The ChainLink (LINK) price has been increasing since a strong bounce on September 5.

A breakout above one of the resistance levels outlined below could mean that the price has begun a new upward trend and will head towards a new all-time high.

Range Trading

The LINK price has been falling since reaching a high of $20.71 on August 17. Since then, the price has created one lower high, so it’s possible to outline a descending resistance line, even though it has not been touched sufficient times in order to confirm its slope. The fall continued until LINK reached a low of $9.10 on September 5. After doing so, the price immediately bounced, creating a bullish engulfing candlestick the next day. At the time of writing, the price was trading between support and resistance at $10 and $13.8, respectively. The latter is also the 0.5 Fib level of the entire decline, further confirming the area as resistance Technical indicators are turning bullish. The MACD is in the process of giving a bullish reversal signal, and the stochastic RSI has just made a bullish cross. However, there is no bullish divergence yet. If the price flips the $13.80 resistance area and breaks out from the descending resistance line, it would confirm that it’s heading higher.

Short-Term Movement

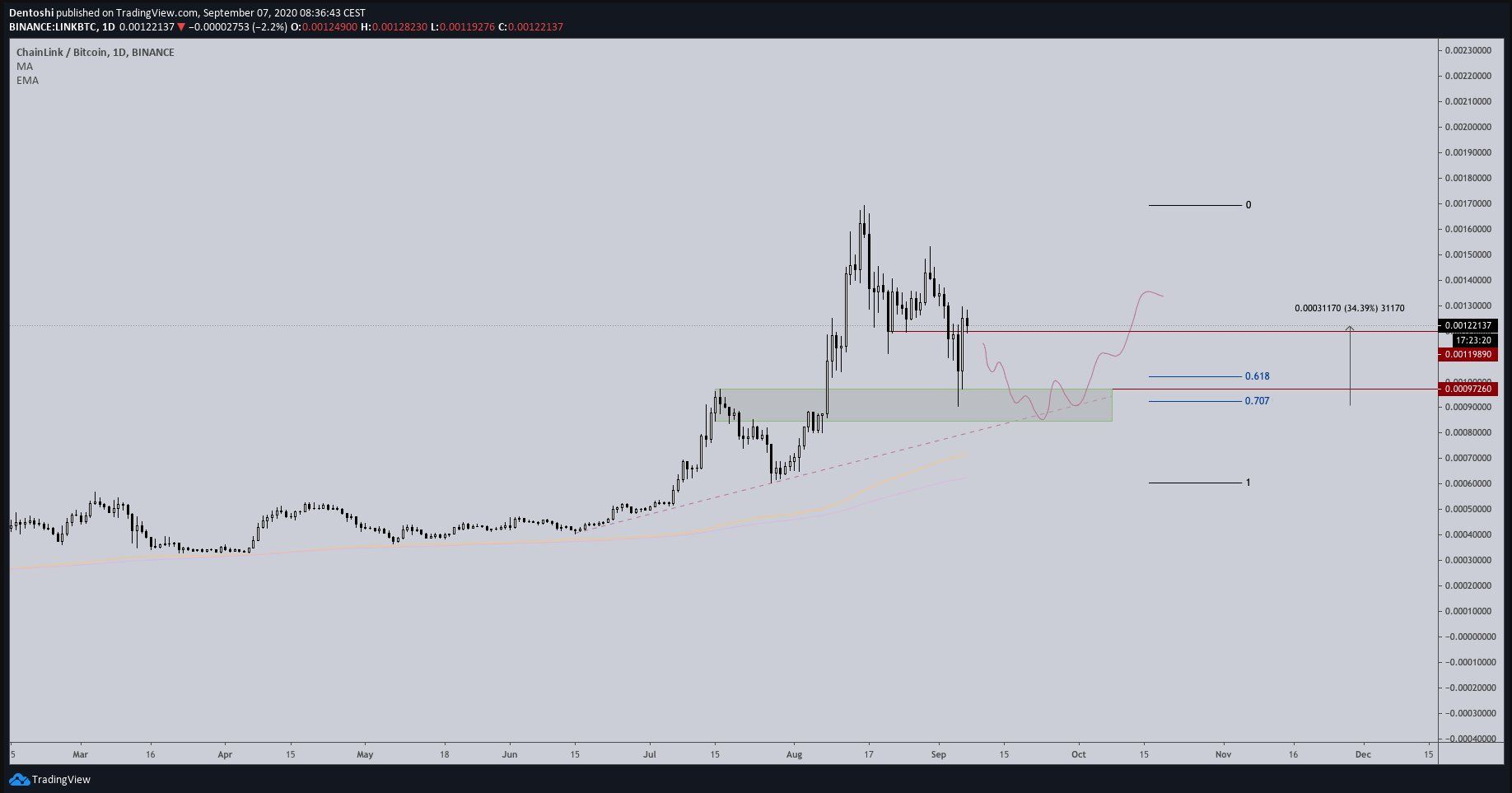

Cryptocurrency trader @Dentoshi93 stated that she closed a long trade for LINK but is looking to long a re-test of the $10 area. The entry also fits with our support area, so a re-test could create a double bottom and offer potential buying opportunities.

