When we talk about the Federal Reserve creating dollars, we often imagine a machine printing new currency. However, the Fed is actually issuing currency not backed by paper bills whatsoever.

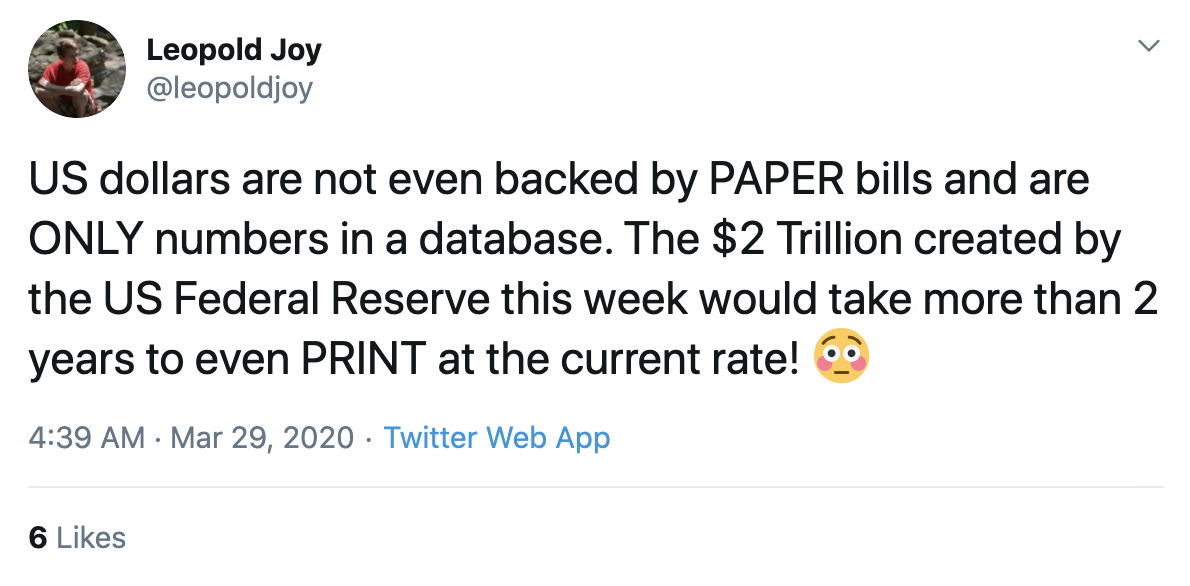

One would think that the Federal Reserve is at least backing its dollars with actual paper currency, but the math doesn’t check out. According to one user, it would take far too long for that to even be possible.

Not Even Backed by Paper Money

The Fed is printing more than ever before—but it’s mostly just numbers on a computer. According to the Bureau of Engraving and Printing, it delivered some 24.8 million notes per day to the Fed in 2014. Assuming all of these notes were worth $100, that’s $24.8 million dollars of notes printed per day. That means it would take years for the Fed to print the trillions in ‘stimulus’ it is providing to financial markets. That’s simply not possible, as co-founder of Stake Capital, Leopold Joy (@leopoldjoy) pointed out on Twitter recently. Even if we’re being generous and the Fed is printing more than double what it did in 2014, it would still take a long, long time for the central bank to issue that much currency. In effect, the money currently said to be printed is not even printed.

Long story short, it seems like money printer doesn’t even go brrrr—almost all of new currency issued is done electronically.

Even if we’re being generous and the Fed is printing more than double what it did in 2014, it would still take a long, long time for the central bank to issue that much currency. In effect, the money currently said to be printed is not even printed.

Long story short, it seems like money printer doesn’t even go brrrr—almost all of new currency issued is done electronically.

Record Amounts of USD Issued

Generating dollars without needing to print is obviously much easier, and the Fed has not held back. In late March, BeInCrypto reported that the Fed was creating some $60M every minute. That number is likely higher now. Even before the COVID-19 crisis, the Fed was doing so. In early February, the money supply had already been double 2008 levels. The past two months have seen this number explode exponentially. Despite concerns, however, the Fed has maintained it has an ‘infinite amount of cash.’ Unlimited QE is on the table to keep financial markets afloat, no matter the long-term consequences. It’s not just the Fed, either. Central banks worldwide have been buying assets in record amounts, many times greater than what we saw during the 2008 Great Recession. Compare this money-printing to an alternative like Bitcoin and it becomes clear why the cryptocurrency industry has been so fixated on the Fed’s actions. The fact that it is not even printing real, paper currency just adds insult to injury.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Advertorial

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

READ FULL BIO

Sponsored

Sponsored