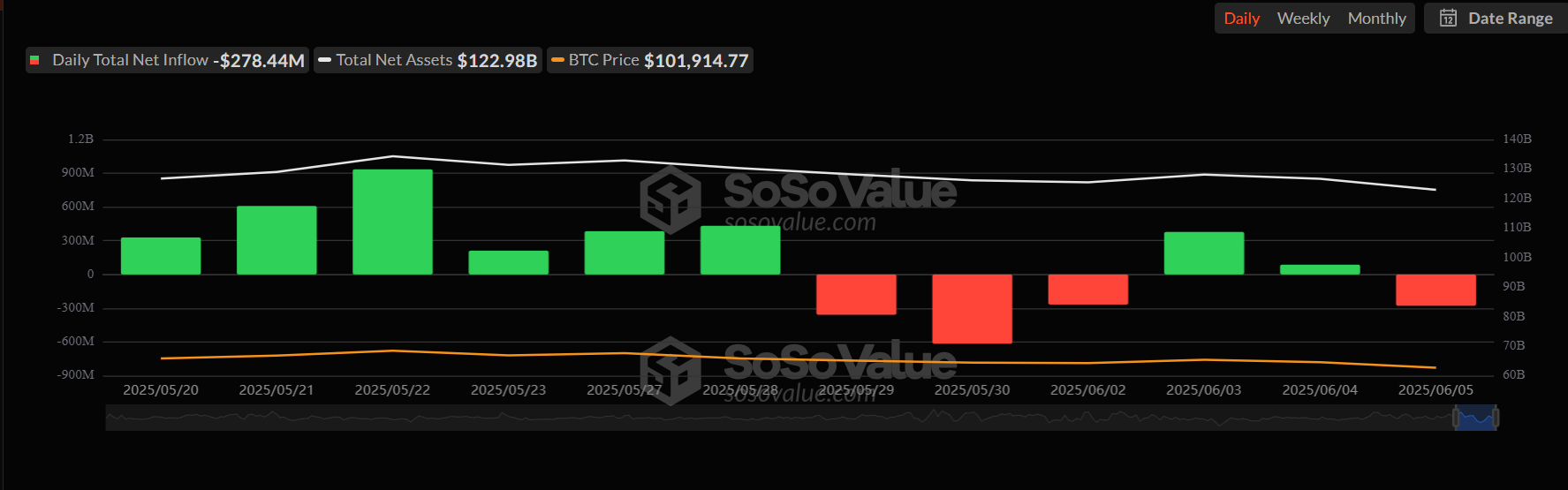

Bitcoin exchange-traded funds (ETFs) recorded net outflows exceeding $250 million yesterday, extending the retreat from bullish momentum. This comes on the heels of a sharp 77% drop in net inflows the day before.

This pullback follows BTC’s drop below the psychological $105,000 price zone during Thursday’s trading session.

BTC Spot ETFs Bleed Capital Amid Price Drop to $101,000

On Thursday, Bitcoin spot ETFs recorded net outflows of $278.44 million. The capital exit extends the decline in bullish sentiment, beginning with a 77% drop in net inflows the previous day.

This ETF sell-off followed the move lower in BTC’s price during that day’s trading session. The leading coin broke below the $105,000 support level and fell to an intraday low of $101,201, dampening investors’ sentiment.

A sustained net outflow from BTC spot ETFs would signal weakening investor confidence and a shift in market sentiment. This can exert additional selling pressure on BTC, exacerbating the price decline.

Yesterday, ARK 21Shares’ ARKB led the pack with the highest daily outflows, totaling $102.02 million. Its total historical net inflow at press time is $4.67 billion.

Bitcoin Down as Futures Market Cools

As of Friday, BTC is down another 2% on the day. During the same period, its futures open interest has also dipped 1%, suggesting traders are closing out positions rather than adding new leverage.

Open interest refers to the total number of outstanding derivative contracts, such as futures or options, that have not been settled. When it falls, traders are closing existing positions, signaling reduced market participation. This puts BTC at risk of further price drops.

