The Bitcoin price has reached an important resistance line which has been in place since the price reached an all-time high in December 2017.

Well-known trader @PostyXBT tweeted a Bitcoin price chart that shows that the price is trading at a very critical resistance level.

Personally not longing into horizontal and diagonal resistance here. Need to see a clean break here and then look for opportunities. Could be a great place to short but shorting an uptrend has never gone well for me. Maybe after the halving if we’re still around here.

Bitcoin’s Long-Term Resistance

The Bitcoin price has been following a descending resistance line for the past 875 days, more specifically since reaching an all-time high price in December 2017. At the time of writing, the price was trading directly under this resistance line, validating it for the fifth time. In addition, the price is trading inside a minor resistance area, found at $9,300. Each time the BTC price has reached this line, it has initiated a rapid downward move. However, these movements have also been combined with an increase above the upper Bollinger Band, which is not the case in the current movement. This means that the rally is not overextended and BTC could possibly break out. If BTC breaks out, it would still be likely to retrace after it reaches $10,500. We have outlined one such wave count here.

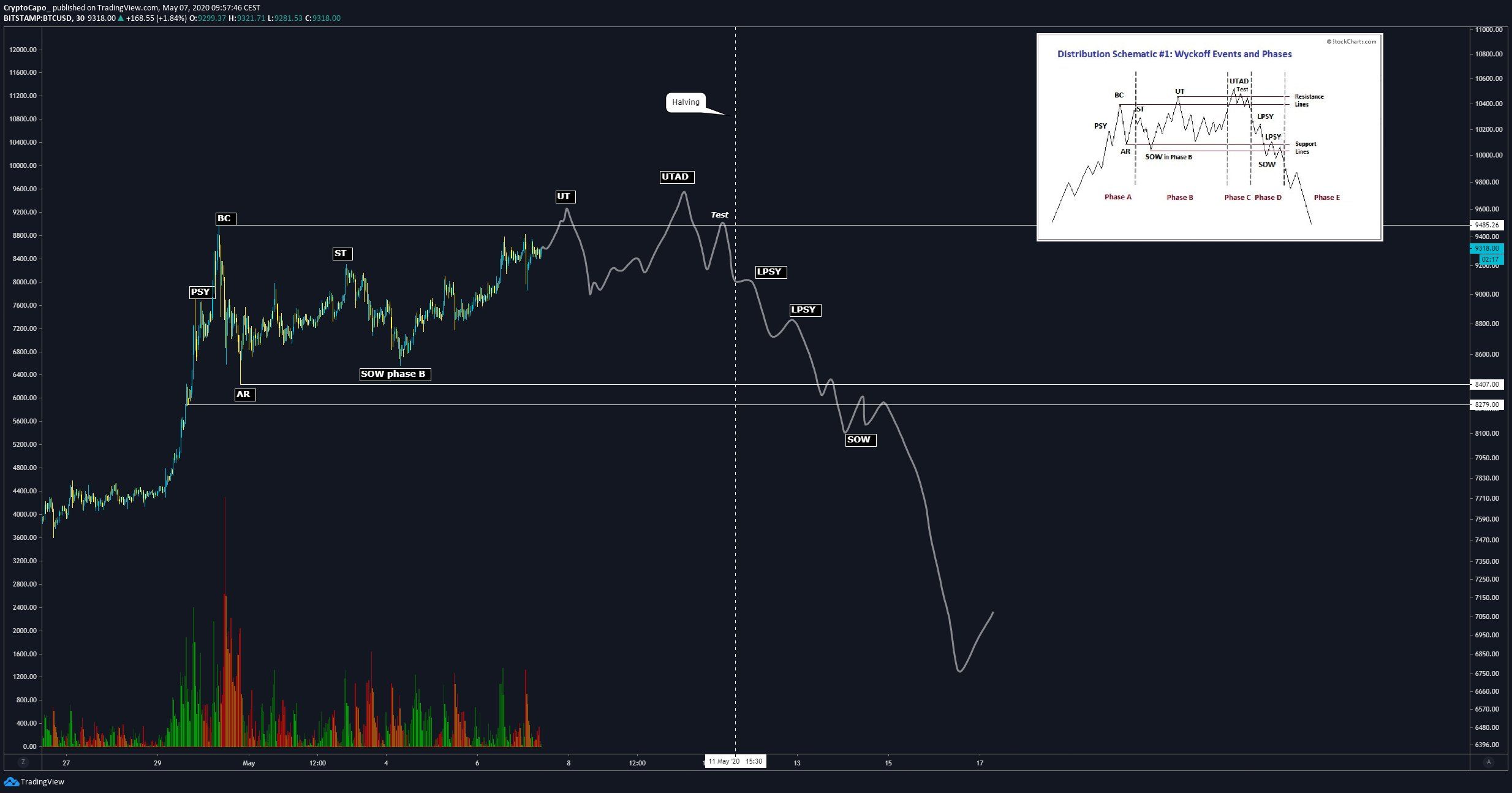

Wyckoff Distribution

In the short-term, one possible way that this decrease would play out is in the form of a bearish Wyckoff distribution. One such movement was outlined by cryptocurrency trader @CryptoCapo_, who tweeted the following chart:

Top crypto platforms in the US

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored