After getting rejected on Aug 17, the Bitcoin (BTC) price has made another unsuccessful attempt at breaking out above $11,900.

Until the price reclaims this level with a daily close above it, the short and medium-term trend is considered bearish.

Bitcoin Faces Resistance

Since the losses Aug 17, the Bitcoin price has unsuccessfully attempted to move above the $11,900 area, which has been acting as resistance since Aug 2. The failure of the price to move above this level suggests that the Aug 17 breakout was not legitimate, but rather was just a deviation above the range high. The RSI has also been rejected by the 50-line. While the MACD is increasing, it has not turned positive yet nor has it generated any bullish divergence.

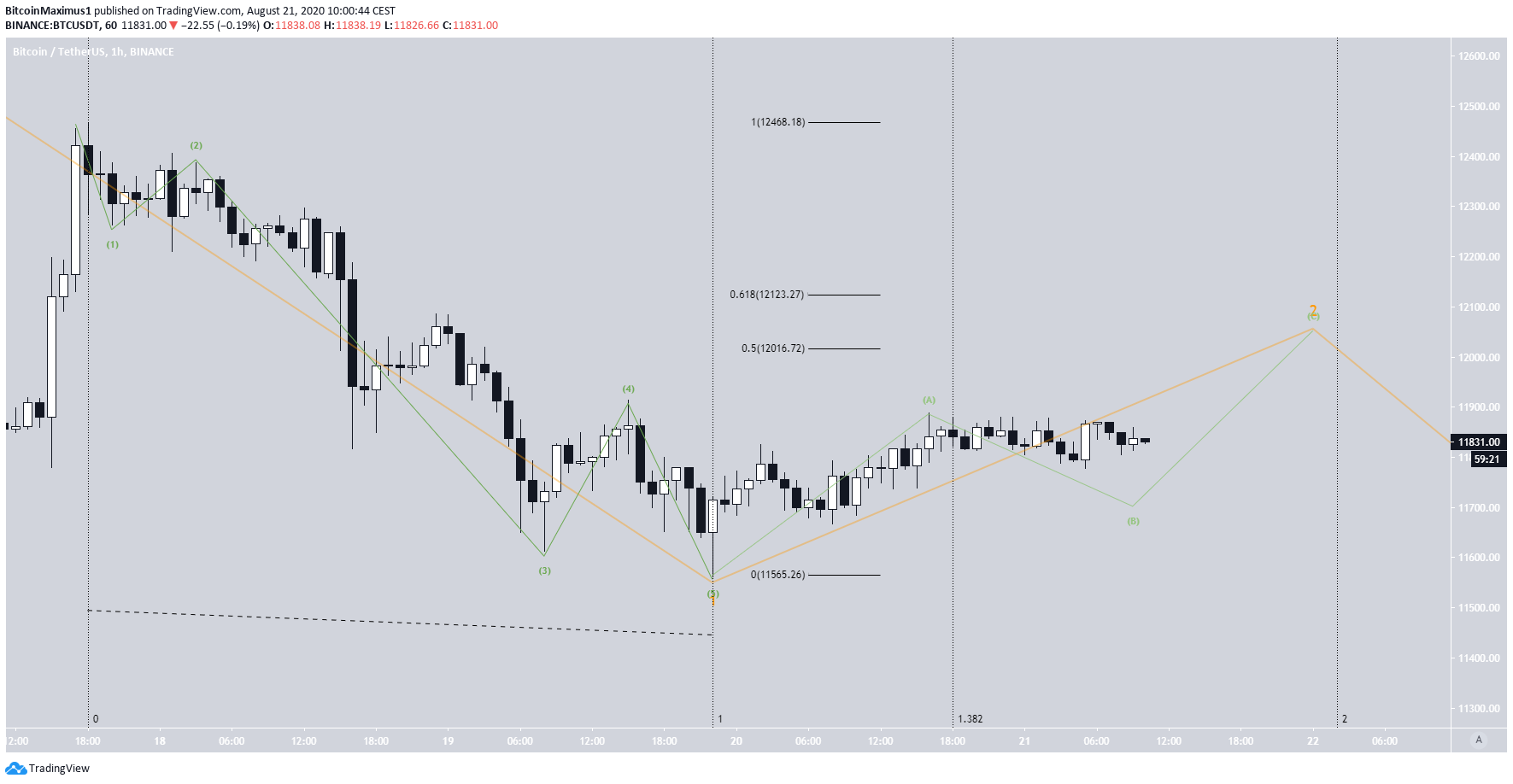

Bearish Wave Count

The price movement since the Aug 17 high resembles a completed five-wave formation (in green below) with an extended third wave. This is a part of a larger wave 1 (orange). If the price retraces upwards as expected, it will likely increase until the 0.5-0.618 Fib levels between $12,016-$12,123 before resuming its downward movement. A possible date target for the correction to end would be in the early hours of Aug 22, assuming that the retracement will take the same amount of time as the downward move.

The price is likely in a C corrective wave (blue), which is expected to end in the ranges of $10,954-$10,850 or $9,659-$9,732.The correction has already taken more time than the preceding upward move, and the next important Fib time target is 2.61. This falls on Aug 29, making this day a likely place for the entire correction to end.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored