Crypto never sleeps, but it received a wake-up call after an indictment came down against widely used bitcoin exchange BitMEX, which allows up to 100x leverage and technically bans US traders.

The Commodity Futures Trading Commission and Department of Justice are both coming after the exchange and its owners, including the face of the company, Arthur Hayes, for not enforcing KYC and AML protocols. Two others on the management team, Ben Delo and Samuel Reed, are also in hot water.

Crypto Twitter Responds

Crypto market leaders were quick to weigh in, including bitcoin bull Mike Novogratz. The Galaxy Digital chief reminded his crypto friends that in America, you are innocent until proven guilty. He added that while he does not have any insight into the case, he wishes Arthur Hayes well. In addition, he addressed the elephant in the room, which is the bitcoin price and the future of the cryptocurrency market. After all, the demise of Mt. Gox 2013 had a damaging and prolonged effect on the BTC price, so it’s understandable that investors would worry that the same could happen if BitMEX, which boasts more than $1 billion in daily trading volume, is shuttered. Novogratz offers some perspective in a tweet, saying that in his opinion bitcoin is bigger than what’s going down at BitMEX and advising investors to “buy dips.”So far, investors aren’t heeding his advice, with the BTC price down more than 1%. But bitcoin remains perched above $10,600, and the bottom doesn’t appear to have fallen out in response to the BitMEX charges.Crypto friends, Let’s remember that you are innocent to proven guilty. It’s a cornerstone of American justice. I have no insight into the case but I wish @CryptoHayes well.

— Mike Novogratz (@novogratz) October 1, 2020

I do think that $btc and crytpo is far bigger than any one exchange or person. So buy dips.

BitMEX Bashing

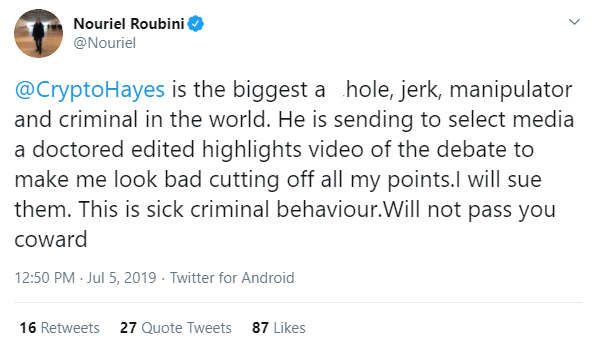

Not everybody will likely be as forgiving, including economist and bitcoin basher Nouriel Roubini. Based on his remarks from a year ago, after debating the BitMEX chief, Roubini might revel in the fact that Hayes’ loosey-goosey attitude toward the law has finally caught up with him.

“From our early days as a startup, we have always sought to comply with applicable U.S. laws, as those laws were understood at the time and based on available guidance.”While the precedents in the courts are still being written for crypto, relying on the bad advice defense might not get them very far.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Gerelyn Terzo

Gerelyn caught wind of bitcoin in mid-2017, and after becoming smitten by the peer-to-peer nature of crypto has never looked back. She has been covering the space ever since. Previously, she wrote about traditional financial services, Wall Street and institutional investing for much of her career. Gerelyn resides in Verona, N.J., just a hop, skip and a jump from New York City.

Gerelyn caught wind of bitcoin in mid-2017, and after becoming smitten by the peer-to-peer nature of crypto has never looked back. She has been covering the space ever since. Previously, she wrote about traditional financial services, Wall Street and institutional investing for much of her career. Gerelyn resides in Verona, N.J., just a hop, skip and a jump from New York City.

READ FULL BIO

Sponsored

Sponsored