The elastic supply token Ampleforth (AMPL) has lost two-thirds of its market cap in a matter of days. The atypical characteristics of the token attracted many investors that jumped in.

After a dramatic surge in price and market cap, the tables have turned and Ampleforth has entered a corrective phase.

The token is understood by many as just an experiment, and it may impact the way future tokens are created.

$AMPL investors in disbelief

When there is so much opportunity around, who's going to buy into a 4% negative daily rebase 🤷♂️ pic.twitter.com/cKjeJm7hyD

— Shitcoin minimalist (@bccponzi) August 9, 2020

AMPL: The Ultimate Digital Money?

Ampleforth is not your typical cryptocurrency. It’s quite a complex token with some revolutionary ideas, so let’s go over some of them.

Ampleforth launched back in 2019, becoming the first Initial Exchange Offering (IEO) on Bitfinex.

Its promise is ambitious—to become the ultimate form of adaptative money. Ampleforth aimed to become a stablecoin, targeting the price of $1 in 2019.

This is different from your usual dollar-based stablecoin, which is pegged to whatever value the USD is at the moment.

That means that, as long as the Federal Reserve keeps printing money year after year, Ampleforth won’t target one dollar, but $1 of 2019 inflation-adjusted value. To give an example, $1 in 2009 equates to $1.20 in 2020.

AMPL’s website expands on this, saying:

Today AMPL’s unique volatility pattern makes it a valuable new building block for decentralized finance. Tomorrow AMPL can be a better Bitcoin.

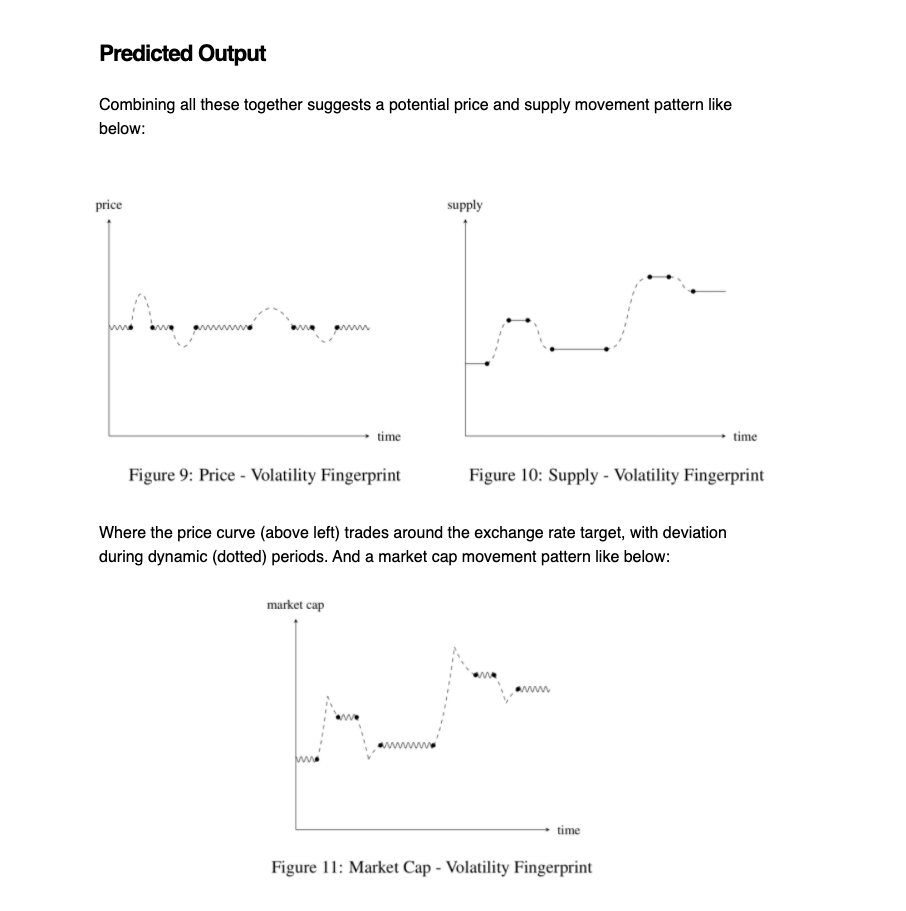

Another novel concept is an elastic supply. AMPL’s smart contract increases or decreases the total supply automatically based on the target price, between $1.06 and $0.96—a process called “rebasing.”

