ApeCoin (APE) faces strong downward pressure, with several indicators signaling potential further declines. The 7-day MVRV suggests recent buyers are mostly at a loss, which hints at undervaluation but leaves room for additional downside.

The RSI remains low yet hasn’t entered oversold territory, indicating that selling pressure may continue before any rebound. Additionally, the EMA lines have formed a bearish death cross, suggesting APE’s price could either test deeper support levels or, if momentum shifts, aim for a recovery toward key resistance points.

APE MVRV Shows An Important Threshold

APE’s 7-day MVRV is currently at -8.79%, suggesting that most holders who bought within the past week are at a loss. A negative MVRV typically indicates that assets are undervalued, as holders are generally in the red, which sometimes leads to a price rebound as selling pressure decreases.

This level of negative MVRV implies that APE price could be approaching a bottom, as lower MVRV values often signal a potential buying opportunity.

Read more: ApeCoin (APE): Everything You Need To Know

The 7-day MVRV (Market Value to Realized Value) measures short-term profitability by comparing the current price to the average cost basis of assets purchased over the last seven days. Historically, APE has rebounded when its 7-day MVRV dropped below -9.2%, meaning further correction is possible before a recovery.

While the current MVRV is close to this threshold, it suggests that APE’s price could still dip a bit more before hitting a level that has previously triggered upward momentum.

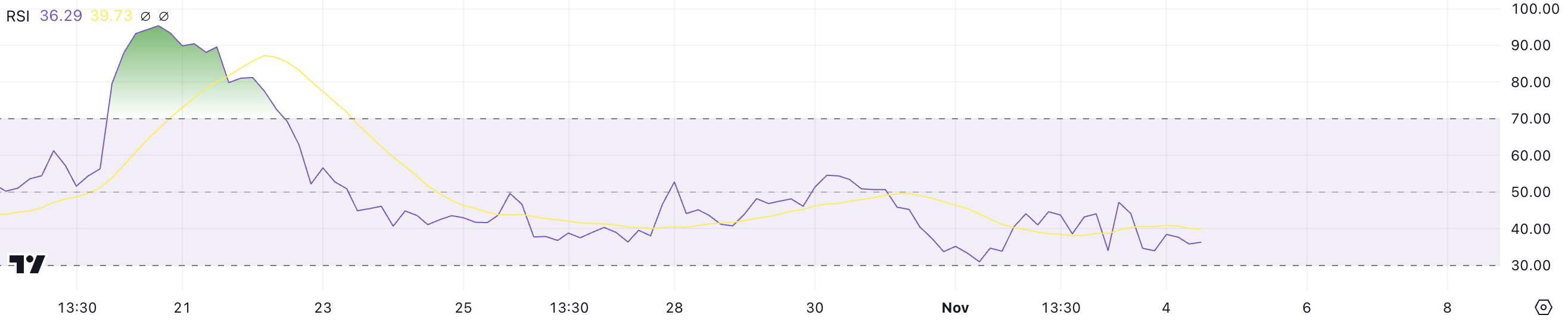

ApeCoin RSI Is Not Oversold Yet

APE’s RSI is currently at 36.29, indicating a relatively low level of momentum and signaling that selling pressure has been dominant. RSI, or Relative Strength Index, is an indicator used to assess whether an asset is overbought or oversold.

Values below 30 generally suggest an oversold condition, while values above 70 indicate an overbought state.

Although APE’s RSI is low, it hasn’t reached the oversold threshold yet, suggesting that there may still be room for further downside.

This level hints at weakness in buying interest, and without an oversold reading, the likelihood of an immediate rebound remains uncertain. Consequently, APE’s price correction may continue before any potential reversal occurs.

APE Price Prediction: A Further 24.5% Correction?

APE’s EMA lines are forming a bearish “death cross,” with short-term EMAs crossing below the long-term EMAs. This formation is typically a strong bearish signal, suggesting that downward momentum may intensify as sellers gain control.

A death cross often indicates that the current downtrend could continue, placing additional pressure on APE’s price.

Read more: ApeCoin (APE) Price Prediction 2024/2025/2030

With APE already down roughly 10% in the last 24 hours, the continuation of this downtrend could lead to a test of support at $0.68, which would imply a further 24.5% price correction.

On the other hand, if buying interest emerges and the trend reverses, APE could attempt to break resistance at $1.14, offering a potential 25% upside. The direction of the next move will likely depend on whether APE can maintain current support or attract new buyers.