Despite the Bitcoin price holding just above $108,000, most of the market is watching one number; $110,000. And while Bitcoin price has tried to touch that elusive level unsuccessfully over the past week, the setup now shows signs of fruition.

Not all systems are green yet, but one clean breakout could flip everything.

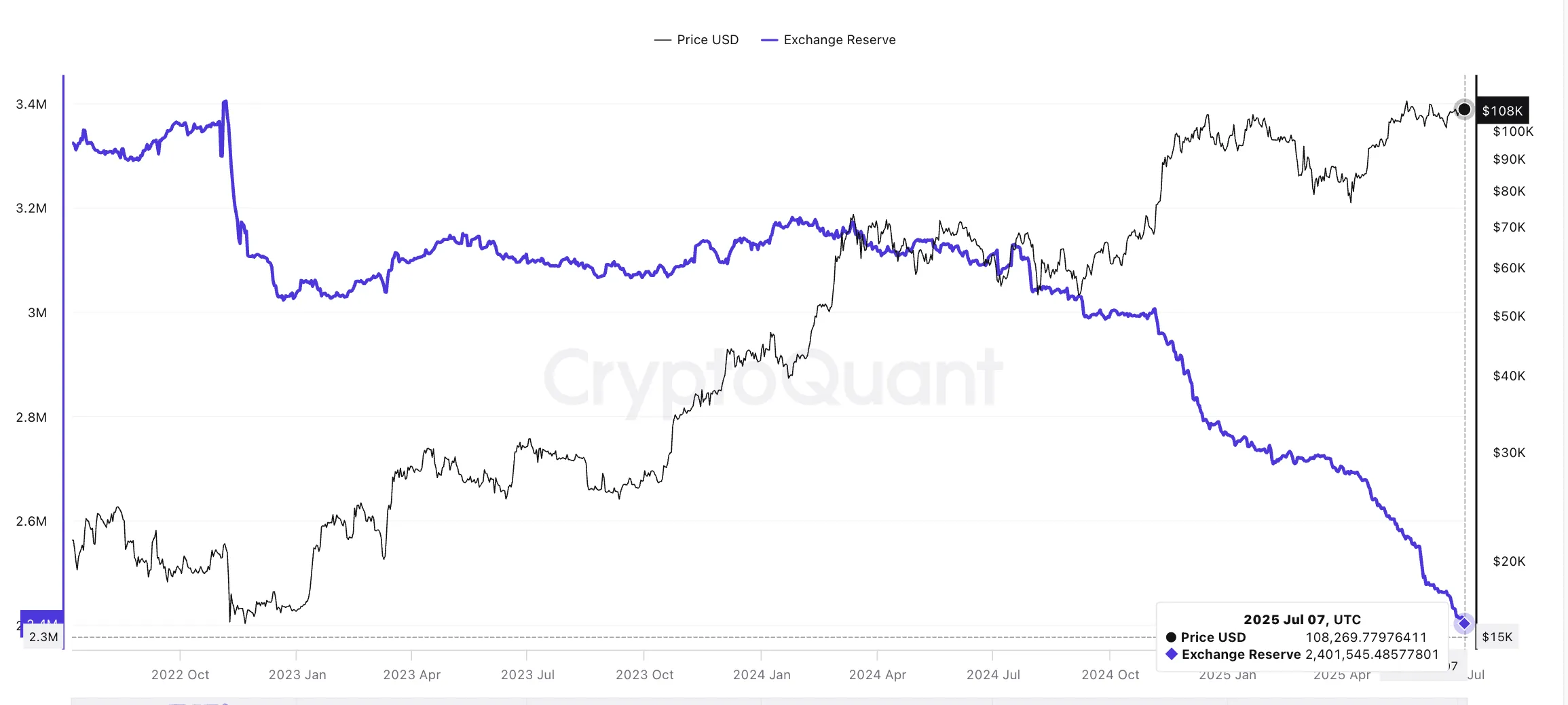

BTC Reserves Keep Falling, And That’s Bullish

The clearest bullish indicator right now is how fast Bitcoin reserves on exchanges are dropping. As of July 7, there are just 2.4 million BTC left across centralized platforms, the lowest in over three years. Historically, falling reserves signal that investors are pulling their coins into cold wallets, reducing the supply available to sell.

This setup often precedes major price runs as the float tightens, and any sudden demand surge leaves little room for sellers to react. When this supply squeeze combines with light resistance levels, even modest volume can drive outsized moves.

Taker Buy-Sell Ratio Below 1, But It’s Getting Close

One metric worth watching closely is the taker buy-sell ratio. This measures how aggressively Bitcoin buyers are lifting offers compared to sellers hitting bids. Right now, the ratio is sitting at 0.95, which means BTC sellers are still slightly in control, but only just.

Once this flips above 1, it tends to signal that BTC buyers are stepping in with conviction. Each time that has happened in the past six months, it’s triggered short upside runs. If we see this ratio tick higher over the next few days, it could serve as the final push needed to break past the $110,000 wall.

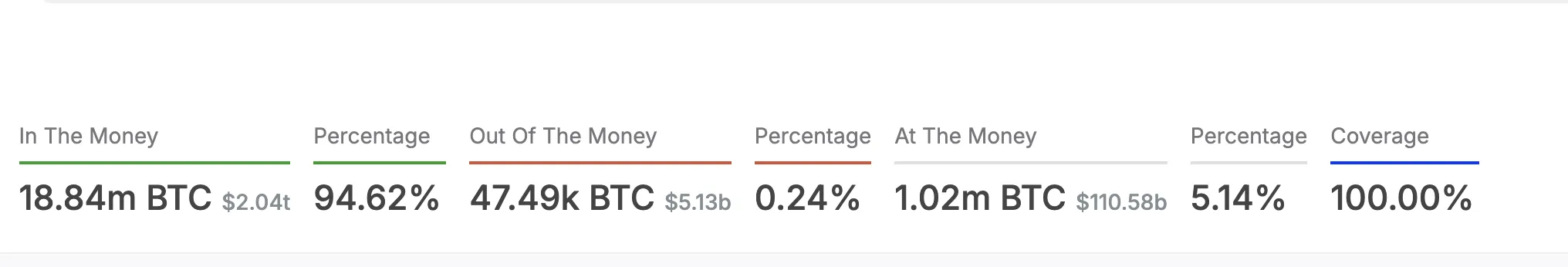

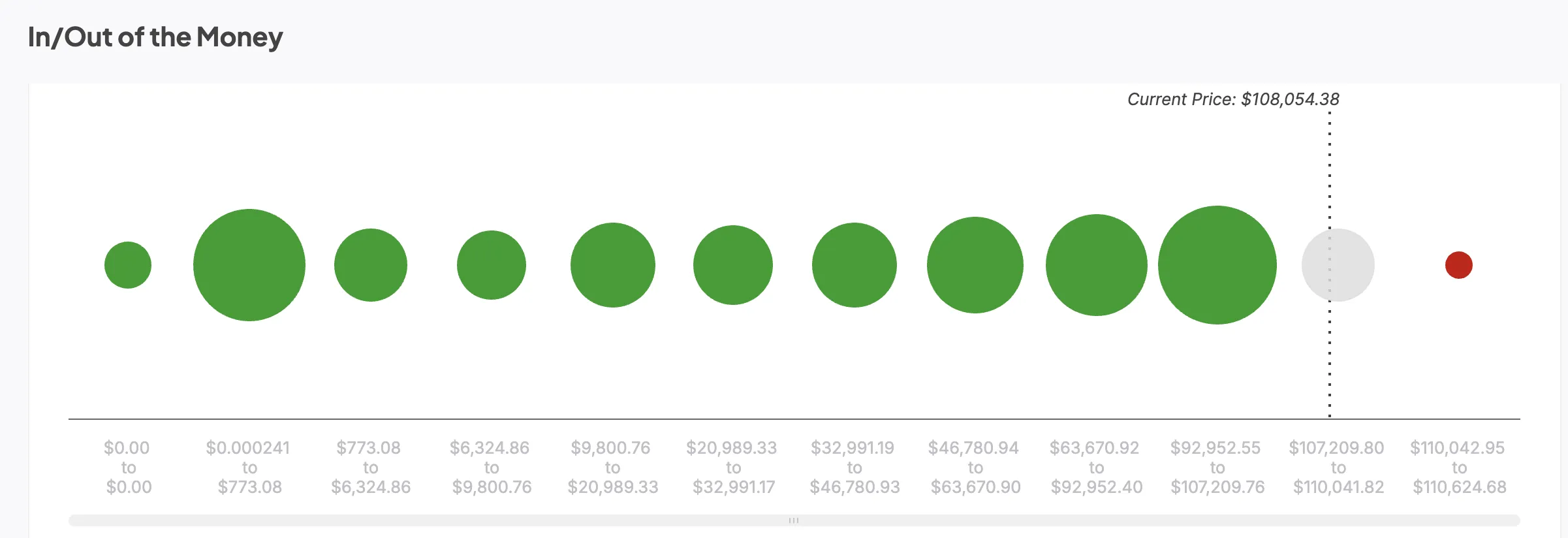

Strong Support Zones Confirmed by IOMAP Clusters

The In/Out of the Money Around Price (IOMAP) indicator maps wallet addresses that bought Bitcoin at different price levels, showing where the most buying and selling pressure may occur. Clusters of wallets “in the money” (currently in profit) form support zones, while those “out of the money” (currently at a loss) form resistance.

According to the latest IOMAP snapshot, 94.61% of all BTC addresses are currently in profit. That’s a significant cushion; historically, high profitability tends to reduce sell pressure since holders are less likely to exit early.

The data also shows an extremely strong support zone between $107,209 and $110,041, where a large number of wallets acquired BTC. That creates a powerful buy wall if prices dip.

Meanwhile, the resistance zone between $110,042 and $110,624 is thin. Very few wallets are positioned here, meaning there’s minimal overhead supply to block upside movement if BTC breaks above $110K. That alignment, strong support, and light resistance set up a potentially explosive move if momentum returns.

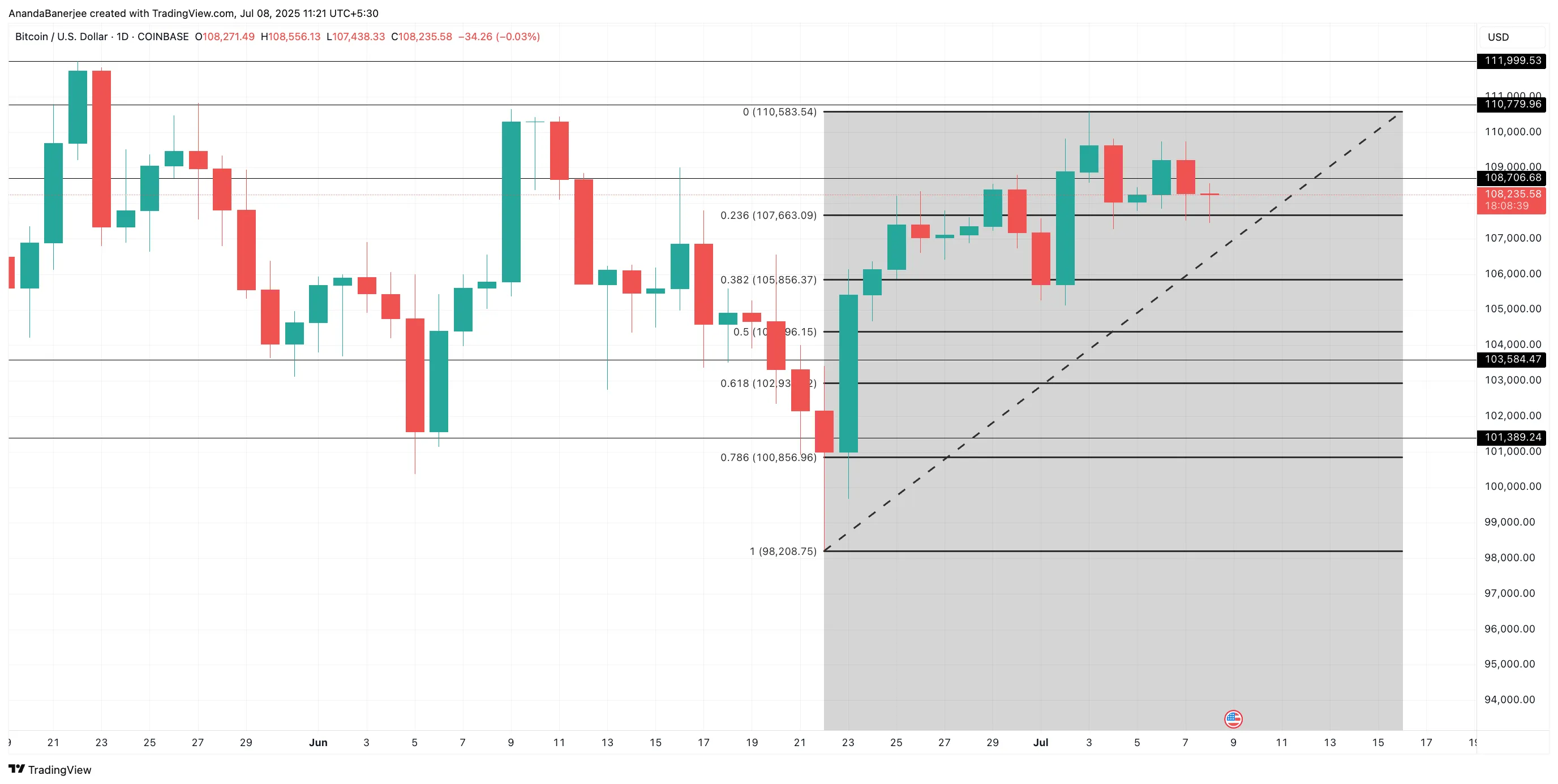

Bitcoin Price Levels Align With On-Chain Signals

Both the Fibonacci retracement chart and horizontal resistance lines now confirm what on-chain metrics have been signaling: Bitcoin is tightly positioned just below a breakout zone.

Currently trading at $108,235, BTC sits slightly above the 0.236 Fibonacci retracement level, drawn from the recent swing low to high. This level has acted as a magnet for price consolidation and now forms a soft short-term base.

Looking up, horizontal resistance levels between $110,583 and $110,779 represent the final hurdle before a potential surge. What strengthens this technical picture is the perfect alignment with on-chain IOMAP clusters.

As highlighted earlier, the In/Out of the Money indicator shows that most BTC holders are in profit, with dense wallet support from $107,209 to $110,041. On the downside, key fallback support levels remain intact at $103,584 and $101,389. But as things stand, the chart confirms the on-chain story: Bitcoin is primed, and one clean break above $110,779 could be the signal the market’s been waiting for.

However, if Bitcoin fails to hold the $107,209–$110,041 support band and closes below $103,584, the bullish thesis could unwind. That would suggest buyer exhaustion at the top end and increase the risk of retesting the $101,389 zone.

If the Bitcoin price breaks above $110,000 with volume, the structure is there for a rapid leg higher. There’s minimal resistance until the psychological all-time high at $111,970 hit just weeks ago. That remains the final ceiling. At least for now!

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.