Taiwan’s Financial Supervisory Commission (FSC) released rules to regulate the crypto sector today. The move comes as the nation looks to cash in on crypto investors’ Asian migration.

Like upcoming European regulations and existing Hong Kong legislation, businesses must separate customer funds, employ robust cybersecurity, and limit money laundering. And new token issuers must submit a white paper before exchanges can list their tokens.

Taiwan Crypto Regulation Focuses on User Protection

The new law also prohibits exchanges and investors from using stablecoins or trading derivatives. The FSC claims the risk of market manipulation in derivatives amplifies risks for ordinary retail consumers.

“Considering that the price of virtual assets fluctuates violently, prices are easily manipulated, and derivatives transactions are more complex than traditional financial products, derivatives with virtual assets as the underlying target are more difficult for ordinary people to understand.”

Overseas companies cannot advertise or offer services to Chinese consumers unless they comply with the FSC’s money laundering regulations. In addition, registered crypto businesses must report the identities of all parties involved in crypto transactions.

Economic Significance of Taiwan Grows

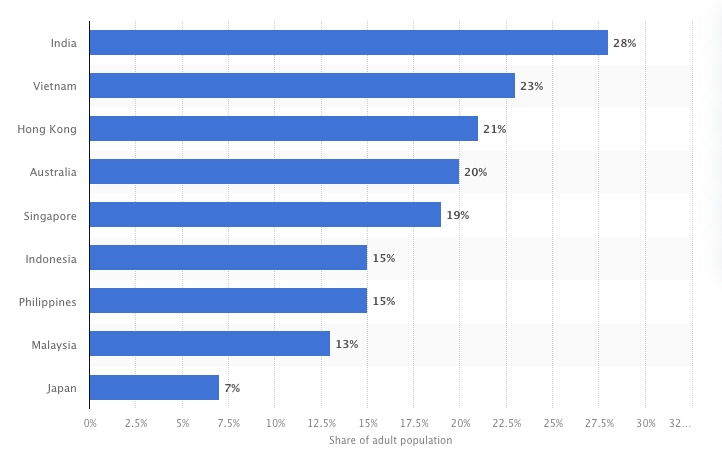

The move to regulate the crypto industry means the region’s economic significance continues to grow. Japan’s Financial Services Agency, Hong Kong’s Securities and Futures Commission, and South Korea’s Financial Services Commission have all passed comprehensive crypto legislation in the past 18 months.

Hong Kong regulators are already facing their first instance of non-compliance after police charged employees of Japanese crypto exchange JPEX with fraud. The exchange falsely claimed it was registered with the Hong Kong Securities and Futures Commission and reportedly charged exorbitant fees.

Find out the best crypto exchanges for beginners here.

The Taiwanese regulator has also been busy, recently pressuring the Taiwan Stock Exchange to create better rules to govern a new dividend program for high-yield exchange-traded funds (ETFs). The ETFs attracted significant interest in Taiwan’s ETF industry.

Find out the best investment apps here.

Overseas investors are also affected by the geopolitical tensions in the region. Nvidia Corp., Apple Inc., and many other public firms rely heavily on the services of Taiwan Semiconductor Manufacturing Corporation (TSMC). TSMC holds patents for manufacturing processes critical to the correct functioning of Nvidia’s artificial intelligence chips, which could be a bottleneck for the company and hurt shareholders.

Do you have something to say about the new crypto regulation in Taiwan, its growing importance as an economic hub in Asia, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).