XRP has experienced extreme volatility recently, preventing the altcoin from finding any stability. After facing sharp price fluctuations, XRP has struggled to regain momentum.

This lack of consistency is evident in investor behavior, as market uncertainty has created hesitation. The altcoin has failed to establish a clear trend, keeping many traders on the sidelines.

XRP Is Leaning on Bitcoin

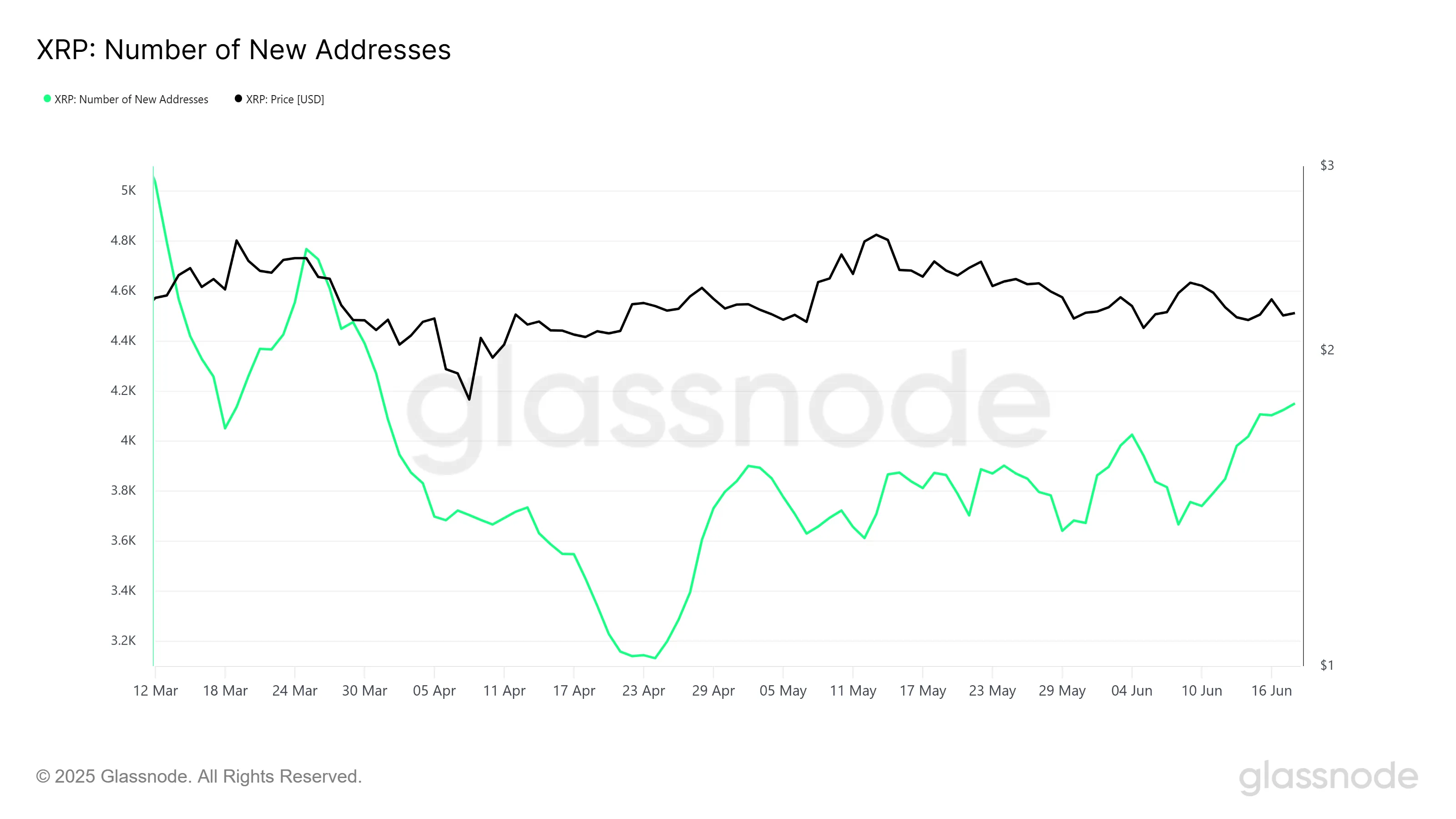

The rate of new address additions for XRP has seen a considerable decline since March, signaling that the coin is losing its appeal to new investors. With only a little over 4,000 new addresses being added daily, XRP’s growth is slowing. This trend reflects a broader uncertainty in the market, where investors are hesitant to engage with an asset that lacks clear direction.

The recovery has not been as strong as anticipated, and the overall sentiment surrounding XRP seems lukewarm. The lack of significant new investor interest may be attributed to the prolonged downtrend seen over the past month.