LINK Wave Count

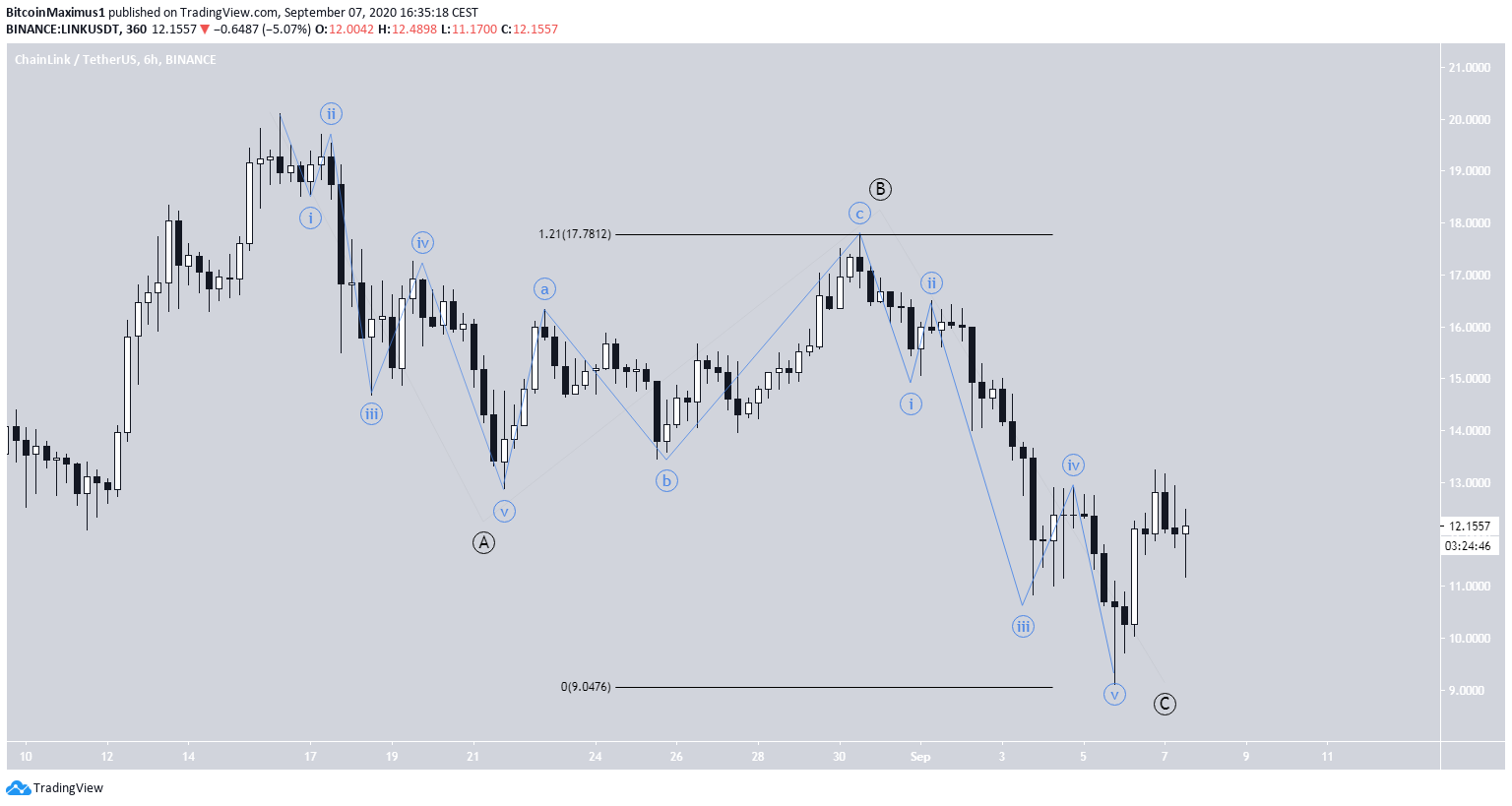

Beginning from the previous high on August 27, the LINK price seems to have completed an A-B-C correction (shown in black below), in which the C wave is 1.21 times longer than the A one. In addition, we can outline five sub-waves (blue) in both the A and the C waves, making this a very likely formation.

Top crypto platforms in the US

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored