The Ocean Protocol (OCEAN) price has been increasing at an accelerated rate since the beginning of July, reaching a new all-time high on August 4.

All-Time High Price

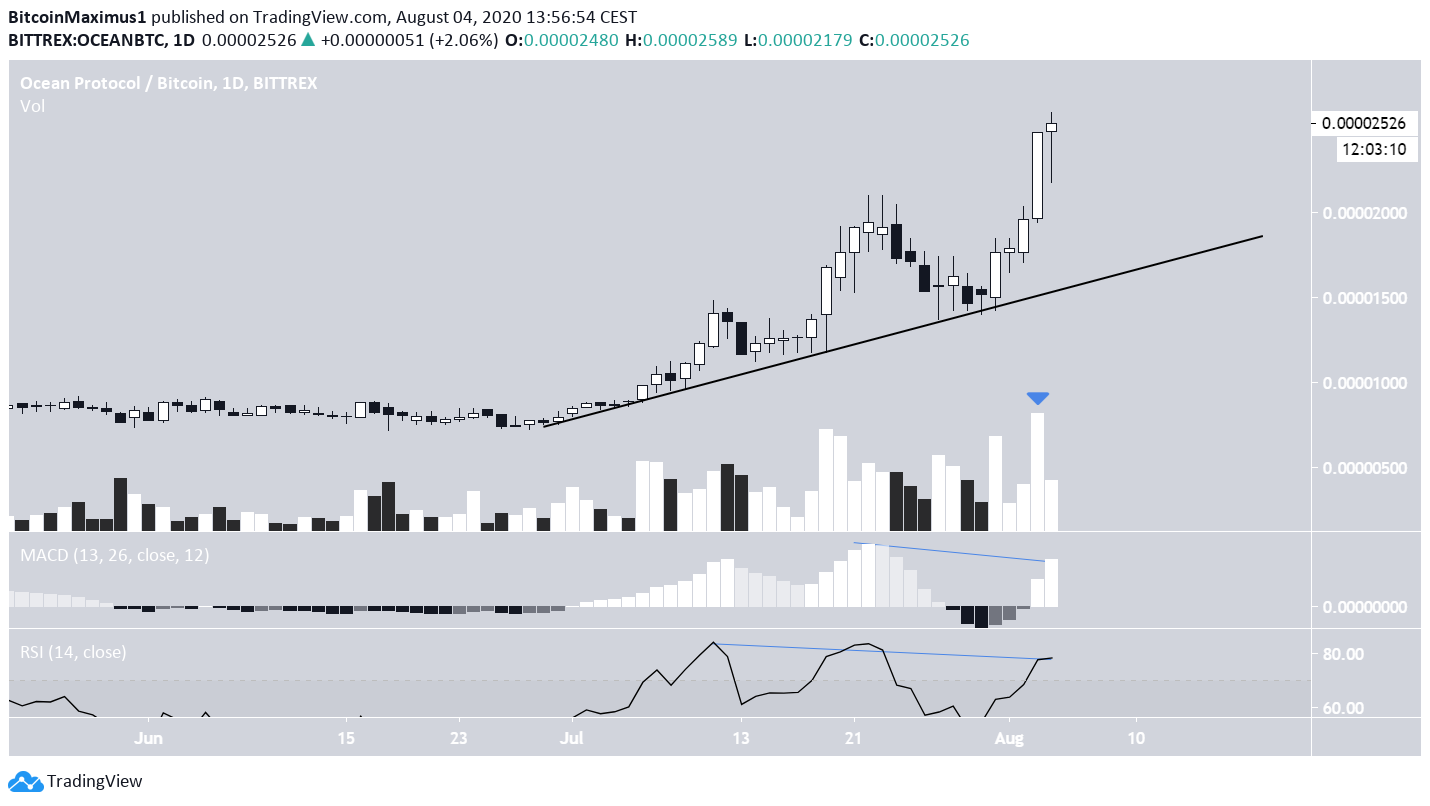

The OCEAN price has been trending upwards alongside an ascending support line since the beginning of July, creating three higher highs and three higher lows until now. On August 4, the price reached a new all-time high price of 2589 satoshis. Technical indicators have begun to show weakness, however. Both the MACD and the RSI have formed bearish divergence, and the latter is also inside overbought territory. Volume was highest during yesterday’s bullish engulfing candlestick, a sign that the move is not yet close to a top. As long as the price is following the current ascending support line, the trend is bullish.

Top of the OCEAN Move

The shorter-term chart for OCEAN shows that the move is still strong. The price declined as a result of the bearish divergence on the two-hour time-frame, however, a bullish engulfing candlestick then formed and regained all of the losses. Since the price is at an all-time high, we can use Fib extensions on the most recent fall to attempt to determine the next high. The price has already reached the 1.618 Fib of the previous decline. The next significant level would be the 2.2 one, found at 2914 satoshis, which could act as the top of the move before a retracement. However, the price is at an all-time high, so it’s possible that the current move will extend.

The Bitcoin Dominance Rate

An important chart to look at when analyzing ALT/BTC pairs is the Bitcoin Dominance Rate (BTCD). BTCD is currently sitting at a strong long-term support level around 62%. A breakdown below this level could trigger a rapid drop. However, there is significant bullish divergence on both the RSI and the MACD, a sign that the price could move upwards, possibly towards the previous support level at 66%, which is now likely to act as resistance.

Top crypto projects in the US | May 2024

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored