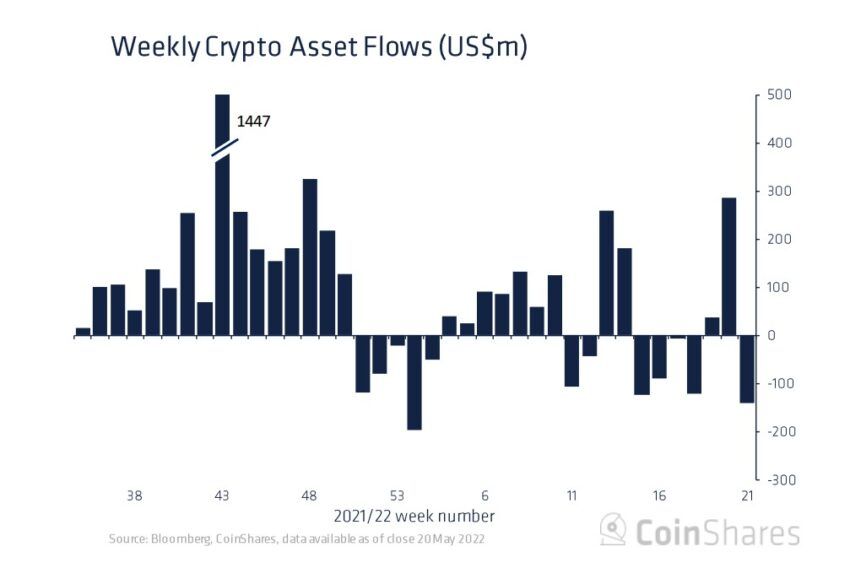

Digital asset investment products for the week ended May 20 recorded outflows of $141 million amid broader market weakness.

Coinshares’ report highlighted that the total assets under management (AuM) also reached the lowest point since July 2021 at $38 billion.

In the week prior, CoinShares had recorded the highest weekly inflows for the year of $274 million. While the inflows for the week ending May 13 were led by buying opportunities in a weak market, overall market sentiments are now bearish, the report noted.

Analyst James Butterfill said: “The ongoing volatility has led to fickle investors with some seeing this as an opportunity while the aggregate sentiment is predominantly bearish.”

When it comes to asset-specific flows, bitcoin witnessed an outflow of around $154 million last week. However, its year-to-date and month-to-date flows remain net positive at $307 million and $187 million respectively.

On the altcoin front, while Ethereum witnessed slight outflows in the week, assets like Cardano and Polkadot witnessed positive flows totaling $1 million each.

Blockchain equity investment products report outflows

Meanwhile, weakness in the equity market spilled on to the blockchain equity investment products as the category reported outflows of $20 million.

But the report noted that “multi-asset (multi-crypto) investment products remain the stalwart with inflows totaling US$9.7m last week.”

With regard to the unsteady crypto markets, Grayscale CEO Michael Sonnenshein noted at the WEF’s Davos Summit that a pullback like this is nothing new in the crypto space.

According to Sonnenshein, crypto markets need to be examined in the context of broader markets, adding, “You’ve seen rising rates in the U.S. has caused a lot of volatility in a lot of different asset classes, crypto along with it. The recent selloff, though, from what we’re hearing from investors, has not deterred them.“

That said, the cumulative cryptocurrency market cap is hovering close to $1.33 trillion at the time of writing.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.