Many cryptocurrencies in the Layer 2 (L2) ecosystem have seen their values surge in the last week.

Leading L2 token Arbirtum (ARB) has witnessed a 10% price hike during that period and currently trades within an ascending channel. As of this writing, the altcoin exchanged hands at $0.73.

Arbitrum Rallies Above 20-day EMA

Arbitrum’s double-digit price surge in the last week has caused it to form an ascending channel. An ascending channel is a bullish signal formed when an asset’s price moves between two upward-sloping parallel lines. The upper line of the channel acts as resistance, while the lower line serves as support.

ARB has been trending within this channel since July 4, and its value has grown by 17%. During Monday’s trading session, the token successfully closed above its 20-day Exponential Moving Average (EMA) for the first time since June 5.

An asset’s 20-day EMA tracks its average price over the past 20 trading days. When its price climbs above this level, it indicates a shift towards a bullish trend. It suggests that the short-term price momentum is turning positive, with recent prices trading higher than the average price over the past 20 days.

Further, an asset’s price crossing above its 20-day EMA offers confirmation of an uptrend. It indicates that the asset’s price is rising, and the uptrend may continue in the short term.

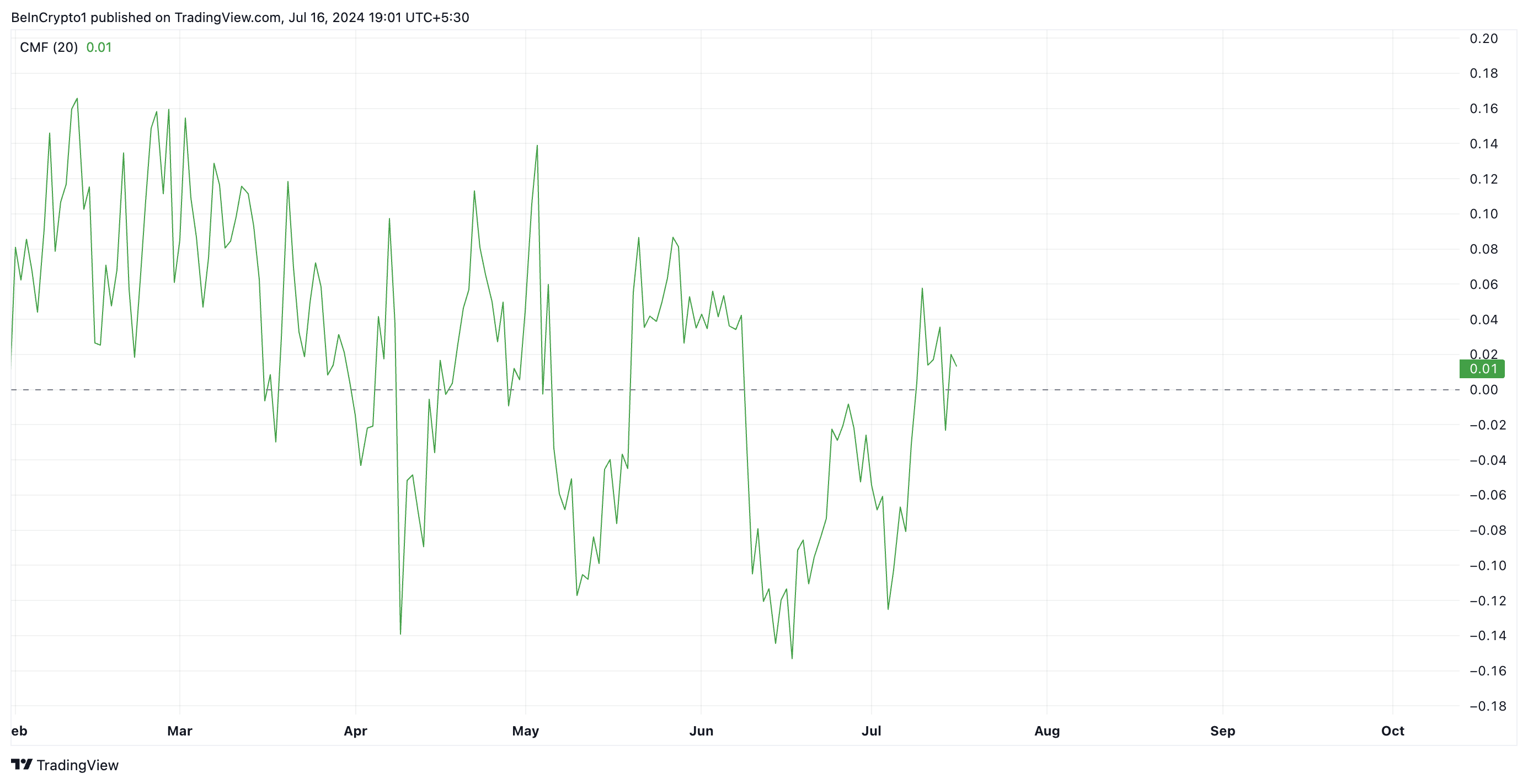

ARB’s surging Chaikin Money Flow (CMF) lends credence to the above position. As of this writing, the token’s CMF value was above zero at 0.01.

