Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee and peek into the Bitcoin (BTC) backdoor in British finance. Amidst the City’s polished facades, reports suggest that two quietly emerging firms are beginning to challenge the foundations of how capital flows through the UK’s financial system, rewriting the rules with code, not lawbooks.

Crypto News of the Day: Smarter Web, Satsuma, and the Bitcoin Blueprint for UK Capital Disruption

In the heart of the City of London, where financial tradition meets regulation, a quiet revolution is unfolding, with Bitcoin at the center.

A new wave of blockchain-native firms is pushing the boundaries of what capital markets look like in the digital age. Among them are Satsuma, a London-based tokenization platform, and Smarter Web, an on-chain venture studio.

The two firms are reshaping how capital is raised, accessed, and governed in the UK’s tightly regulated financial ecosystem.

In a press release on Wednesday, Smarter Web announced the launch of a new initiative that leverages Bitcoin-backed asset rails to tokenize early-stage UK ventures.

The studio, which previously backed Base-native applications, is now building a regulatory-compliant path for retail and institutional investors to access high-growth British tech through Bitcoin-denominated capital structures.

“We have been building our Bitcoin-backed balance sheet with laser focus, and today’s announcement marks yet another first for the UK capital markets,” read an excerpt in the announcement, citing Andrew Webley, CEO of The Smarter Web Company.

Satsuma, meanwhile, has launched what it calls the “capital issuance layer for a post-ETF world.” This model issues shares, bonds, and hybrid equity instruments as programmable tokens directly on blockchain networks.

These tokens can interact with decentralized liquidity, enable instant settlement, and allow voting and dividend flows to be handled entirely via smart contracts.

Both firms have signaled alignment with UK regulators, positioning their infrastructures to be MiCA-compliant in the EU and sandbox-ready in the UK.

This strategic posture could allow them to move ahead of larger incumbents still encumbered by legacy custodial models.

Is Bitcoin-Backed Equity the Next Frontier in UK Financial Engineering

Bitcoin’s presence in these models goes beyond symbolism. Smarter Web’s latest experiments include tokenized offerings where Bitcoin serves as capital collateral, as a recent US Crypto News publication indicates.

It also includes a programmable incentive layer, blurring the lines between venture investment and decentralized financial (DeFi) primitives.

This design could create a new form of Bitcoin-denominated equity, particularly attractive to sovereign-grade investors wary of fiat devaluation and regulatory arbitrage. For skeptics, this can present more as a test:

- Can Bitcoin-backed token issuance coexist with UK financial regulation?

- Will the UK FCA adopt programmable equity tied to decentralized assets?

In this inadvertent race, whoever cracks compliant, on-chain capital issuance in the UK could lead the next generation of fintech infrastructure, with Bitcoin already positioning itself as the bridge.

Meanwhile, these reports come only days after former chancellor George Osborne’s recent concerns, highlighting the UK’s lag in the Bitcoin race.

“What I see makes me anxious. Far from being an early adopter, we have allowed ourselves to be left behind,” wrote Osborne in a Financial Times opinion piece.

Beyond Bitcoin, Osborn is also worried the UK will miss the stablecoin wave, which he says is the next growth stage in crypto.

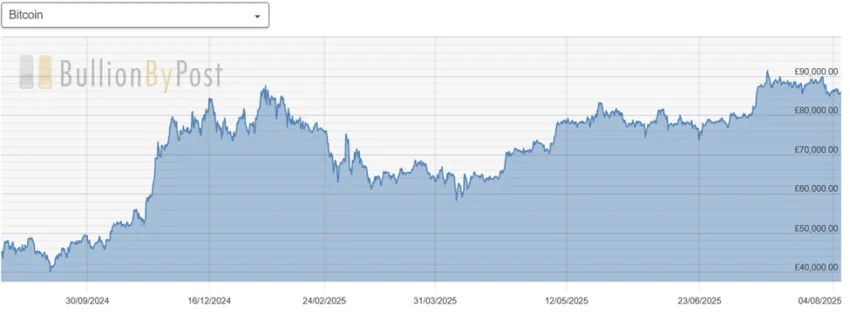

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- All-time highs for Solana activity—Yet $70 million in SOL moves to Binance

- Bitwise’s CIO highlights three major crypto investment areas after the SEC’s ‘Project Crypto’.

- Two reasons why Ethereum’s rally may be on hold this August.

- Odds of Bitcoin dropping to $111,000 rise as ETF outflows top $1 billion.

- XRP price faces pressure as key holders’ outflows reach a 7-month high.

- OpenAI eyes $500 billion valuation as China flags crypto iris scans.

- Coinbase to unlock every Base token: What you need to know.

- PUMP whale eyes $1 million loss exit—Is the token’s liquidity drying up?

- MNT explodes as stablecoin liquidity hits an all-time high on Mantle.

- US stagflation fears were triggered as Bitcoin and the stock market faced the Fed policy crisis.

Crypto Equities Pre-Market Overview

| Company | At the Close of August 5 | Pre-Market Overview |

| Strategy (MSTR) | $375.46 | $377.98 (+0.67%) |

| Coinbase Global (COIN) | $297.99 | $299.83 (+0.62%) |

| Galaxy Digital Holdings (GLXY) | $27.68 | $27.69 (+0.036%) |

| MARA Holdings (MARA) | $15.62 | $15.63 (+0.064%) |

| Riot Platforms (RIOT) | $11.13 | $11.14 (+0.090%) |

| Core Scientific (CORZ) | $14.08 | $14.06 (-0.14%) |

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.