Solana (SOL) has recently struggled to break the $200 mark, failing to breach this resistance last week.

Despite the setback, a shift in investor behavior, marked by maturing holdings and an increasing cohort of long-term holders (LTHs), may provide the necessary support for recovery and future gains.

Solana Investors Are Maturing

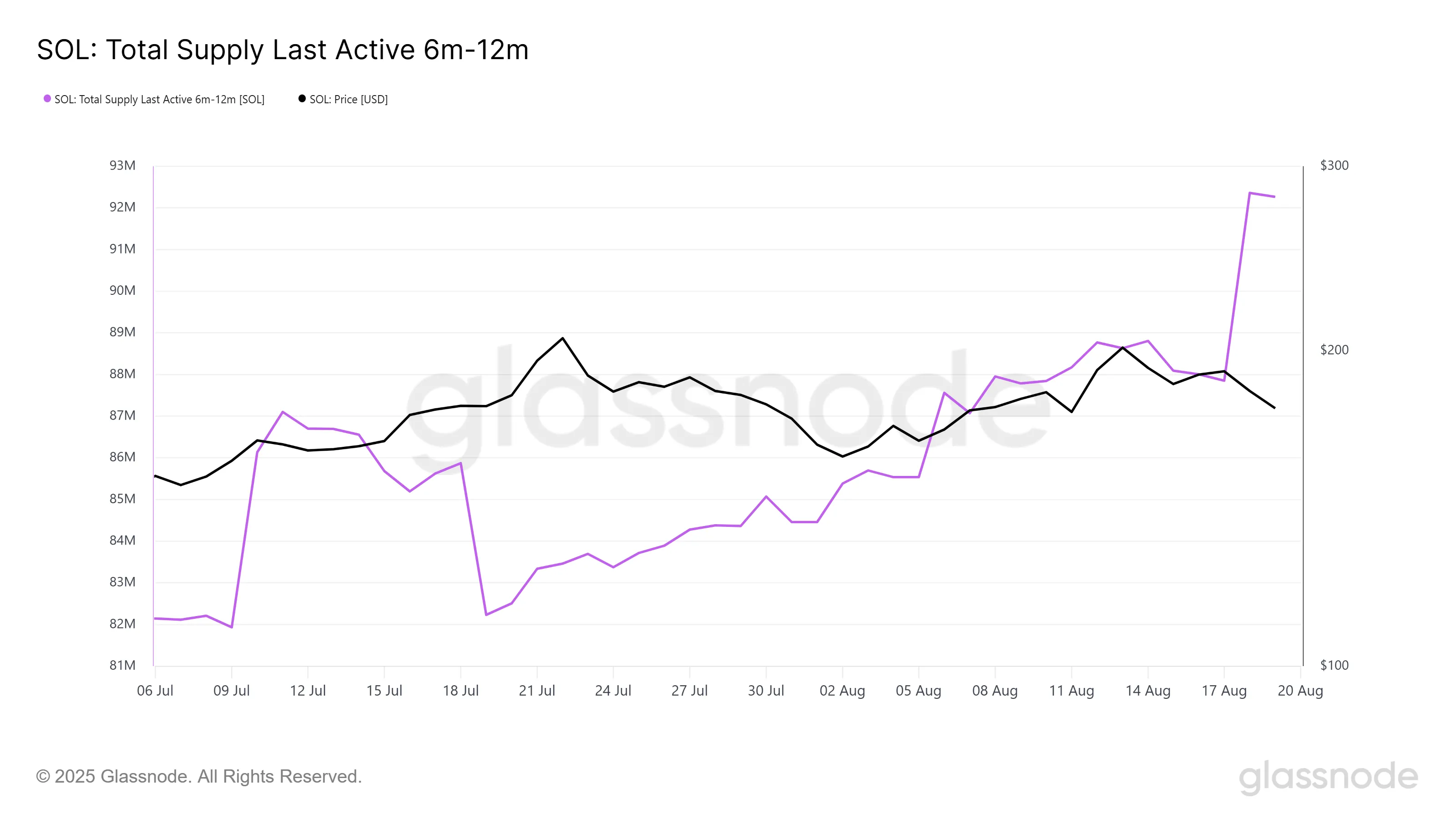

In the past 24 hours, the supply of Solana that had remained dormant between 6 and 12 months surged by 5 million SOL, valued at over $905 million. This uptick in supply indicates that a significant portion of the token’s holdings is maturing and transitioning toward long-term investment.

The maturation of these tokens could signal confidence in Solana’s long-term outlook. As investors hold longer, this reduces the circulating supply and may lead to upward price pressure.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

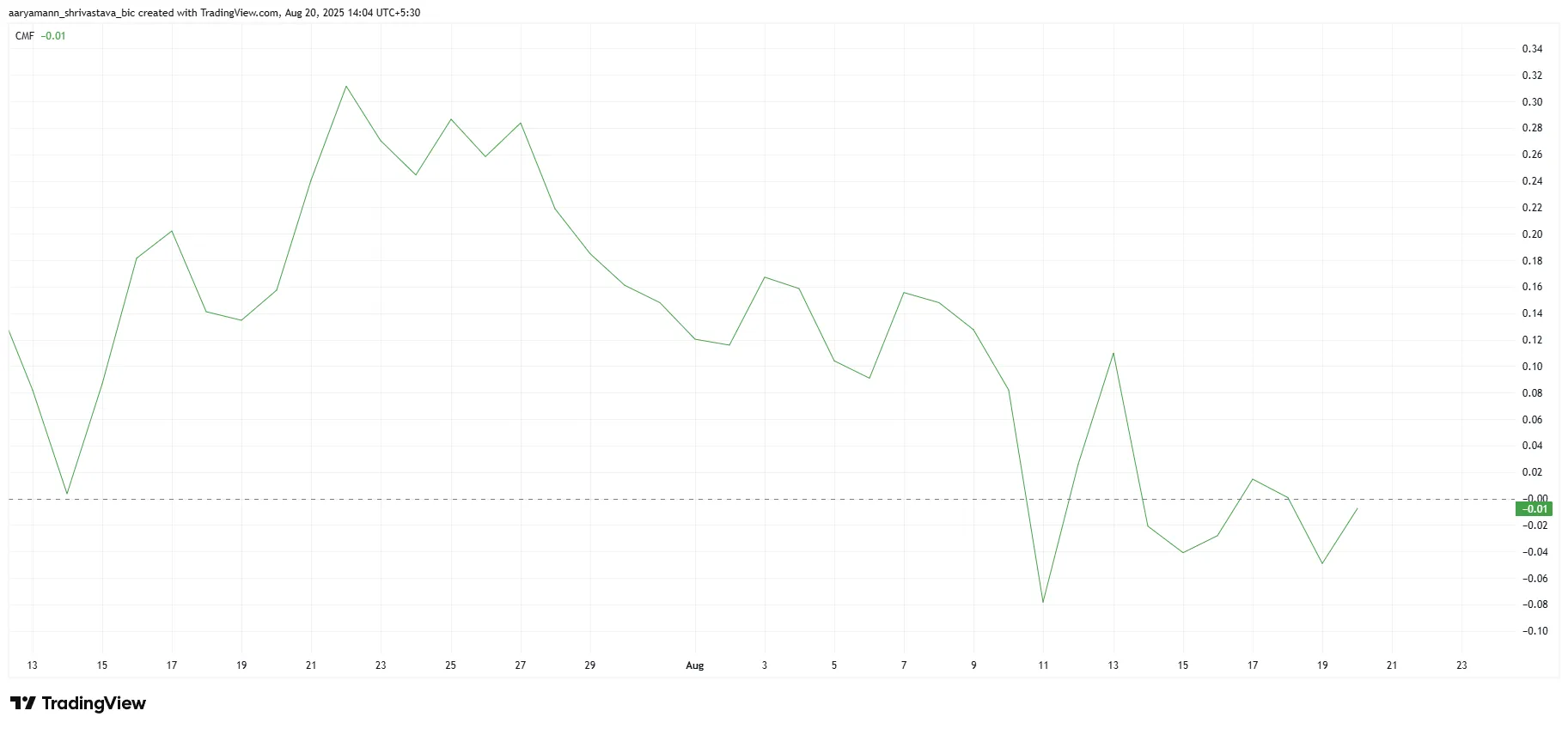

The overall macro momentum for Solana shows signs of strain as the Chaikin Money Flow (CMF) indicator is currently noting a decline. The CMF, which tracks capital inflows and outflows, is sitting below the zero line, suggesting that outflows are outpacing inflows.

As outflows continue to grow, the selling pressure could intensify, impacting the price of Solana in the short term. The presence of growing investor skepticism and a lack of significant buying pressure could limit SOL’s ability to break through critical resistance levels.

SOL Price May Bounce Back

At the time of writing, Solana’s price is at $180, holding above the support level of $175. Given the ongoing investor behavior, the chances of a significant decline seem low for now. The price is well-supported by the influx of maturing holdings and steady investor interest.

If long-term holders maintain their resilience and resist the urge to sell, Solana could reclaim the $189 support level. Successfully holding this level would allow the altcoin to inch closer to the $201 resistance, a level it has failed to break twice over the past month. This could mark a potential turning point for Solana.

However, if the selling pressure intensifies and the price falls below $175, Solana could slip to $163. Such a move would invalidate the bullish thesis, extending the recent decline and placing further downside risk on the cryptocurrency. The outcome depends heavily on investor sentiment and broader market conditions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.