Animal Farm envisions providing a decentralized yield aggregation model with sustainability in mind.

DeFi is gaining widespread popularity in the crypto realm. Financial services offered on public blockchains are referred to as DeFi (or “decentralized finance”).

Most banking services are supported by DeFi, including earning interest, borrowing money, lending money, purchasing insurance, trading derivatives, trading assets, and more.

Yield farming has been gaining popularity since its introduction in 2020. It allows high-yield farmers to get a fixed APY. However, several platforms scoop up major profits in the form of hefty fees from their users. This limits the potential for users to earn more.

Let us take a look at Animal Farm, decentralized lending, and the yield aggregating DeFi protocol.

Animal Farm in a nutshell

Animal Farm is a decentralized ownership lending and yields aggregating protocol. This DeFi protocol sets itself apart from its competition with its mechanics.

The platform offers decentralized lending without relying on algorithm stablecoins or high-risk models. Animal Farm uses a fully decentralized dynamic supply control algorithm. This allows the platform to trustlessly adjusts yield within a sustainable range with a focus on optimal performance. This even allows the native assets to become deflationary in low-demand cycles.

“Our vision is to make traditional finance tools, typically only reserved for the super-wealthy, available to anyone by using decentralized protocols which are not limited by the gatekeeping of centralized institutions,”

Forex_shark, main Animal Farm dev.

What makes Animal Farm unique?

Its goal is to make traditional financial instruments, which are generally exclusively accessible to the extremely wealthy, available to everyone.

Did you know?

Animal Farm’s core product is lending and yield aggregation, but unlike other platforms, it is the only one that truly supports genuine decentralized ownership. Here are some of the key features that make Animal Farm stand out.

Fully decentralized lending

Animal Farm has a fully decentralized lending protocol. It minimizes high-risk exposure by not relying on any algorithmic stablecoins. Instead, Animal Farm uses collateralized TVL to lend to PancakeSwap. Pancakeswap then utilizes this collateral to fill orderbooks for trading and perform other profit-generating tasks.

This is one of the many cash flows Animal Farm takes advantage of to create low-risk yield aggregation, paid out in a BUSD dividend. Unlike other platforms, Animal Farm’s yield comes from real profit-generating utilities.

Dynamic supply control

A fully decentralized dynamic supply control mechanism is used in Animal Farm to keep the yield within a sustainable range. The demand for the underlying assets determines how to reward and regulate emissions.

Animal Farm recognizes that demand in markets comes in cycles. When demand is low, emissions adjust, restricting the supply and empowering the current demand to achieve optimal performance for the Animal Farm tokens (AFD & AFP). This enables AFD and AFP to perform at their best prices throughout all market situations. This makes it different from other platforms that blindly inflate their supply to emit rewards.

Full governance model

The full governance model of the platform allows investors to be a part of owning the platform and not just the tokens. This also allows investors to vote for crucial decisions, including roadmap proposals. It also allows investors to secure dividends such as BNB and BUSD that are generated by platform fees.

Rewarding loyalty

One of the standout features of Animal Farm is that there is a unique loyalty system for investors. It adjusts the tax related to the yield generated depending on the individual’s loyalty to the platform. Basically, this works because when investors conduct actions beneficial to themselves and the network, their loyalty score increases, and their tax rate on transacting AFD reduces.

Users can gain loyalty points by staking DOGS (AFD) on the platform. This will set up a reward system for supporters with all the benefits of vesting without locking up the tokens or introducing any of the additional negative externalities which come with vesting, such as predictable unlocking periods that introduce additional tokens to the circulating supply.

PigPen and Dog Pound

Animal Farm has two types of native tokens. Holding these tokens provides users with different benefits. Both these tokens have unique tokenomics and provide users with several benefits for those who want to get the most out of the platform.

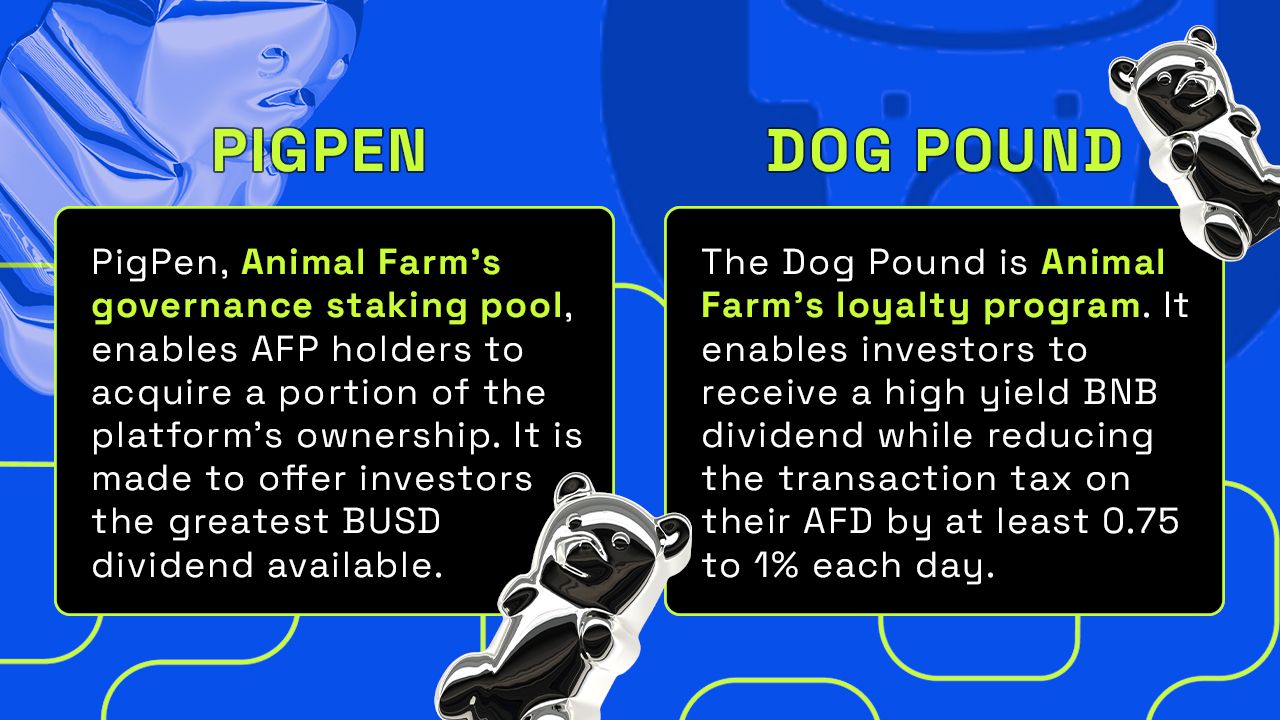

PigPen

PigPen, Animal Farm’s governance staking pool, enables AFP holders to acquire a portion of the platform’s ownership. It is made to offer investors the greatest BUSD dividend available. It pays stakers a BUSD dividend made up of 30% of the income from its rehypothecation collateral lending strategy, 75% of all platform deposit/withdrawal fees, and 1/3 of all taxes paid on AFD transactions.

It enables users to vote on specific ideas for important platform roadmap and crowd-funding decisions.AFP invested in PigPen also gains PIGS earned by Piggy Bank fees.

Dog Pound

The Dog Pound is Animal Farm’s loyalty program. It enables investors to receive a high-yield BNB dividend while reducing the transaction tax on their AFD by at least 0.75 to 1% each day. AFD features a variable tax that serves as a form of vesting. Instead of locking up the users’ assets, Animal Farm distributes value from users transacting AFD with low loyalty scores to users in the DogPound.

Incentivising users to remove AFD tokens from circulation to earn a BNB dividend and increase their asset holdings rather than risking their assets through speculative trading for short-term high-risk gain. Dog Pound stakers receive 2/3 of all taxes levied on AFD transactions in exchange for BNB.

Due to the unique incentive structure and the real-world profit-generating utility Animal Farm provides, through its collateral lending, it’s the only platform where investors can secure profits in a high-yield BNB and BUSD dividend without ever selling their native assets AFD or AFP.

In all market conditions, one class makes a consistent profit, and that’s the owners of innovative platforms; Animal Farm is the only platform providing this value to its participants.

Roadmap

Animal Farm is cooking up developments with Drip Garden and laying out future plans.

- Mid-October 2022 – Animal Farm launch, Dog Pound and Dogs Roulette launch

- Mid-November 2022 – DOGS of Fortune game launch, New DRIP UI

- Mid-December 2022 – Partnership Vaults, Scratchy integration

- 2022-2023 – Plans to bring TradFi instruments, lending to individuals and insurance

Conclusion

The team at Animal Farm is trying to make a platform that allows it’s user base to secure profits in the form of a BNB & BUSD dividend created through participating in decentralized profit-generating services, while maximizing yield and price performance with the implementation of innovative incentive structures.

Animal Farm envisions being a leader in the DeFi industry with a comprehensive roadmap. It includes products that are already created and an inventive yield-producing method that works in all market situations.