Cardano (ADA) price is showing increasing bearish momentum across multiple technical indicators as the ninth-largest cryptocurrency by market cap faces mounting pressure. ADA is down 12% in the last seven days and more than 4% in the last 24 hours, with its market cap now at $33 billion, though it maintains its position as a top-10 cryptocurrency in ninth place.

Multiple technical indicators suggest the downward pressure could continue, with ADX showing strengthening bearish momentum and whale accumulation remaining below recent peaks. The potential formation of a death cross in EMA lines adds to the bearish outlook, though key support levels could provide temporary relief.

Cardano Downtrend Is Getting Stronger

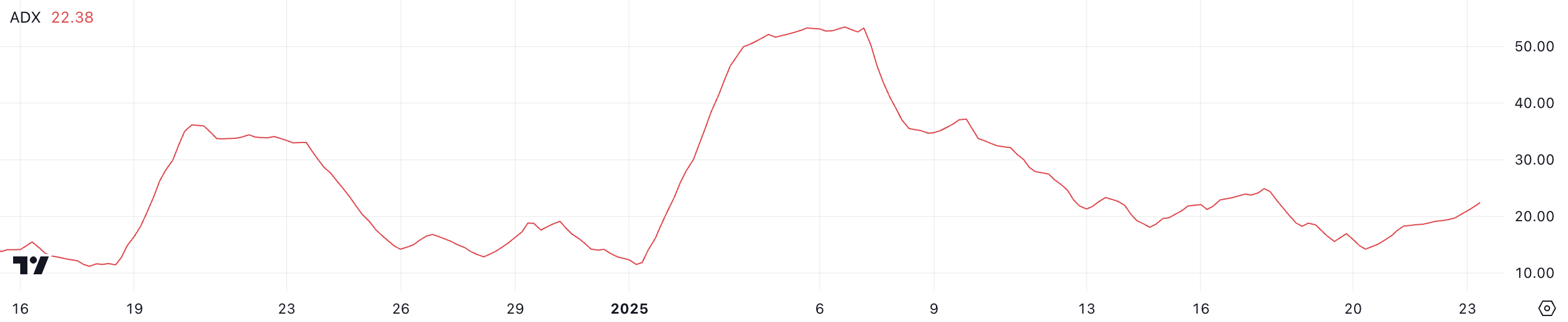

Cardano Average Directional Index (ADX) has shown notable strengthening, rising from 14.2 to 22.3 in just two days.

This sharp increase in ADX, which measures trend strength regardless of direction on a 0-100 scale, suggests the current trend is gaining momentum as it moves from a weak trend zone (below 20) into an emerging trend zone (20-25).

With ADA price in a downtrend and ADX rising above 20, this indicates the bearish momentum is likely strengthening. An ADX climbing from weak (14.2) to moderate trend strength (22.3) while price moves lower typically confirms increasing selling pressure.

However, since ADX hasn’t yet crossed above 25 (strong trend threshold), the downtrend may still be in its early stages of development.

ADA Whales Are Recovering

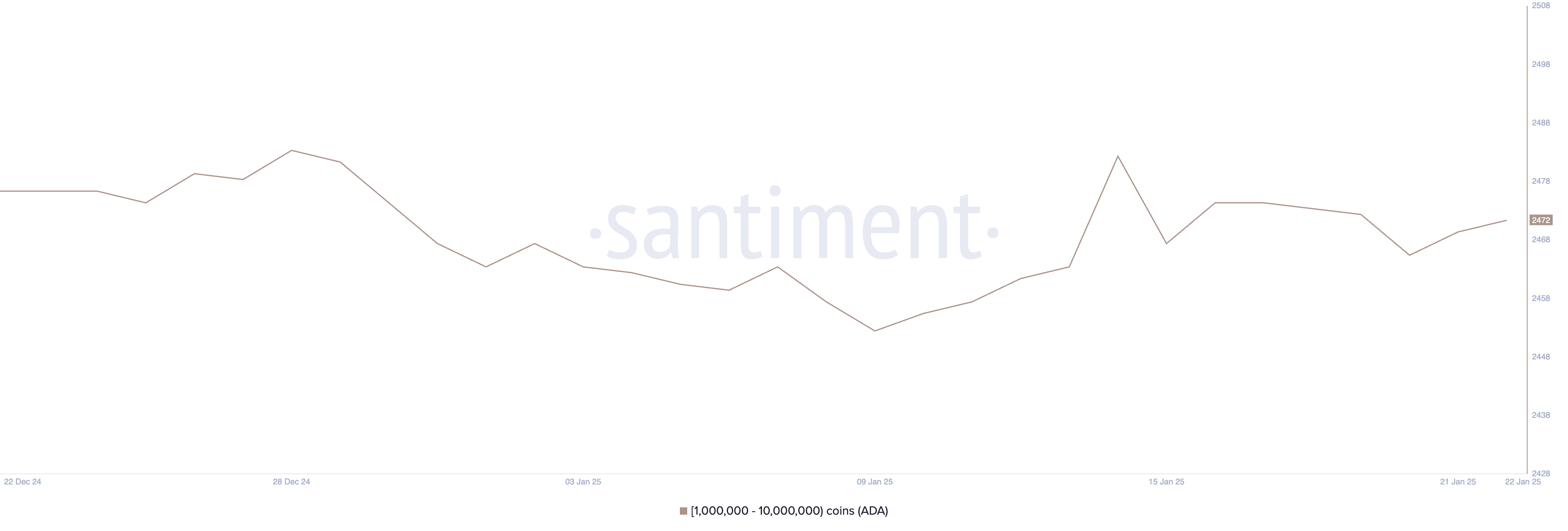

The number of Cardano whale addresses holding between 1 and 10 million ADA has slightly increased from 2,466 to 2,472 in the past three days, though it remains below the January 14 peak of 2,483 addresses.

Whale accumulation patterns often provide insight into potential price movements. These large holders can significantly influence the market through their trading decisions and typically have sophisticated market analyses informing their positions.

The current whale metrics present a mixed signal for ADA price outlook. While the recent uptick in whale addresses suggests some renewed accumulation interest at current prices, the number remains below mid-January levels.

This pattern of whales slightly increasing positions but staying below recent peaks could indicate cautious accumulation rather than strong conviction, suggesting large holders may be testing current price levels rather than showing aggressive buying sentiment.

ADA Price Prediction: A Further 20% Correction?

Cardano Exponential Moving Average (EMA) lines suggest an imminent death cross, with shorter-term averages potentially crossing below longer-term ones.

This bearish technical pattern could trigger a cascade of support tests at $0.87, $0.829, and potentially $0.76, representing a significant 20% downside risk for Cardano price.

A bullish reversal scenario would first need to overcome resistance at $1.03. Further upside targets exist at $1.11 and $1.16, offering potential 21% gains for Cardano price.

However, the looming death cross suggests any upward movement may face significant resistance until the EMA lines show bullish realignment.