Over the past week, Grayscale Investments added more than 7,300 BTC worth over $140 million to its Bitcoin holdings that underpin its popular Bitcoin Trust.

It will be recalled that year to date, Grayscale has pursued an aggressive Bitcoin investment strategy, at one point even buying more BTC than had been mined since its last halving.

The new whale purchase brings the company’s total Bitcoin asset value to just under $10 billion.

Grayscale’s Acquisition Spree

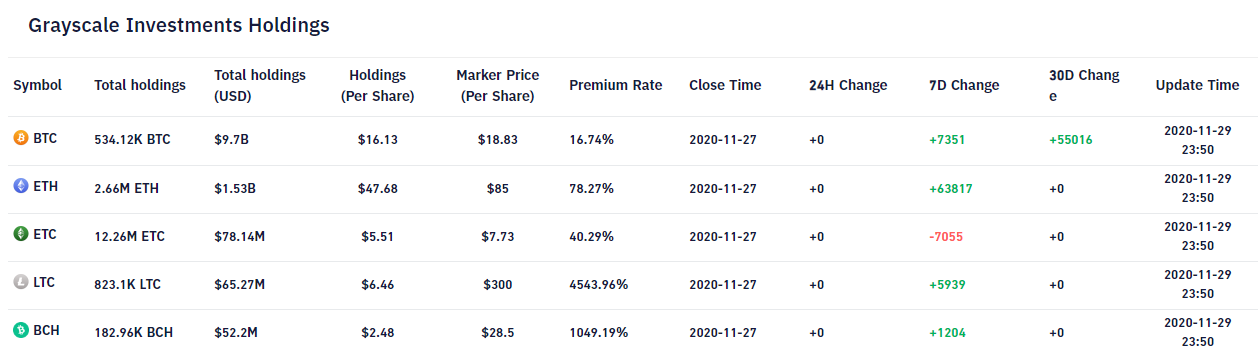

Data from crypto futures trading and analysis platform Bybt shows that over the past seven days, Grayscale has significantly boosted not just its BTC portfolio, but also its Ethereum, Litecoin, and Bitcoin Cash holdings.

In that time, Grayscale added 7,351 BTC worth over $141 million at press time. It also purchased 63,817 ETH currently worth over $38 million, 5,939 LTC worth $498,876, and 1,204 BCH worth $358,515.

Of its top-five asset holdings, only Ethereum Classic (ETC) saw a reduction, shedding 7,055 tokens worth $45,716.

As it stands, Bitcoin alone now commands more than 84 percent of Grayscale’s total portfolio with $9.7 billion worth of BTC under management out of a total asset portfolio of $11.46 billion.

Grayscale Goes Big on Bitcoin

On Nov. 9, BeInCrypto reported that Grayscale now manages over $9 billion worth of crypto assets, the majority of which is in Bitcoin. In just one week in September 2020, the company hoovered up 17,100 BTC, then worth $182 million.

Prior to this on May 29, BeInCrypto also reported that the firm grabbed a total of 18,910 BTC in just two weeks, which at the time was worth just over $179 million.

Its Bitcoin Trust has proved to be a smash hit with investors, first doubling its USD value in August 2020, before reporting record asset growth in excess of $1 billion at the end of Q3.

Speaking to CNBC on Nov. 30, Grayscale Managing Director Michael Sonnenshein stated that after taking a look at the inflows coming into Grayscale’s investment products and the makeup of the investors the demand is coming from, he believes that the company is “just getting started.”

A cursory look at the firm’s Bitcoin purchases over the past year shows that its biggest purchases have come at low price levels relative to current prices. This is an indication that Grayscale likely does not plan to slow down on its all-action Bitcoin investment push anytime soon.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.