Read More: How to Buy Arbitrum (ARB) and Everything You Need to Know

This indicator measures how money flows into and out of an asset. A value above the zero line is a sign of market strength. It indicates liquidity inflow into the market and is often a precursor to a sustained price rally.

ARB Price Prediction: Demand is Needed to Sustain Rally

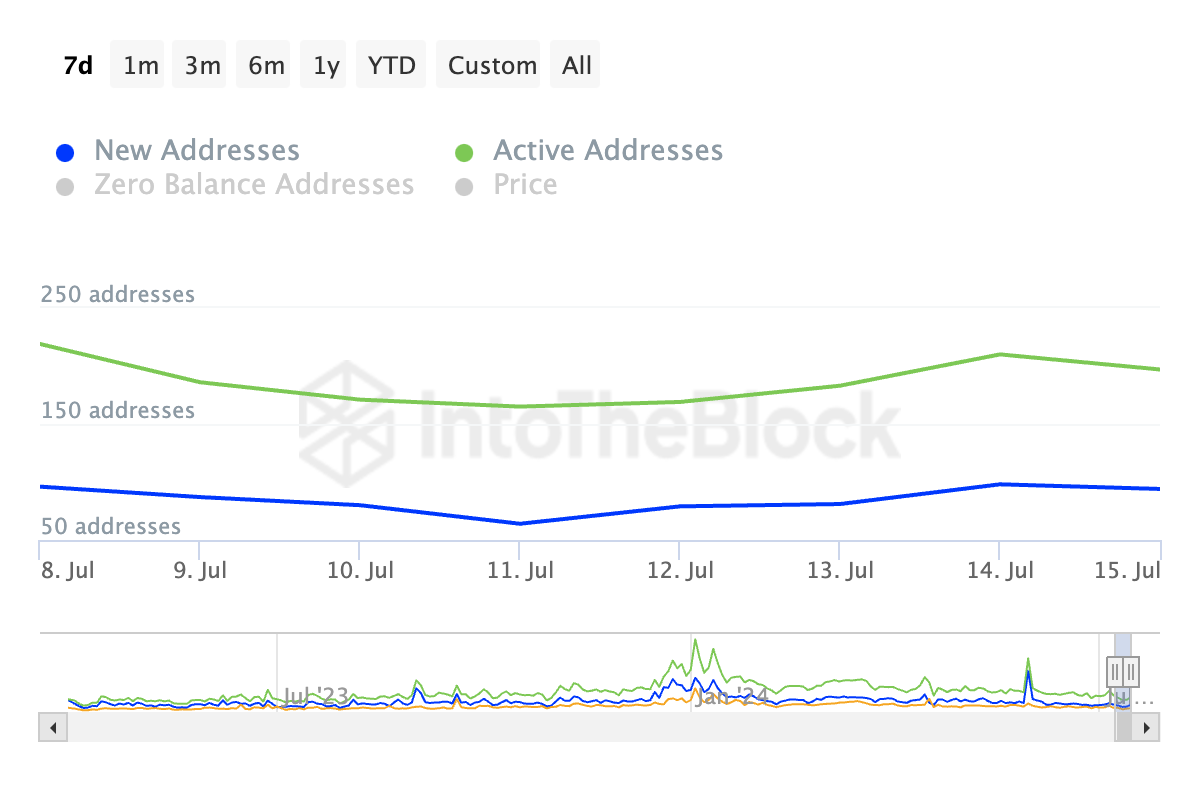

New demand for ARB has steadily declined amid its price uptrend. Data from IntoTheBlock show that in the past seven days, the number of new addresses created to trade the altcoin has dropped by 2%.

Likewise, the daily count of active addresses that have completed at least one transaction involving ARB during that period has plunged by 10%.

For ARB’s rally to be sustained, this trend must change. It must continue to enjoy market demand. If demand resurges, its price may rally to $0.99.

Read More: Arbitrum (ARB) Price Prediction 2024/2025/2035

However, if market participants begin to take profits at this level, the token’s price will drop to $0.55.