If the price goes over $1.06, at 2 AM the protocol will automatically print more AMPL in order to bring the price down to the target. If the price goes below $0.96, the protocol will burn excess tokens.

Long story short, it means that you don’t own a certain amount of AMPL, but a percentage of the supply. Investors see their AMPL tokens increasing or decreasing, which is not the usual way things work with any other currency.

All’s Good Until it Isn’t

Some have made fortunes in a matter of weeks just by holding AMPL.

The token entered an expansion phase near the end of June. Increased demand for the token pushed the price up, and holders received a series of “positive rebases.”

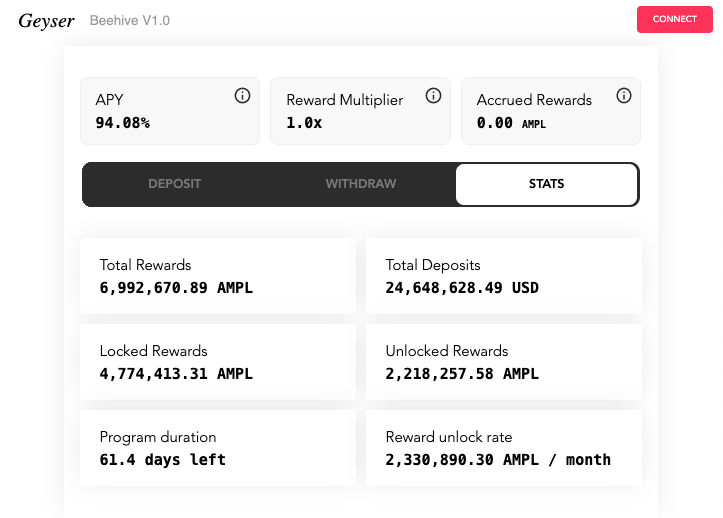

Ampleforth also launched its staking program called Geyser. Geyser enables users to stake their AMPL to provide liquidity on Uniswap, giving some utility to the token.

Ampleforth made it on the top-100 cryptocurrencies on Coingecko at lightspeed. In days, the project reached top-30 and the FOMO became wild.

What Goes Up Must Come Down

At the end of each month, Ampleforth’s team and early investors get some of their token allocations unlocked. These investors and team members have benefited from the expansive period of positive rebases, holding good chunks of the supply.

And of course, they sold massively as soon as they could, along with many retail investors that wanted to lock in profits.

In less than 24 hours, the price went from $1.30 to $0.67, a loss of roughly 50%. Some retail investors jumped in attracted by the lower prices, hoping to ride the next wave—but that’s not how Ampleforth surfs:

The protocol has entered a contractive phase, and the same momentum that took it up is currently driving it down. This is causing a massive change in investors’ psychology, as many are now wary of putting money on this experimental project.

There’s a complex convergence of factors at play with Ampleforth’s recent contraction phase. The biggest one is the psychological effect of the negative rebase phase. As the protocol is adjusting the supply from its growth, tokens are being burned.

Many retail investors are getting out of their AMPL positions and moving their money into what they perceive as hotter and safer projects.

Less demand means a lower price, and the lower price will lead to negative rebases, causing further decreased demand.

If it sounds difficult, it’s because it is. Like it or hate it, Ampleforth’s economics are one of a kind. Or at least, they were.

The AMPL Rebase Party

A series of other projects are taking Ampleforth’s rebase concept and adapting it in creative ways.

