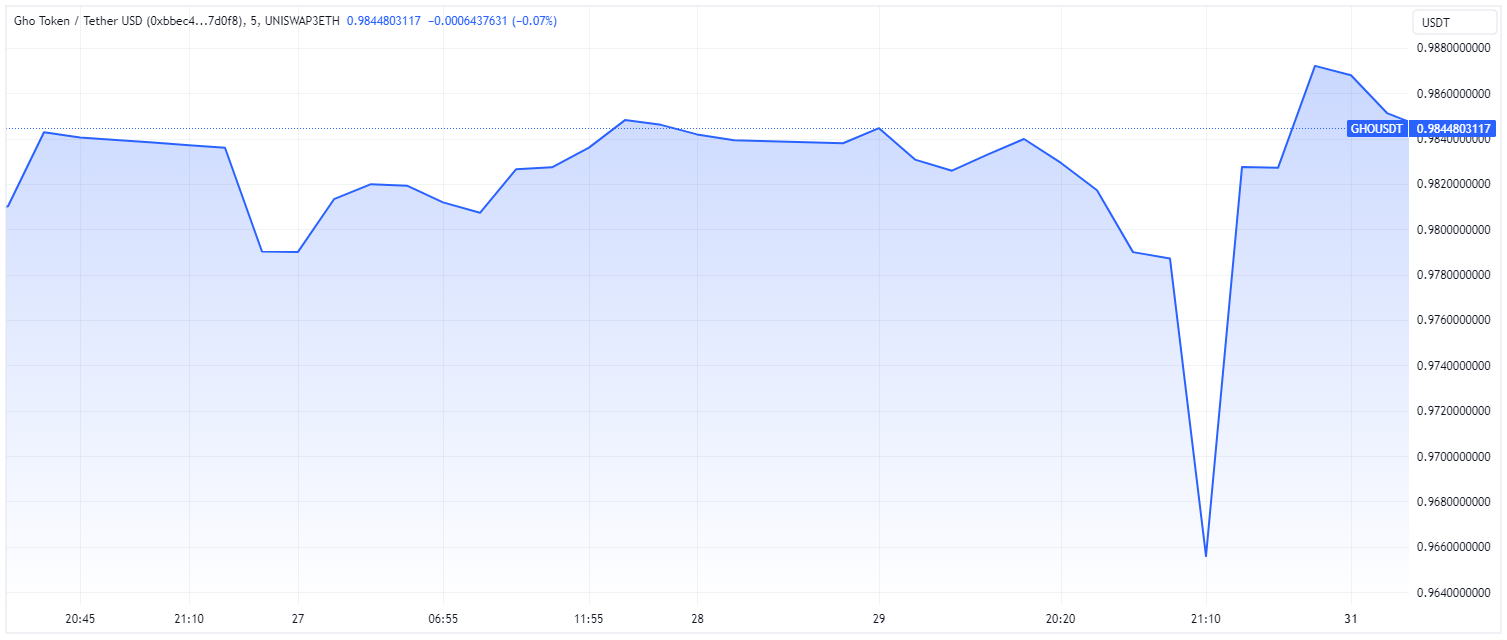

The stablecoin GHO, created by DeFi platform Aave, lost its $1 peg for a few hours on July 31. The token has risen to $0.98 since then, and analysts are theorizing what might have caused the depeg.

DeFi giant Aave’s stablecoin GHO experienced a depeg on July 31, regaining its peg after about 2 hours. The depeg appears to be a result of the reentrancy attack which occurred on Curve Finance. The token now has a valuation of about $0.98.

Stablecoin GHO Experiences Depeg

Aave’s GHO stablecoin depegged on July 31, dropping to $0.96 and losing its $1 peg for about two hours. It regained its peg in the early hours of July 31, and the current value of the token is $0.98.

Members of the crypto community have noted the effects and causes of the depeg. Phoenix Labs co-founder Sam MacPherson pointed out that the FRAX, crvUSD, and GHO pegs were “being stressed to save the Aave V2 position.”

Several Curve Finance pools were exploited on July 30 as a result of vulnerabilities in older versions of the Vyper smart contract language. The platform lost over $47 million due to this reentrancy attack.