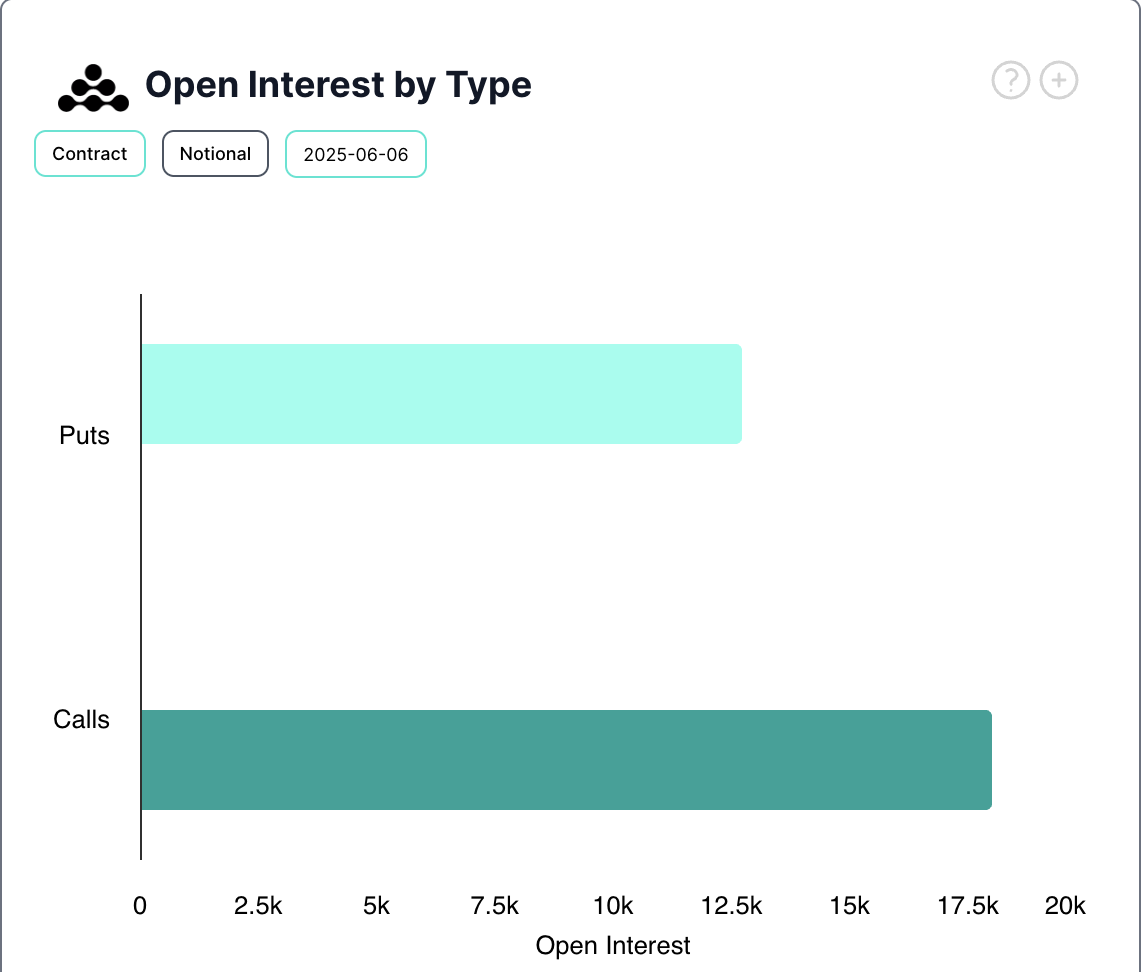

Interestingly, despite the downturn, the options market remains notably resilient. Demand for call options (bullish bets) continues to outpace that for puts. When this happens, it suggests that traders are anticipating upward price movement and are positioning for a potential rally.

The combined reading of the ETF flows and options sentiment indicates that while institutional capital is retreating, derivatives traders are watching for potential upside.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.