Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee for insights into investor actions ahead of the FOMC’s interest rate decision tomorrow. The Federal Open Market Committee (FOMC) is convening today for a two-day meeting to determine the Fed’s next stance.

Crypto News of the Day: Treasury Yields Dip Ahead of FOMC’s Interest Rate Decision

US Treasury yields are dipping along with the broader financial market. The yield on the benchmark 10-year Treasury note fell 3 basis points (bps) to 4.424%. Meanwhile, the 2-year Treasury yield was lower by more than 1 bp to 3.958%.

The drop comes amid geopolitical tension in the Middle East between Israel and Iran. In a recent US Crypto News publication, BeInCrypto reported how an escalation in the Middle East could affect Bitcoin price.

Meanwhile, beyond geopolitics, other fundamentals are also influencing investor sentiment. There is broader caution in the market as traders and investors brace for the FOMC interest rate decision on Wednesday.

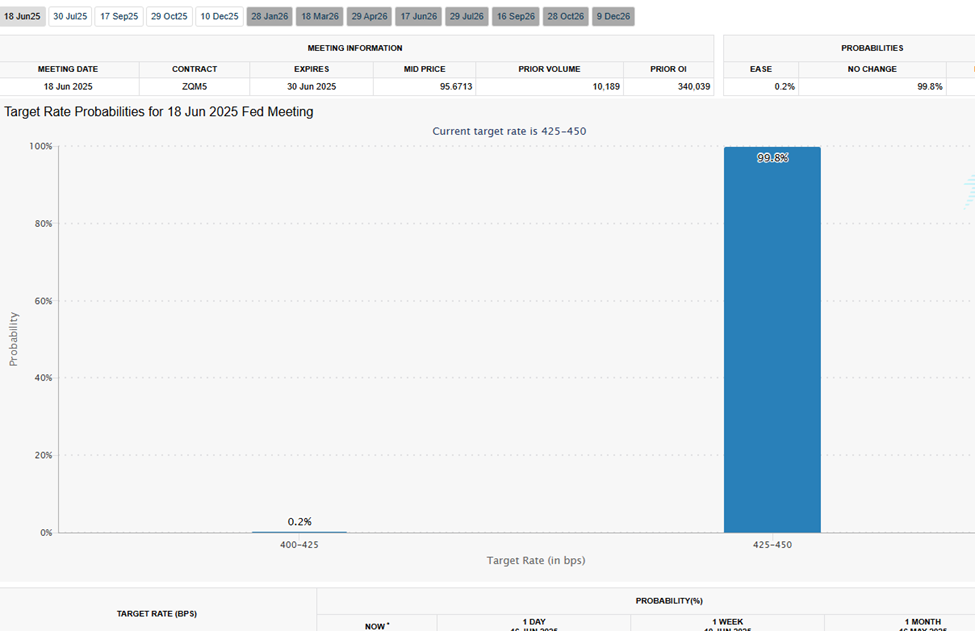

BeInCrypto reported that the FOMC interest rate decision is expected to maintain rates at 4.25-4.5%. According to the CME FedWatchTool, markets are projecting a 99.8% probability that the Fed will leave interest rates unchanged at 4.25-4.5%.

It comes after inflation increased in May, and for the first time since February. Speculation has shifted to subtler sources of liquidity, especially changes to the Supplementary Leverage Ratio (SLR), as a hidden trigger for the next crypto bull run.

Lagarde Declares “Global Euro” Moment Amid Dollar Dominance Doubts

Elsewhere, European Central Bank President Christine Lagarde has declared a pivotal opportunity for the euro to rise as a global reserve currency. She called on the EU to strengthen its geopolitical clout, economic resilience, and institutional unity.

In a speech titled Europe’s “global euro” moment, Lagarde warned that the unraveling of open markets and the fading dominance of the US dollar present both threats and openings for Europe.

She said that “Protectionism, zero-sum thinking, and bilateral power plays” are replacing multilateral norms, jeopardizing 30 million EU jobs tied to global trade.

While the euro is currently the world’s second most-used currency—representing 20% of global FX reserves—Lagarde argued that increasing its global stature is not guaranteed.

“It must be earned,” she stressed, pointing to surging gold demand as a sign that investors are still wary of alternatives to the dollar.

Lagarde outlined three foundational pillars to support the euro’s rise. First, she emphasized leveraging the EU’s position as the world’s top trading partner to forge new trade agreements and stabilize liquidity via ECB swap lines.

Second, she urged Europe to resolve its “structural challenges” such as low growth, fragmented capital markets, and limited supply of safe assets. Deepening the capital markets union and funding strategic industries could help close the gap with the US, she said.

Third, Lagarde called for EU institutional reform, including more qualified majority voting, to project unity and stability. “A single veto must no longer be allowed to stand in the way of the collective interests of the other 26 Member States,” she said.

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- No cuts, no Bitcoin breakout: FOMC and SLR speculation grip crypto markets

- Kraken’s “Rune June” post and growing community support trigger a 79% price spike for Bitcoin meme coin Magic Internet Money.

- Coinbase CEO Brian Armstrong urges UK policymakers to fast-track crypto regulations, positioning the country as a potential crypto hub on par with the US.

- SEC and Ripple jointly request to pause appeals, waiting for an indicative ruling from Judge Torres on their updated filing.

- The correlation between TRUMP and Bitcoin weakens, signaling that TRUMP’s price may continue to fall independently of Bitcoin’s performance.

- Arthur Hayes argues Circle’s IPO and valuation are inflated, citing the firm’s reliance on Coinbase for distribution, unlike Tether’s independent network.

- BlackRock’s IBIT saw $267 million in inflows, boosting its total to $50.03 billion, signaling strong institutional interest.

- Pump.fun’s X account, along with its founder Alon Cohen’s, was suspended ahead of the PUMP token launch, sparking speculation in the crypto community.

- Bitcoin mining costs soared over 34% in two quarters, surpassing $70,000 per BTC due to rising hashrate and energy prices.

- Kaito AI updates its crypto mindshare algorithm to address criticism over manipulated engagement and low-quality content dominating leaderboards.

Crypto Equities Pre-Market Overview

| Company | At the Close of June 16 | Pre-Market Overview |

| Strategy (MSTR) | $382.25 | $375.15 (-1.86%) |

| Coinbase Global (COIN) | $261.57 | $256.65 (-1.88%) |

| Galaxy Digital Holdings (GLXY) | $19.37 | $19.00 (-1.91%) |

| MARA Holdings (MARA) | $15.32 | $14.98 (2.22%) |

| Riot Platforms (RIOT) | $10.17 | $9.98 (-1.87%) |

| Core Scientific (CORZ) | $12.08 | $12.00 (-0.66%) |

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.