Aave’s stablecoin GHO is making headlines as it lost its peg. But what exactly is a stablecoin? Check out our in-depth dive into this type of cryptocurrency to learn more: What Is a Stablecoin? A Beginner’s Guide

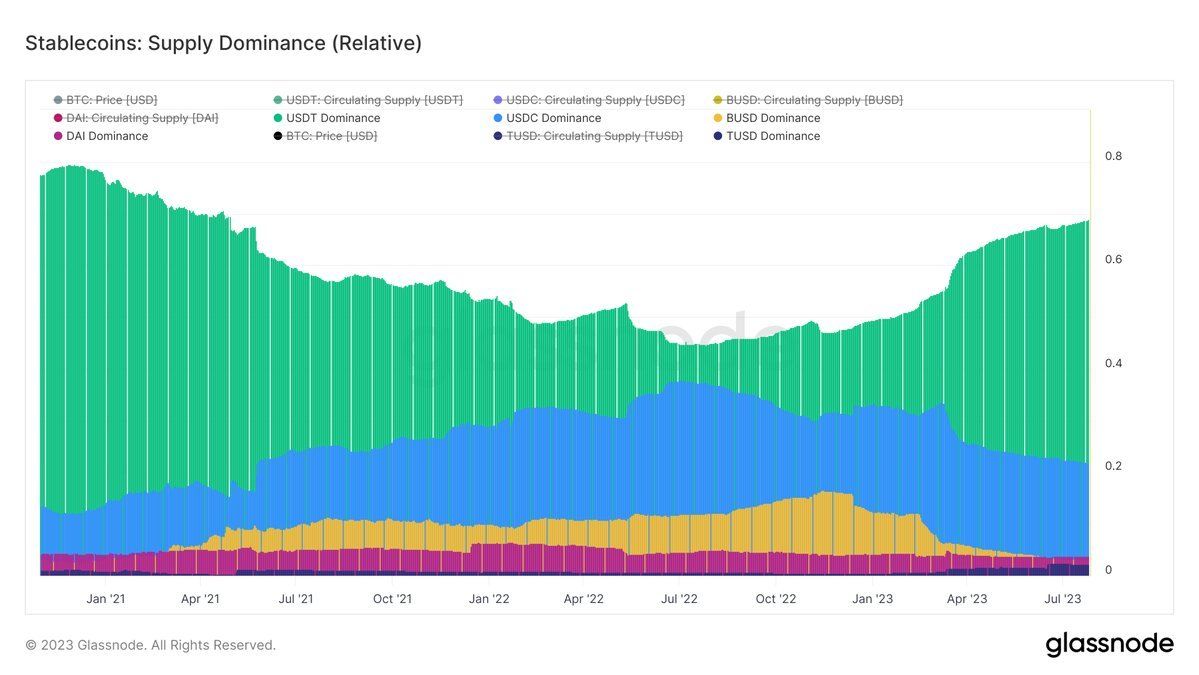

USDT Dominates Stablecoin Market

Stablecoins have continued to be a major part of the crypto and DeFi market. There have been some notable changes in the market shares of various stablecoins, with Tether (USDT) continuing to dominate.

USDT’s market share has jumped from about 49% to 68% on a year-to-date basis, while USDC dropped from about 33% to 22%. BUSD and DAI have also decreased, while True USD (TUSD) increased. Tether’s dominance topped 70% in late July 2023.

Stablecoin Depegs Continue To Happen

There have been several instances of instability in the niche in 2023 and the stablecoin GHO is far from the most significant of these depegs.

Stablecoin giant USDC depegged by a large margin in March 2023 but recovered after promising to cover any shortfall in its reserves. The depeg was due to the Silicon Valley Bank (SVB) crisis.

Even USDT experienced a depeg, though CTO Paolo Ardoino said it was because of a planned attack on the stablecoin. The debugging was marginal and a result of an imbalance in Curve’s 3pool.

One notable drop was that of Platypus’ stablecoin USP, which lost 50% of its value. Though a smaller stablecoin, it sparked a discussion. The team revealed that it was a victim of a flash loan attack worth $8.5 million.