Ethereum (ETH) has surged to the forefront of market attention after a rare flip in trading volume over Bitcoin (BTC).

However, analysts are concerned about the broader mismatch between euphoria and Ethereum price action.

Ethereum Trading Volume Surpasses Bitcoin’s After Fidelity Report

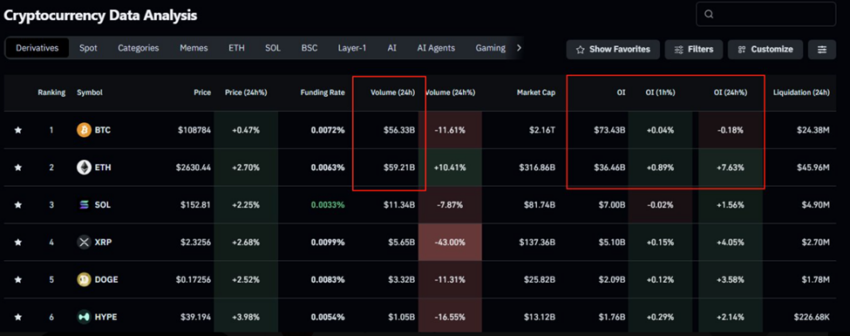

According to data from Coinglass, Ethereum’s 24-hour trading volume recently surpassed Bitcoin’s for the first time in the current cycle.

Given both political and institutional interest around Bitcoin, this is not a mean feat for Ethereum. It marks a symbolic milestone for the largest altcoin on market cap metrics.

A surge in trading volume indicates traders are interacting with Ethereum more, an outlook likely stemming from Fidelity Investments, which manages $4.9 trillion. The firm stated that Ethereum’s operating structure is very similar to the GDP of a real economy.

Bankless co-founder Ryan Sean Adams shared his excitement over Fidelity’s recent Ethereum report, calling it a breakthrough.

Yet even Adams’ bullish enthusiasm was met with caution, because while enthusiasm is building online, the price of ETH has barely moved.

“All this euphoria and ETH still at $2,600,” wrote Ran Neuner, analyst and founder of Crypto Banter.

The analysts warned that the rally could falter without stronger momentum. The contrast between growing hype and sluggish price action drives increased skepticism, especially as macro and structural risks persist.

“I’m genuinely concerned about ETH. The sentiment on my timeline is euphoric but the price isn’t moving at all… ETH bulls are celebrating $2,620…. If it doesn’t actually start moving soon, the next move could be down,” Neuner added.

According to Neuner, the excitement around new Ethereum treasury companies may be misleading. As BeInCrypto reported, Ethereum investment strategies are paying off.

Publicly traded companies, including SharpLink Gaming, BTCS, and GameSquare Holdings, are intensifying their Ethereum investments.

While this surge in institutional adoption highlights a growing confidence in ETH’s prospects, the Ethereum price action fails to reflect this hype.

Neuner ascribes this mismatch to companies trading existing Ethereum for shares at net asset value (NAV) rather than buying fresh ETH.

That disconnect has cast doubt over the rally’s sustainability despite a broader narrative shift in traditional finance (TradFi).

Is Bitcoin Delaying the Rally for Ethereum?

The unease goes beyond Ethereum, with analysts saying Bitcoin’s long-term structure may contribute to the momentum stall.

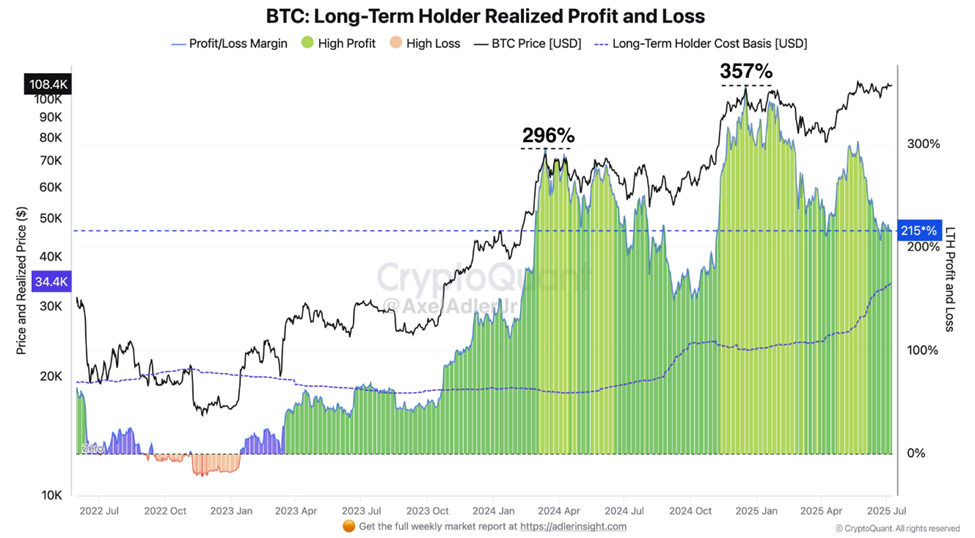

According to on-chain analyst Axel Adler Jr., long-term Bitcoin holders (LTHs) are approaching a threshold that has historically triggered major profit-taking events.

“[Bitcoin] Long-term holders will begin dumping the market once their returns exceed 300%. Currently, LTH are sitting on an average profit of 215% above their cost basis. We are now in the range between orderly profit-taking and a potential LTH dump,” Adler wrote.

That looming risk from BTC could pressure ETH further. If Bitcoin sees large-scale sell-offs, Ethereum, often tied closely to macro flows and BTC sentiment, could struggle to sustain upward movement even if its fundamentals improve.

For now, Ethereum is caught between momentum and misalignment. On one hand, it is gaining attention from institutions and outpacing Bitcoin in trading volume. On the other hand, Ethereum fails to deliver the price action that typically follows such market euphoria.

Without a clear breakout or new catalyst, the excitement may fade quickly, and if Bitcoin long-term holders decide to lock in profits, ETH could face a sharp correction.

As of this writing, Ethereum traded for $2,611, surging by a modest 2.44% in the last 24 hours.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.