With Bitcoin’s price struggling to find its footing and a direction, the altcoins seem to be forced to rely on external cues. These cues could alter the crypto tokens’ current heading and potentially even help them in noting a breakout rally.

BeInCrypto has analysed three such altcoins that investors should watch in the coming week.

1Inch Network (1INCH)

1INCH is drawing attention as investors await a mysterious announcement scheduled for August 19. The project’s official post hinted at uniting DeFi, sparking speculation across the market.

The altcoin has shown little movement in recent sessions, consolidating without strong direction. However, the upcoming announcement could serve as a key catalyst, potentially lifting 1INCH toward $0.273. Securing this level as support would allow the token to aim for $0.311, reinforcing a bullish outlook and improving market confidence.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

If investors fail to engage after the news, 1INCH risks losing momentum and slipping lower. The price could test $0.241 as a support zone, and a breakdown from there might send it further down to $0.222. Such a decline would invalidate the bullish scenario, signaling caution among traders.

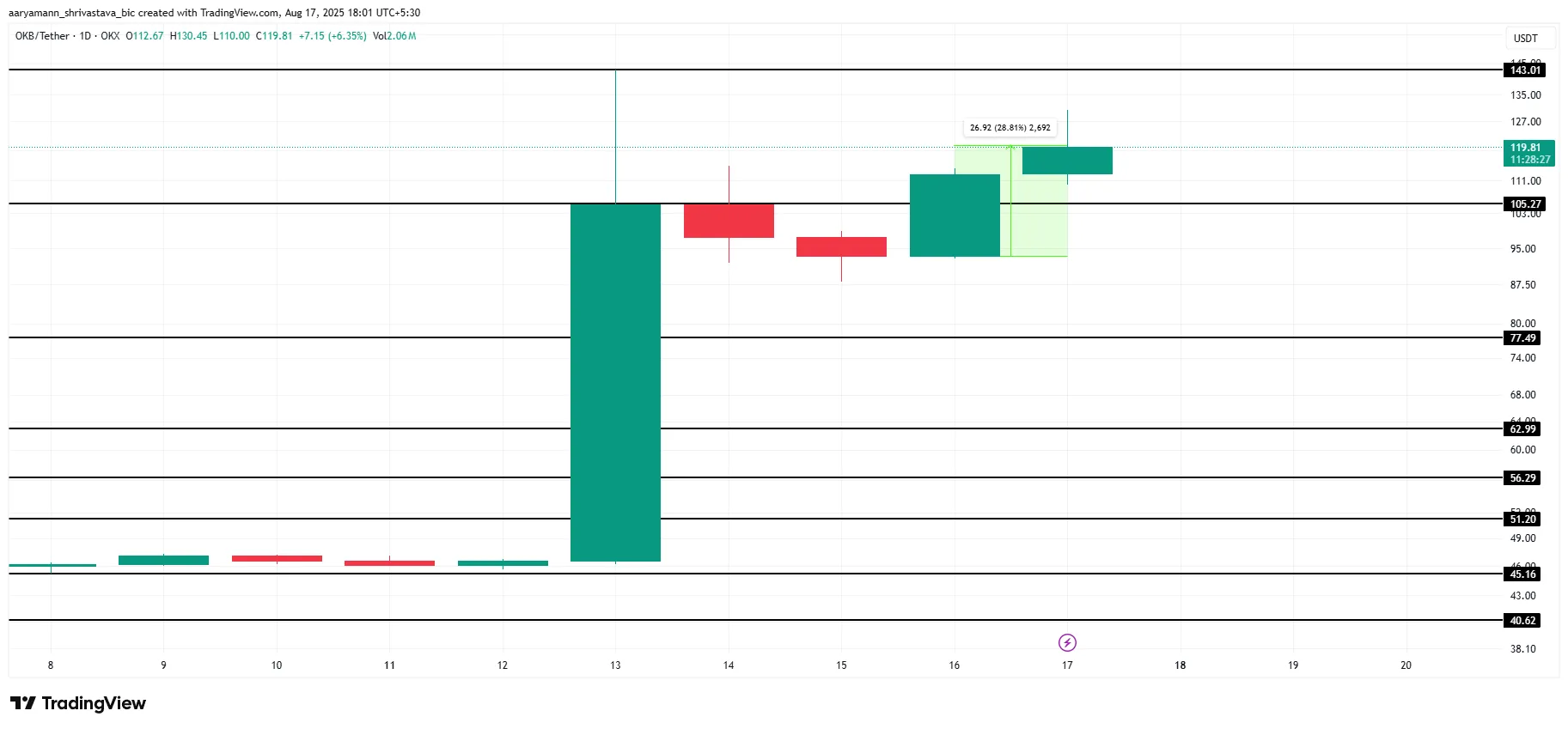

OKB (OKB)

OKB has recorded significant gains over the past week as its supply was slashed in half, fueling strong bullish sentiment. The sudden reduction in circulating tokens created scarcity, attracting investor interest.

In the last 24 hours, OKB price surged 28%, reaching $119 at press time. If this bullish momentum holds, the altcoin could advance toward $143 or even higher levels. Such a move would mark renewed investor confidence.

If momentum fades and traders view the rally as overheated, profit-taking could follow. A wave of selling pressure may drive OKB below $105, exposing the altcoin to further declines toward $77. This scenario would invalidate the bullish thesis.

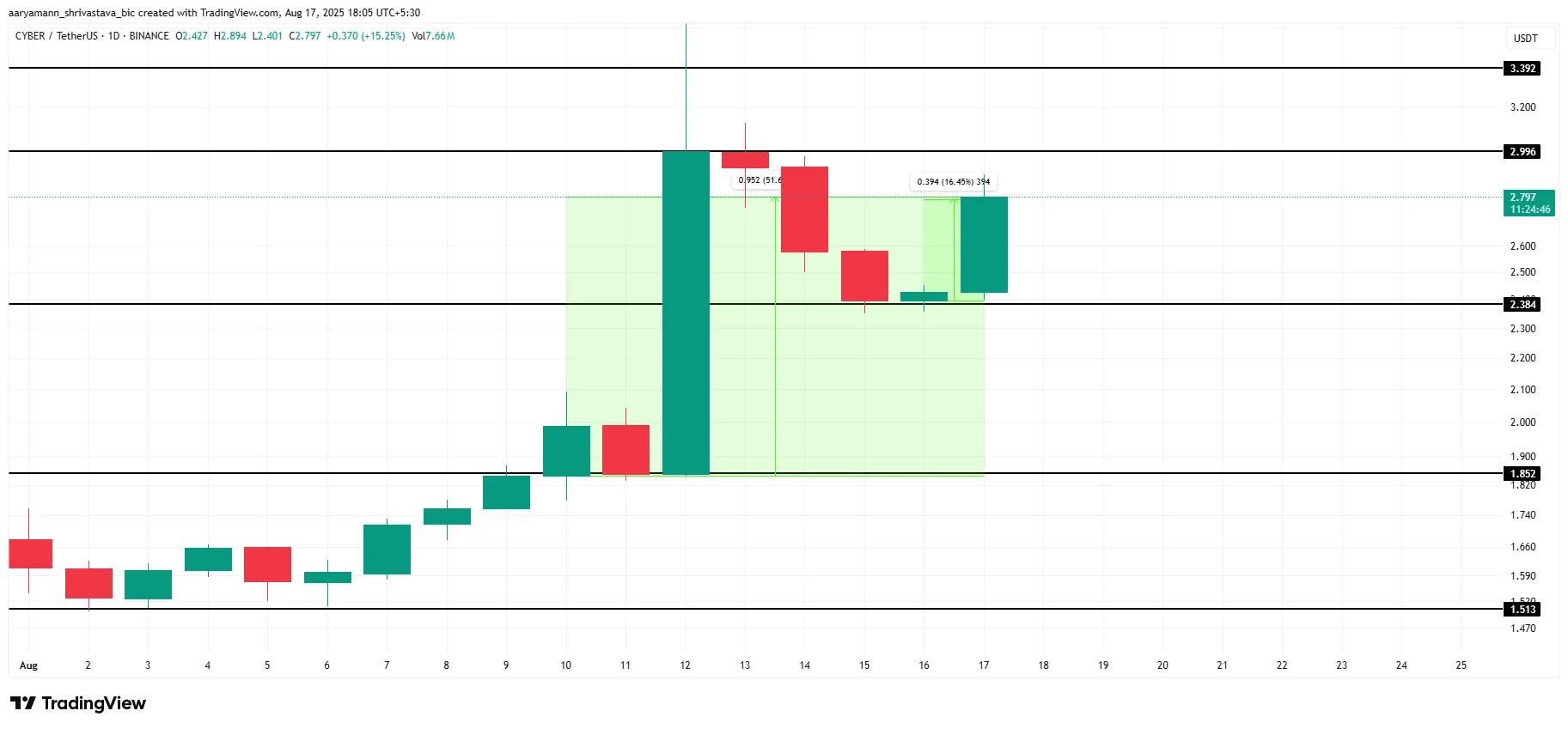

Cyber (CYBER)

CYBER price emerged as a standout performer this week, boosted by its listing on Upbit Korea on August 12. The development sparked strong buying activity, propelling the token to record a 51% gain over the past seven days.

The bullish momentum has yet to cool off, with CYBER posting a 16.45% gain in the last 24 hours. Trading at $2.79 at press time, the altcoin shows potential to breach $2.99. Sustained buying pressure could then extend the rally toward $3.39, reinforcing investor optimism and attracting additional inflows.

Failure to sustain momentum could reverse recent gains, with CYBER risking a breakdown below the $2.38 support. Should selling pressure intensify, the token might retreat further to $1.85. Such a decline would undermine the bullish thesis, signaling caution for traders expecting continued upside in the short term.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.