HBAR has made a solid attempt at recovery recently, but broader market cues are pulling the altcoin back.

Trading at $0.156, HBAR is likely to face some correction in the coming days as weak inflows and bearish sentiment weigh on its price action. Despite this, the token remains a focal point for potential future growth.

HBAR Inflows Strengthen

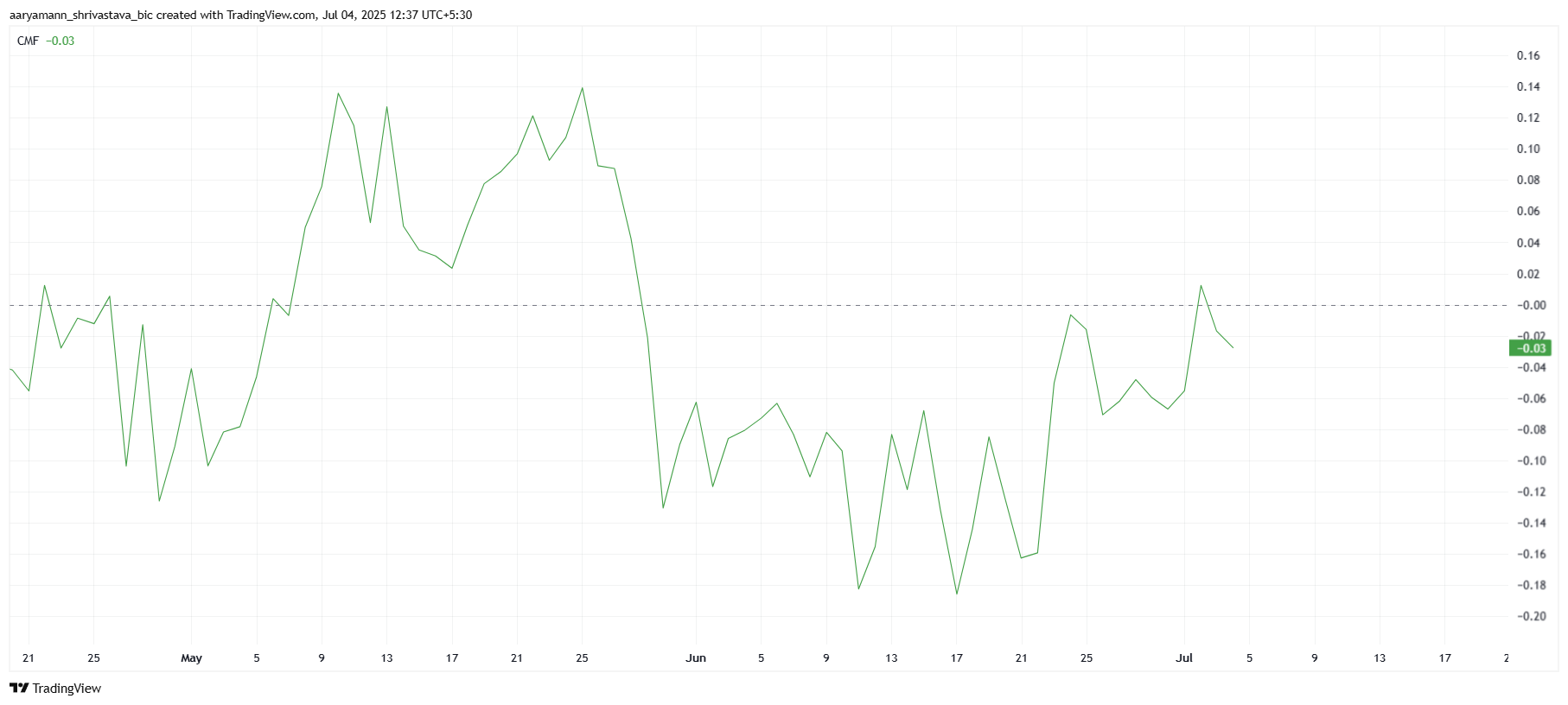

The Chaikin Money Flow (CMF) indicator has struggled to close above the zero line, signaling weak inflows into HBAR. This is a concerning signal, as the CMF’s failure to sustain positive movement reflects investor skepticism and a lack of strong buying interest. Although HBAR briefly crossed into the positive CMF zone for the first time in over a month, the overall market sentiment remains weak.

This struggle with the CMF suggests that investor confidence is fragile, with many hesitant to commit to HBAR at higher levels. As a result, the chances for continued upward momentum appear limited, and the likelihood of further gains remains low unless broader market conditions improve or a surge in buying interest occurs.

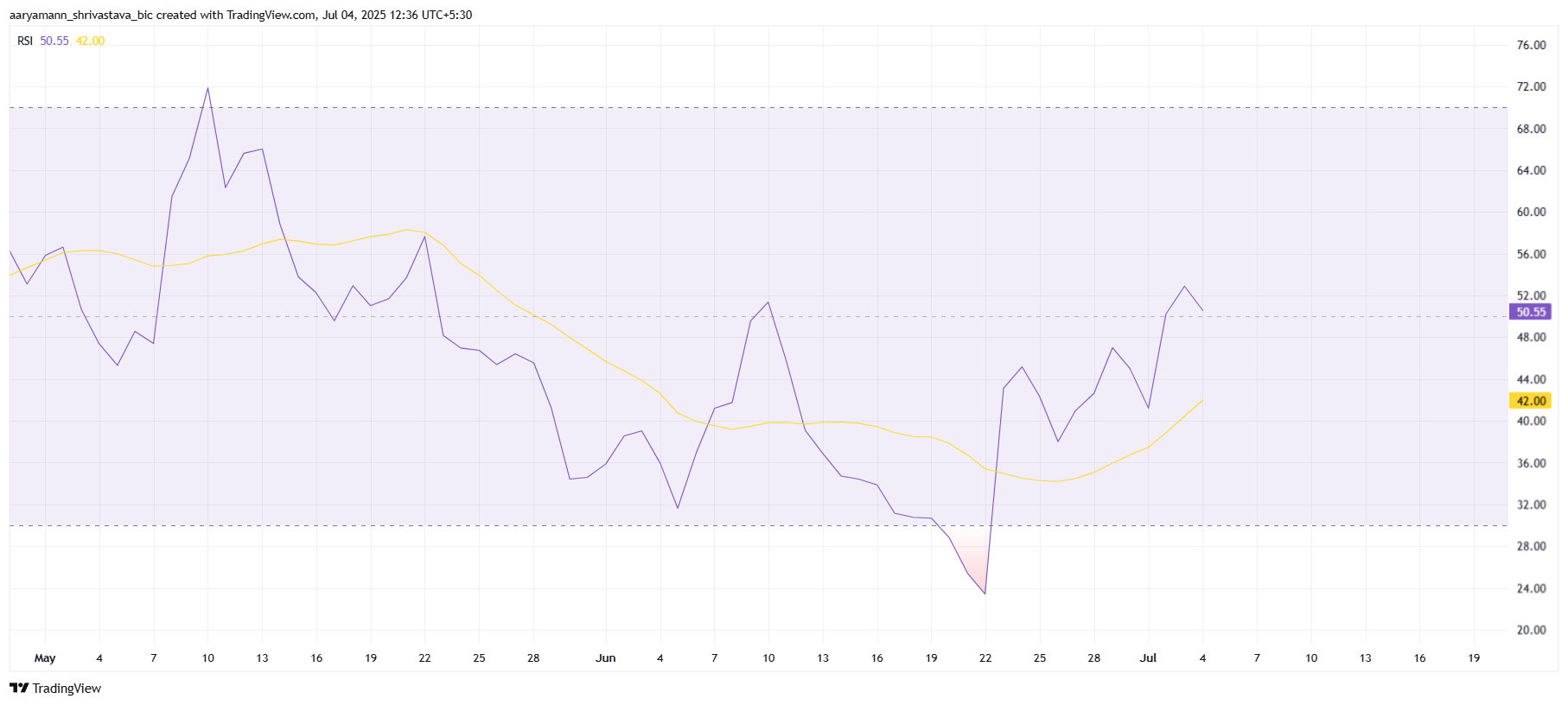

On a more positive note, technical indicators like the Relative Strength Index (RSI) are showing bullish momentum for HBAR. Currently sitting above the neutral 50.0 mark, the RSI indicates that buying pressure is gaining strength. This shift suggests that, despite the weak inflows, there may still be potential for HBAR to experience a positive price move if the momentum continues to build.

The RSI moving into bullish territory is a critical signal for investors, as it shows that the market is not entirely bearish. The increasing momentum could eventually work in favor of HBAR, potentially counteracting some of the challenges presented by weak inflows and broader market uncertainty. The key will be whether this momentum can sustain itself over time.

HBAR Price Prepares To Breakout

HBAR’s price has been stuck under a two-week-long downtrend, currently trading at $0.156. To escape this trend, HBAR will need to show further signs of strength, both from technical indicators and market sentiment. If the conditions outlined above improve, the token may break free from its downward trajectory.

The first major hurdle for HBAR is breaking and flipping the $0.163 level into support. This is crucial as it would pave the way for the altcoin to reach the $0.180 resistance level. Investors will need to hold their positions through this critical phase, as any premature selling could derail the potential for further gains.

However, if investor sentiment shifts to selling, whether for profit-taking or due to increased uncertainty, the bullish outlook could be invalidated. Losing the $0.154 support level would likely result in a drop toward $0.139, ending HBAR’s hopes for a continued recovery in the short term.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.