The Bitcoin price has been decreasing rapidly since Feb 14. The downturn has not been solely observable in the price of BTC, as all of the major stock indices have posted similar losses.

Bitcoin (BTC) Price Highlights

- Bitcoin and the S&P 500 have been positively correlated since at least 2018.

- The correlation is more pronounced in downward moves.

- The BTC price has been more volatile.

Below, we are going to take a look at both the Bitcoin and the S&P500 price in different time-frames in order to determine if there actually is any correlation and use that for future forecasting.$BTC & stocks still moving in lockstep.

— Luke Martin (@VentureCoinist) March 17, 2020

Looks like they both like the conference about further stimulus… pic.twitter.com/aqnLGKe72s

Long-Term Comparison

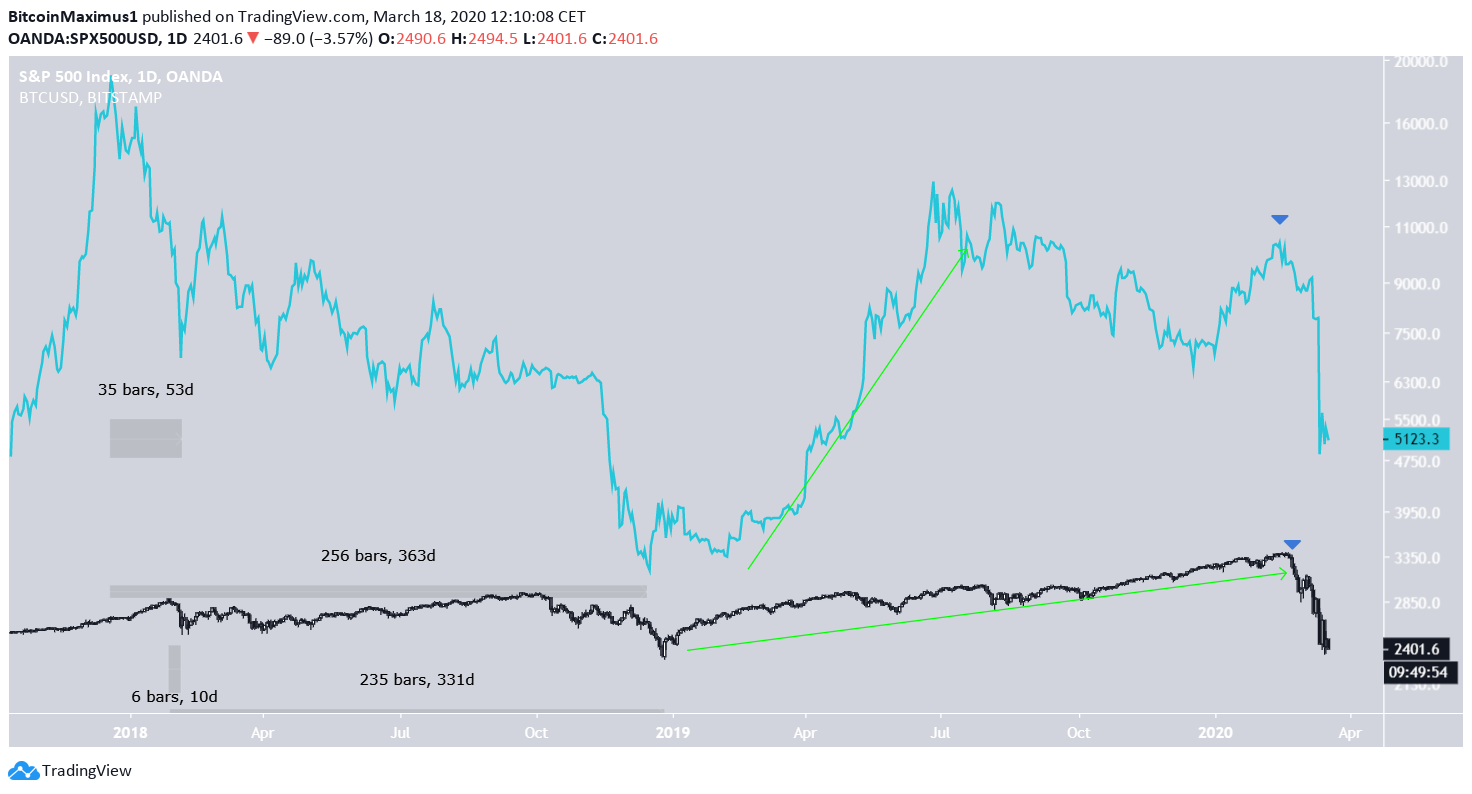

A comparison of the prices of Bitcoin and the S&P 500 side-by-side reveals a positive correlation since at least the beginning of 2018. This was around the time when the BTC price reached an all-time high. The ensuing decrease was similar and ended on Feb 5, 2018. The entire downward move lasted for more than 300 days and ended in December 2018 for both. Until the December 2018 bottom, we can definitely state that the BTC and the S&P 500 prices have been correlated. What transpired afterward was a similar upward trend. This trend was steeper for BTC, however, which reached an initial high then gradually decreased until Feb 14, 2020. The movement after the December 2018 bottom presents the first divergence since the price of the S&P 500 increased gradually until Feb 24, 2020.

Current Movement

The price movement since the beginning of February has been almost identical, especially up until March 12. Both began February with a gradual increase that reversed by the end of the month. By March 12, both the price of BTC and the S&P 500 had decreased by 27%. However, while the S&P 500 price has held its ground, the BTC price has decreased by a further 18%, bringing its total loss since February to 43%. To conclude, the BTC and S&P 500 prices have had a significant correlation since 2018. The correlation is more pronounced in downward moves, while moves in both directions are more pronounced in the BTC price.

To conclude, the BTC and S&P 500 prices have had a significant correlation since 2018. The correlation is more pronounced in downward moves, while moves in both directions are more pronounced in the BTC price.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored