President Trump’s tariff policies are creating stagflation risks in the US economy. This threatens both traditional markets and cryptocurrency prices as the Federal Reserve faces difficult policy choices.

The new US tariff order under President Donald Trump seems to be reaching its final stage. However, signs of stagflation are emerging in the American industrial sector.

Economic Data Shows Warning of US Stagflation

The Institute for Supply Management reported disappointing services data on Tuesday. The US Services PMI for July came in at 50.1, below expectations of 51.5. While still above the 50 expansion mark, meaning that the services sector is expanding, it dropped 0.7 points from June’s 50.8.

In short, the US service economy is still growing, but much slower than expected, and it’s dangerously close to shrinking.

The employment index fell to 46.4, down 0.8 points from the previous month. When this goes below 50, it means that businesses are cutting jobs, and it marks the lowest level since March. Conversely, the price index jumped 2.4 points to 69.9—the highest since October 2022. When this goes above 50, it means that prices are rising fast.

This combination creates stagflation, where fewer jobs exist while prices rise simultaneously. For regular people, it’s harder to find work while everything costs more. Policymakers face an impossible choice between fighting unemployment and controlling inflation.

For central banks, combating inflation requires rate hikes, while stimulating growth demands rate cuts. Both problems cannot be solved simultaneously. In stagflation, central banks may struggle to lower rates decisively.

More Signs of Stagflation Will Crush the Crypto Market

This backdrop weighed heavily on the US financial markets on Tuesday. The Dow Jones fell 61.90 points (0.14%) to 44,111.74. The S&P 500 dropped 30.75 points (0.49%) to 6,299.19. The Nasdaq declined 137.03 points (0.65%) to close at 20,916.55. Bitcoin also fell by approximately 1%.

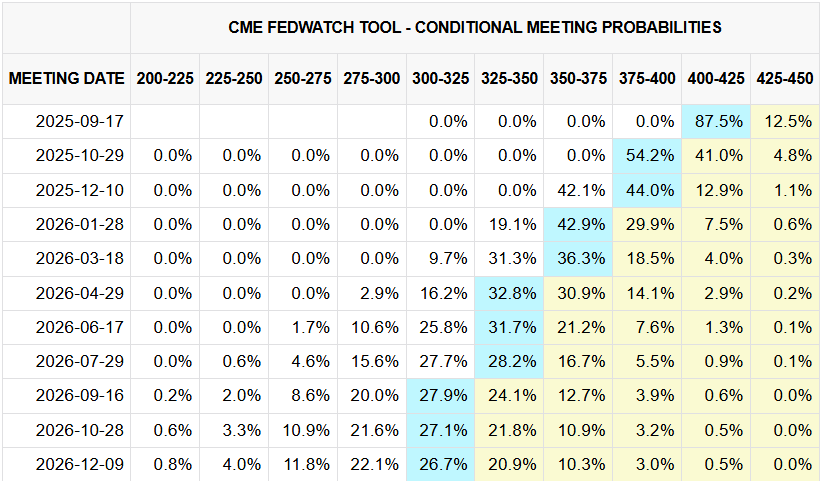

After the July jobs report, expectations changed for Federal Reserve policy. Markets now expect two rate cuts this year instead of three. According to CME Group’s FedWatch tool, markets expect 25-basis-point cuts in September and October.

The probability gap between a rate hold and cut in December is just 2%. However, if stagflation signals strengthen, this gap will likely widen.

This issue could significantly impact crypto prices. Since Congress passed the GENIUS Act on July 18, Bitcoin has shown increasing sensitivity to economic data. Most altcoins have been tracking Bitcoin’s movement accordingly.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.