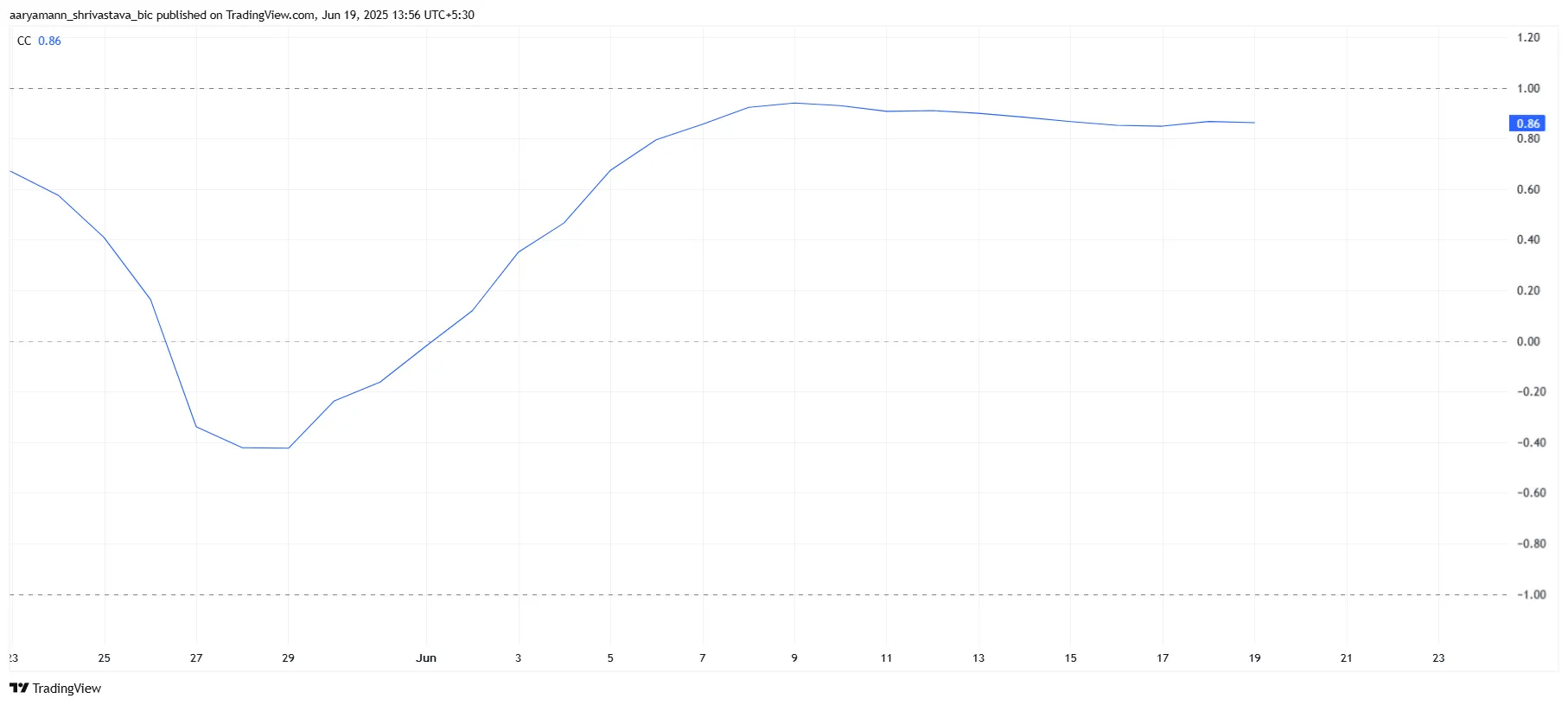

XRP currently shares a strong correlation of 0.86 with Bitcoin, which could work in the altcoin’s favor. If Bitcoin continues its upward movement towards the $110,000 price point, XRP may benefit from the positive momentum.

Should Bitcoin maintain its bullish trend, XRP could see a similar resurgence, as the altcoin typically mirrors BTC’s price action. This strong correlation may provide some relief for XRP holders.

XRP Price Is Seeking Recovery

At the time of writing, XRP is trading at $2.16, holding above the support level of $2.13. This support has helped prevent further declines, and the likely scenario for XRP is a consolidation above this level. The next resistance point stands at $2.23, which could cap any short-term gains if it remains unbreached.

Should Bitcoin continue its upward momentum, XRP could break through the $2.23 resistance, paving the way for further gains. This could enable the altcoin to challenge the $2.27 barrier, which has acted as a strong point of resistance. A sustained rise could drive XRP toward higher price levels, depending on market conditions.

However, if market conditions fail to trigger any significant gains, XRP may experience a drop below the $2.13 support level. In this case, the altcoin could slide to $2.08, mirroring the dip seen earlier this month. A decline below this level would signal further weakness for XRP and could prompt further sell-offs among investors.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.