Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to read how a decentralized derivatives exchange (DEX) is disrupting Wall Street’s efficiency metrics, outpacing giants like Tether, Nvidia, and even Apple on revenue per employee metrics.

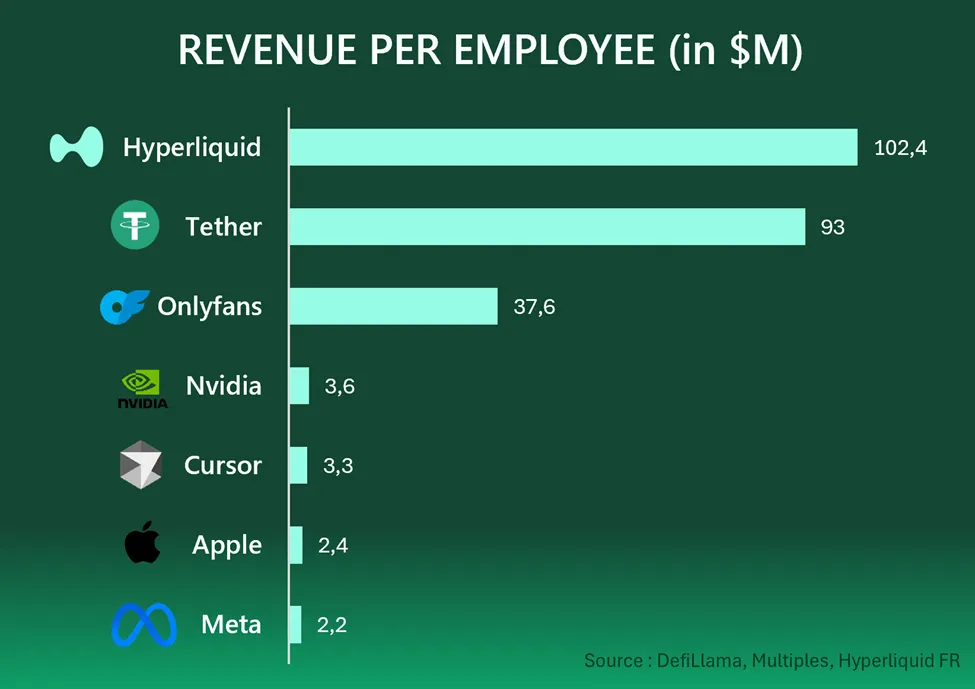

Crypto News of the Day: Hyperliquid Surpasses Apple and Tether With $102.4 Million Revenue Per Employee

According to data compiled by DeFiLlama, Hyperliquid generates an estimated $1.127 billion in annual revenue with just 11 core contributors. That translates to $102.4 million in revenue per employee, the highest figure globally.

In comparison, Tether’s per-employee revenue stands at $93 million. Despite its $400 billion annual sales machine, Apple produces just $2.4 million per employee.

This success highlights the power of crypto’s lean operational models. Unlike traditional firms with sprawling headcounts, Hyperliquid’s structure allows a handful of developers and contributors to generate revenue rivaling that of some of the largest corporations.

Jeff Yan, CEO and co-founder of Hyperliquid, recently confirmed that the protocol’s team numbers just 11.

Revealing his management model for an 11-person team, Jeff admitted that while the team has its strengths, there is still room for improvement.

Reportedly, Jeff Yan remains deeply involved in the technical work to maintain oversight of the overall architecture and performance.

Further, the DEX also turns down venture capitalists, prioritizing self-funding. This stance comes as Jeff says traditional VC financing creates an illusion of progress by inflating valuations.

With DefiLlama estimating Hyperliquid’s annualized revenue at $1.127 billion, the platform’s lean 11-person team positions it as a new benchmark for efficiency.

It aligns with a 2022 study, which found that DeFi platforms routinely achieve 50–70% higher revenue efficiency than traditional firms.

Hyperliquid appears to be the clearest example yet, pushing beyond niche success to rival mainstream enterprises.

Hyperliquid Dominates Blockchain Revenue

The decentralized exchange’s dominance is also visible at the ecosystem level. According to DeFiLlama, just nine protocols generated 87% of all distributed protocol revenue last week.

Hyperliquid, Solana meme coin launchpad Pump.fun, and Aerodrome account for 75% of the total. Hyperliquid alone captured 37% of blockchain revenue in July, highlighting its outsized role in the DeFi economy.

BeInCrypto reported that July’s record-breaking run was fueled by soaring demand for simple, high-volume derivatives trading.

Open interest, USDC inflows, and active trading volumes surged even as the exchange faced temporary outages that tested its scalability.

Looking ahead, Hyperliquid is preparing for its HIP-3 upgrade, a shift that would evolve the platform from a derivatives exchange into a full Web3 infrastructure layer.

The upgrade is designed to support decentralized applications and “smart derivatives,” extending the protocol’s role in the broader DeFi space.

This ambition puts Hyperliquid on a collision course with centralized exchanges and established DeFi hubs. If successful, it could cement the exchange as a trading venue and a foundational layer for decentralized finance (DeFi).

Meanwhile, by surpassing Apple, Tether, and Nvidia in per-capita efficiency, Hyperliquid forces a rethink of traditional corporate metrics.

While critics argue that comparisons with firms like OnlyFans or tech giants may overlook structural differences, the numbers are difficult to ignore

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Experts warn Bitcoin could face a 51% attack as mining centralizes.

- China mulls yuan-backed stablecoin as Beijing makes a play against US dominance.

- VanEck puts Bitcoin’s biggest detractors on blast with ‘Hall of Shame’ list.

- Harvard economist calls out the US for failing on sensible crypto regulation.

- Is Bitcoin becoming too expensive for retail investors?

- Is MicroStrategy’s Bitcoin flywheel facing its first real stress test?

- Ethereum price dip triggers million-dollar losses for traders.

- HBAR price may repeat history as bearish squeeze strengthens.

- XRP price drops 11% as holders appear stuck between hope and reality.

Crypto Equities Pre-Market Overview

| Company | At the Close of August 19 | Pre-Market Overview |

| Strategy (MSTR) | $336.57 | $339.75 (+0.94%) |

| Coinbase Global (COIN) | $302.07 | $304.34 (+0.75%) |

| Galaxy Digital Holdings (GLXY) | $24.10 | $23.99 (-0.44%) |

| MARA Holdings (MARA) | $15.17 | $15.15 (-0.13%) |

| Riot Platforms (RIOT) | $11.96 | $11.98 (+017%) |

| Core Scientific (CORZ) | $14.35 | $14.32 (-0.21%) |

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.