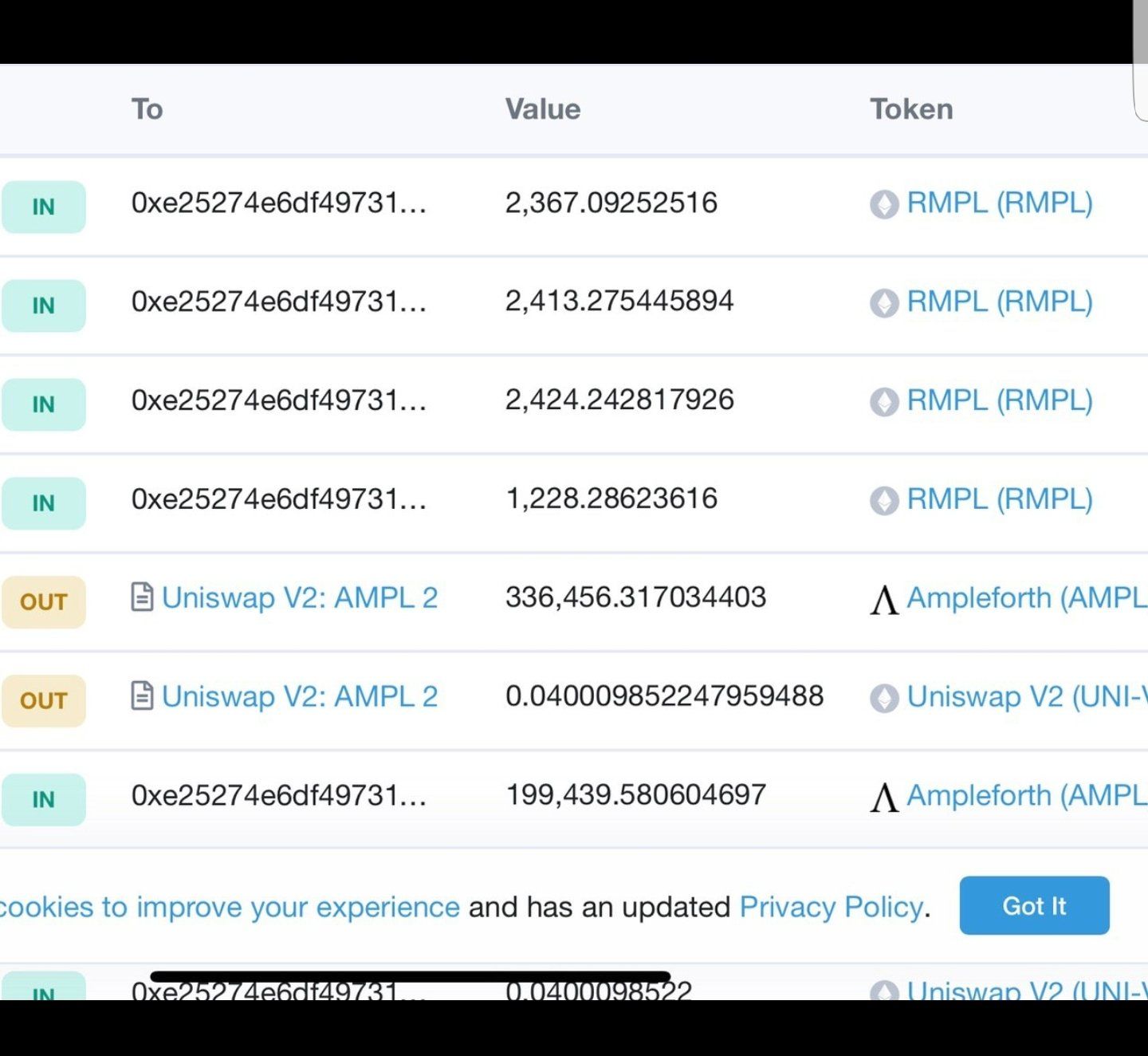

Some like $RUZE have implemented an hourly rebase, while the recently-launched $RMPL has gone one step further and is doing a randomized rebase, gathering lots of transfers from Ampleforth’s holders.

Perhaps the most cyberpunk of them is a project called the AntiAmple ($XAMP). It accuses Ampleforth of replicating fiat in the crypto space, and XAMP claims that it “wants to destroy it.”

While Ampleforth issues more tokens based on supply and demand, we constantly destroy it. The cryptocurrency was born on the concept of deflationary assets. Antiample takes this concept to the extreme.

There are more elastic supply tokens mushrooming at the time of writing, and this might be another factor playing in Ampleforth’s current negative cycle.

Retail investors driven by quick returns will likely jump ship quickly, looking for whichever positive rebase is available.

Is the Future of Crypto Elastic?

Many users accuse Ampleforth of being a scam, printing money, and betraying the spirit of crypto. Regardless of the name-calling, Ampleforth’s novel concepts are changing the way cryptocurrency supplies work.

If the concept of rebasing takes root, we might see a whole rethinking of the tokenomics of many projects. This is very important for DeFi, as the current system is sometimes constrained by the limited supply of many tokens.

The project that gets this right may become the untouchable champion of the new decentralized finance landscape.