Bitcoin (BTC) looks to be approaching the end of its consolidation inside a symmetrical triangle pattern.

A breakout or rejection from this level will be crucial in determining the future trend.

Bitcoin Inside Symmetrical Triangle

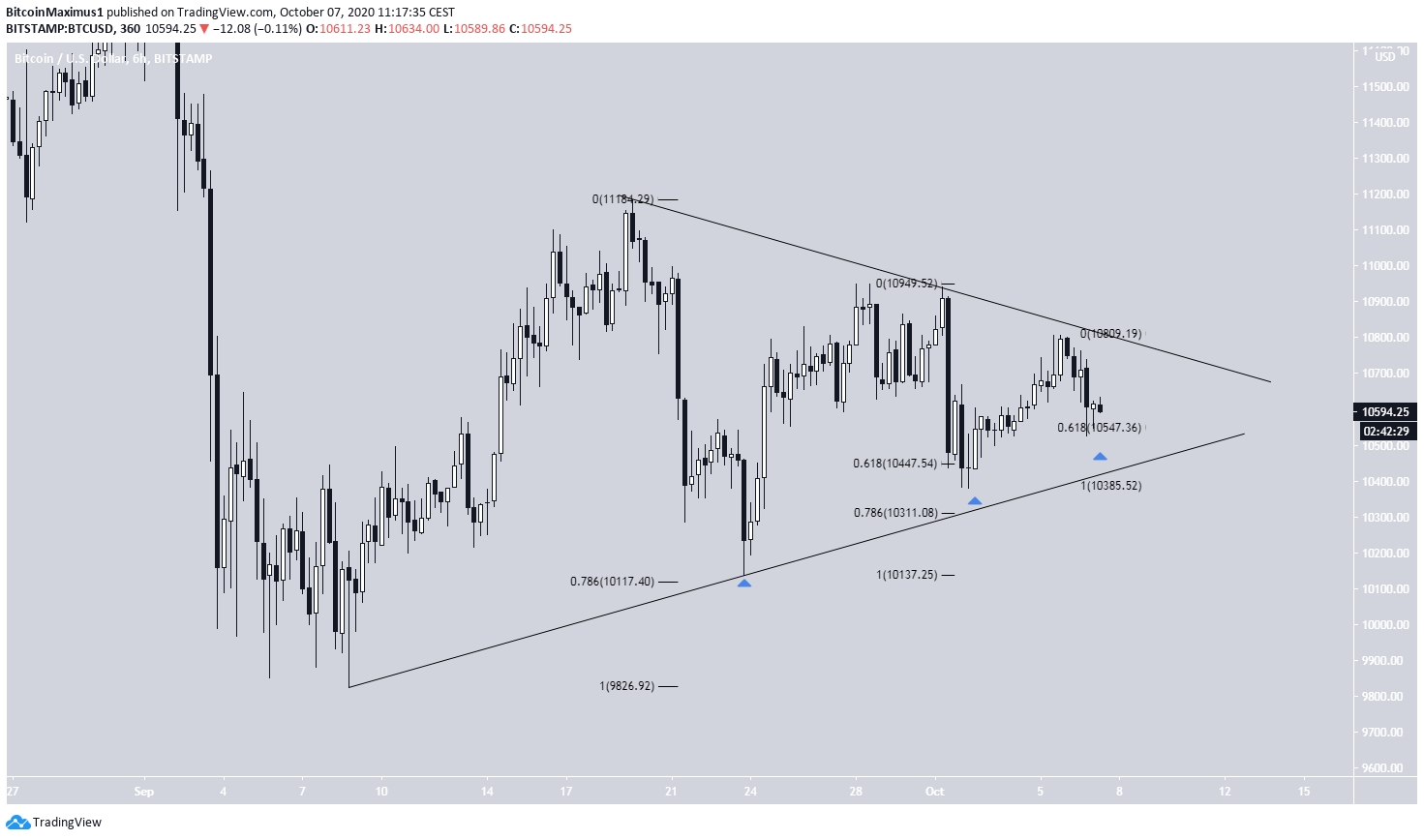

The Bitcoin price has been trading inside a symmetrical triangle since reaching a local low of $9,825 on Sept 8. The symmetrical triangle is normally considered a neutral trading pattern. At the time of press, BTC was approaching the point of convergence between support and resistance.

The price has returned to levels near the support line multiple times up to this point. Relative to the previous upward movement, the decrease has reversed to the 0.617-0.786 Fib levels, making it a likely level for the correction to end.

A decrease below the support line and/or below the $10,380 low (second blue arrow in the image below) would mean that the price has broken down from the triangle, while an increase above the $10,805 high would signal the opposite.

The daily chart reveals that the primary resistance and support levels are found at $11,200 and $10,200, respectively.

However, a breakout/breakdown that travels the entire height of the pattern would take the price much higher/lower, with targets being set at $11,900 and $9,400.

Previous History

In the daily time-frame, technical indicators have created a combination that has previously led to sustained upward movements.

The Stochastic Oscillator has made a bullish cross, and the MACD is close to reaching positive territory. In the previous instances that this transpired, the price increased by 55%, 75%, and 36% once the MACD turned positive.

Future Movement

In BeInCrypto’s Oct 6 Bitcoin analysis, it was stated that:

“BTC likely began a bullish impulse on Sept 9 and now looks to currently be in wave 3.”

While that still remains the most likely scenario, the presence of the triangle forces us to look at another possible count.

Since the price completed a portion of the downward move on Sept 8, it is possible that the triangle is a larger B wave, which the price completed with yesterday’s $10,805 high (green line). If so, BTC should soon break down from the triangle and decrease towards $9,400.

A breakout above the $10,805 high would invalidate this possibility, while a decrease below the $10,380 low (red line) would make it more likely that it is the correct count.

To conclude, while it is still more likely that the BTC trend is bullish, failure to break the $10,805 high could result in a breakdown from the triangle it is currently trading in.

For BeInCrypto’s previous Bitcoin analysis, click here!

Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto.