Aptos (APT) ‘s price experienced extreme bearishness, falling to $5.10 over the last couple of days and losing a key support floor.

However, the altcoin seems to be recovering, with bullish momentum building.

Is Aptos a Good Choice For Investment?

Aptos’s price making a comeback is a positive signal for its investors. The Relative Strength Index (RSI) shows evidence of this. The RSI is showing upward movement after rising from the oversold region.

This uptick in the RSI’s bearish zone is a positive sign, indicating an increase in bullish momentum. It also suggests that investor sentiment may shift towards a more favorable outlook.

Read More: Where To Buy Aptos (APT): 5 Best Platforms for 2024

As the RSI climbs, it reflects a growing interest and potential recovery in Aptos price. This signals that the asset is gaining traction and moving towards a more bullish phase.

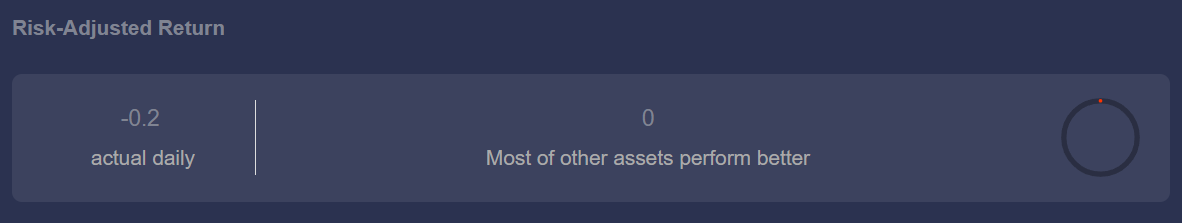

However, despite the positive RSI movement, the Sharpe Ratio for APT is currently at -0.2.

This negative ratio indicates that the returns on APT are not significant relative to the risk taken, suggesting that the asset’s performance has not been meeting expectations.

Overall, while APT is exhibiting signs of recovery, investors should seek better returns before jumping in.

APT Price Prediction: Watching Key Support

Aptos’s price at $5.27 is facing considerable challenges. A recovery will only be confirmed once the local resistance of $6.74 is breached again. Until then, the altcoin must leverage the rising bullishness to reclaim this resistance and turn it into a support.

This could push the altcoin’s price towards the 23.6% Fibonacci Retracement level of $7.91. Once this level is turned into support, APT will have a shot at registering a significant rise.

Read More: Aptos (APT) Price Prediction 2024/2025/2030

On the other hand, if the breach fails, the altcoin will enter consolidation, which has been the case since mid-June. Prolonged consolidation could invalidate the bullish thesis, leaving APT under $8.00.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.