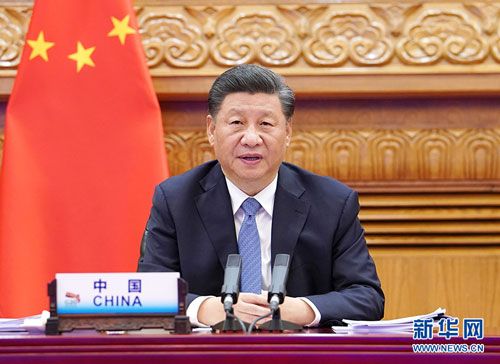

Chinese President Xi Jinping has urged heads of government to take an “open and accommodating” stance toward Central Bank Digital Currencies (CBDCs), as the global economy attempts to recover from the fallout of the COVID-19 pandemic.

Xi spoke to attendees of the 15th G20 Leaders Summit in Saudi Arabia. The comments come as China is attempting to position the yuan as a global reserve currency alternative to the US dollar. These efforts are part of a wide-ranging strategy to translate China’s significant economic heft into international influence at a level comparable to the U.S.

Xi Backs CBDCs

Speaking to world leaders attending the G20 Summit in speech that focused on the world’s response to the pandemic, Xi linked enhanced international cooperation and expansion of the digital economy to inclusion and economic growth. This he said, would aid the world’s recovery and to this end, G20 leaders should adopt a friendly posture toward Central Bank Digital Currencies.

In his words:

The G20 also needs to discuss developing the standards and principles for central bank digital currencies with an open and accommodating attitude, and properly handle all types of risks and challenges while pushing collectively for the development of the international monetary system.

Xi Jinping speaking at the 15th G20 Leaders’ Summit in Beijing, 21 November 2020

On Nov 2, BeInCrypto reported that over $300 million worth of the recently-launched Digital Yuan had been spent. While other countries like the Bahamas and Cambodia launched their CBDCs before China, the sheer potential scale of the Chinese CBDC – estimated by Goldman Sachs to reach 1 billion users, $2.7 trillion annual total payment value (TPV) and $228 billion in issuances within 10 years – makes China the de-facto world leader in CBDC implementation.

Internationalising the Digital Yuan

Analysts have pointed out that Xi’s drive to position the Digital Yuan at the head of the global CBDC rollout is down to more than just technological competition.

While China controls an estimated 16.4 percent of global GDP, the RMB is responsible for just 1.9 percent of global payments, compared to the U.S. dollar, which controls 79.5 percent according to SWIFT. The growth of the Digital Yuan is expected to expand the RMB’s share of payments, albeit marginally.

Just as significantly, the Digital Yuan would present China with the opportunity of a global payment system which is independent of the SWIFT network. This would offer Beijing the chance to increase economic ties with countries currently under U.S.-led economic sanctions such as Russia and North Korea, bringing them closer into its economic orbit and thus reforming the global political order.