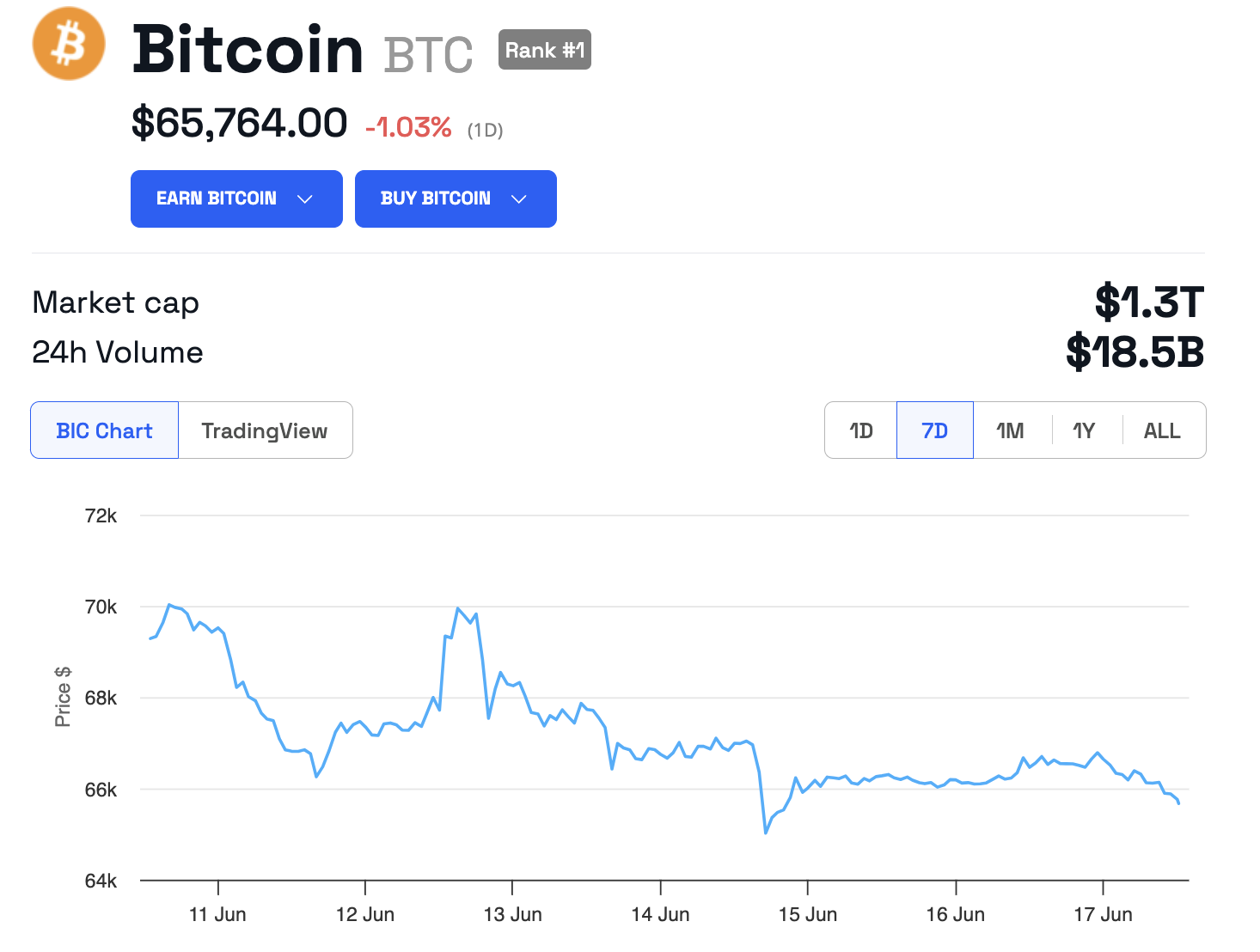

Bitcoin Struggles Despite Australian ETF Developments

The ASX, which handles the majority of equity trading in Australia, has confirmed that VanEck is currently the only applicant to have received approval. However, discussions are ongoing with other potential issuers.

“Notwithstanding that crypto investing is a polarizing topic, we recognize Bitcoin is an emerging asset class that many advisers and investors want to access,” Arian Neiron, VanEck’s CEO in the Asia-Pacific region, said.

The crypto community highly anticipates Australia’s entry into this market, following the footsteps of the United States and Hong Kong, which saw the launch of similar products earlier this year. The US debut of Bitcoin ETFs attracted substantial attention, amassing $57 billion. In contrast, Hong Kong’s spot Bitcoin ETFs have attracted a modest $1.09 billion in assets, according to data from SoSo Value.

In an interview with BeInCrypto, Jamie Elkaleh, the Country Manager at Bitget, said that Australia is a more welcoming market for financial products.

“The US, UK, and Hong Kong now have related products approved shows how futuristic Australia is. Though the size of the Australian market might pale compared to the US, embracing Bitcoin for capital markets before the Western giants set a precedent that is generally shaping the industry at the moment,” Elkaleh told BeInCrypto.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Other Australian firms, including Sydney-based BetaShares Holdings and DigitalX, are also preparing to list on the ASX. A BetaShares spokesperson confirmed that the firm is diligently working on launching spot Bitcoin and Ethereum funds in the near future.

Analysts are comparing Bitcoin and gold, citing the crypto’s role as a store of value and an inflation hedge. This perspective is supported by historical trends, such as the launch of the gold ETF in 2004, which preceded a nearly eight-year bull market in gold prices.

Previously, CBOE Australia, the country’s secondary exchange, listed Bitcoin ETFs with mixed success. It remains to be seen how these funds will perform on the main exchange.

Despite positive developments, the broader crypto market, including Bitcoin, is experiencing significant volatility. Bitcoin is currently trading below $66,000, struggling to regain its March peak.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

According to data from Coinglass, over the past 24 hours, the market’s fluctuations have resulted in over $130 million in liquidations. This includes $98 million from long positions and $32 million from shorts.